【Skilled Stop-Loss Talk】The strongest tool to execute a strategy tailored to your own mindset and capital 【Top and Bottom Master】

Good evening. I am NKI0122, currently listing under Tenka Meijin.

Today is Sunday. How is everyone doing?

In order not to catch a cold, it would be nice to stay warm and prepare for next week,

and if I make money from the exchange, I also think I’d like to go eat something tasty, right?

Now, we have received many questions today as well!

Actually, since we receive questions from a lot of people in various ways, I am amazed by the amount of feedback!

By the way, Tenka Meijin's "Special Period" is scheduled to end on November 15, but the lottery for the Trend Sign Toolwill close as soon as the slots are filled.

Also,The lottery method for the Trend Sign Tool is completely randomwith a 60% winning probability!

All users can buy the notification tool at half price, so if you’ve been thinking of buying at some point, getting it early saves you money.

At Tenka Meijin, you can place buy orders along with sells, so you can take advantage of market moves and waves efficiently.

Because it does not repaint after the candlestick closes, its usefulness in trading is high as well.

Also, even while drawing, a change in position only occurs as highs and lows update, so it is possible to enter in splits, suggesting high versatility.

Now, we received a question about this image that captured the intervention trend!

Thank you!

【Summary】

Q:

In the end, the results show wins, but because of averaging down, do I need to endure a drawdown?

How should I handle capital management?

A: Below, answers!

Firstly, Tenka Meijin does not give a clear directive like "cut loss here."

What!?You might think, but if the entry position is good, the results won’t change much, so please don’t worry.

Also, capital amount varies by individual, and mental control is an important factor in trading as well.

Tenka Meijin does not ignore individual differences!

For example, two traders exist,

A: "I want it to keep rising while I ignore it and forget about it! Even if it hits stop loss during that time, I’d rather not look."

B: "I’m afraid of drawdown while leaving it alone, so I want to watch the charts all the time!"

These are two completely opposite people, yet giving them the same stop-loss criteria is clearly wrong and won’t work well.

Of course, it’s natural to say, but we often forget that there are as many trading methods as there are traders.

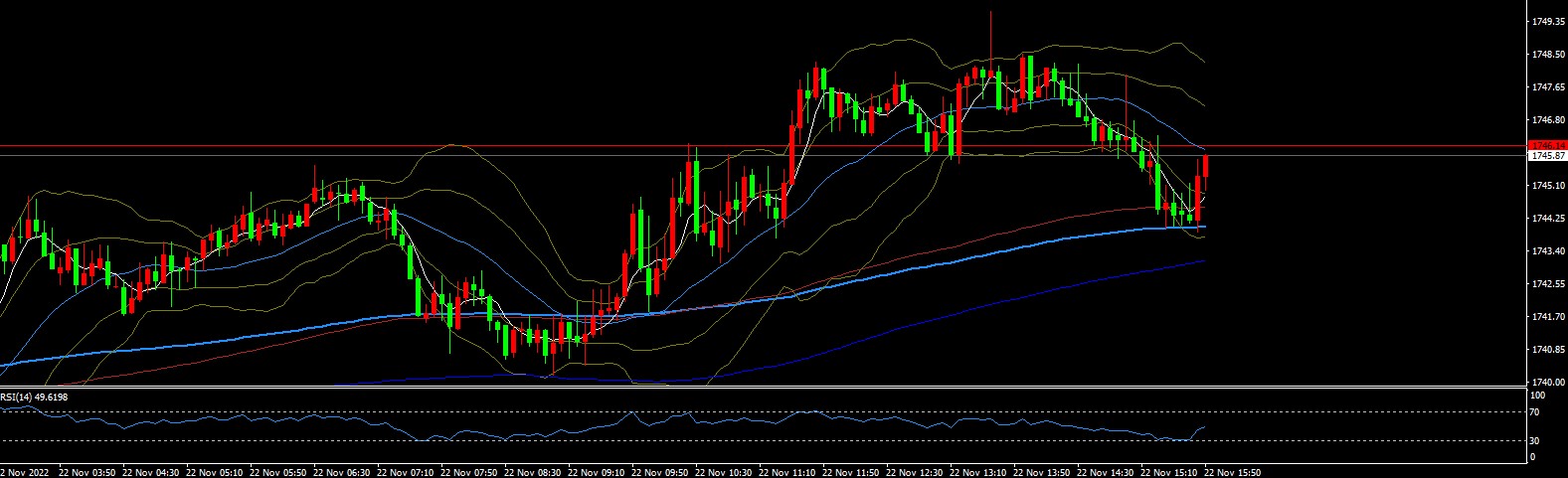

Here, when using Tenka Meijin, with the above chart,

for A, some drawdown can be tolerated, but those who don’t want to be glued to the chart frequently trading

will be recommended an “Add-on” position take.

Instead of holding a large position at the first signal, you add to the position on downtrends, use weighted averaging, and

when profits are substantial, take profits in order, and when the opposite signal appears, lock in profits.

That is the trading approach.

For B,those who are prone to anxiety are recommended to close positions frequently.

When the price exceeds the highs and lows,calmly cut losses.

Then,eventually, at the last point, you will clearly see the payoff

Also, it depends on the situation.

There is almost always a rebound when there are sudden moves like currency interventions.

Tenka Meijin isskilled at counter-trend trading right after a sharp move to catch the rebound bottom, so

In sudden changesyou deliberately go down on the downtrend because the win rate is high.

Itruly trust Tenka Meijin’s win rate (as the seller)…

whether you can completely rely on the tool is a matter of mental strength.

Mental strength cannot be fixed by a tool, so here it is best to get used to trading and tools.

Furthermore, the safest risk-avoidance method is to enter at the previous sell point and, after a steep drop, take profits but

avoid taking the risk of buying deliberately.

In fact, on a Friday at the end of the week, believing the sign and buying that plunge is a brave move (laugh).

Also, Tenka Meijin recommends mitigating the risk of missing weekend signals according to the situation.

Even so, you can sleep well since you are profiting from selling.

Caution!

However, I do not recommend contrarian trading in scenarios where the price is just gradually rising or falling and not during sudden changes!

Keep tight stop losses, and I recommend the B-pattern trend strategy.

Also, we have mentioned many times that using MTF is a prerequisite,

basically the higher-timeframe trend direction provides a higher edge.

Also, you who learned how to use Tenka Meijin are one step closer to becoming a consistently successful trader!

You think, is it okay to rely on tools?

Humans are “Homo Faber” — those who use tools.

Only by using tools can humans remain human.

Humans are so closely tied to tools.

We wouldn’t go into war bare-handed, right?

Even if cowardly or unfair, in battle, the winner is the victor.

In the market, the battlefield, you cannot win with minimal equipment.

Professionals win because they have professional tools. There is no difference in individual skill.

Humans are the strongest on earth because they possess the strongest tools — guns and metals.

The strongest tools in trading are the "latest PC," "multi-monitor setup," and "Tenka Meijin"!

Become the strongest trader on earth with Tenka Meijin here

Special period until November 15!

・Presenting Trend Tool with a 60% probability (special slots limited)

・You can always buy the Notification Tool at half price!