If BTCFX’s chart looks like this, shorts are advantageous!

Hello everyone, short position lover who loves shorting@xi10jun1here.

I hear money has come back from Coincheck. Perhaps because of that, NEM's price has been rising, and unrealized losses have been shrinking.

However, Bitcoin has dropped again significantly. For those who have read up to the paid portion, I wrote about this last week, so it should be fine, right? I’m also surviving properly.

※This column is designed so that half of it can be read for free, a bundle of conscience, so to speak. Of course, if you read up to the paid portion (weekly update for 400 yen per month, so about 80–100 yen per column), I would be very encouraged, and I’d be happy if you subscribe as a tip!

This Week’s Performance (March 9, 2018 to March 15, 2018)

First, as usual, the performance. I’ll announce the changes first.

- Last week (until March 8, 2018) assets: 62,168 yen

- This week (until March 15, 2018) assets: 62,394 yen

- Change: +226 yen

I hardly manage to enter the market at a good timing... Since there’s a rule not to hold positions overnight, it’s frustrating when the market moves in the direction I had in mind in the middle of the night.

Nevertheless, the market sentiment remains bad, as last week. The era of buying aggressively at those previous highs seems gone…

Since the Coincheck incident, the image of cryptocurrencies has clearly worsened. Google announced it will stop displaying cryptocurrency ads from June, so it seems there is no spring for cryptocurrencies yet.

With that in mind, this time I’ll write about shorting timing during price declines.

Shorts Are Favored When the Chart Looks Like This

First, please take a look at this.

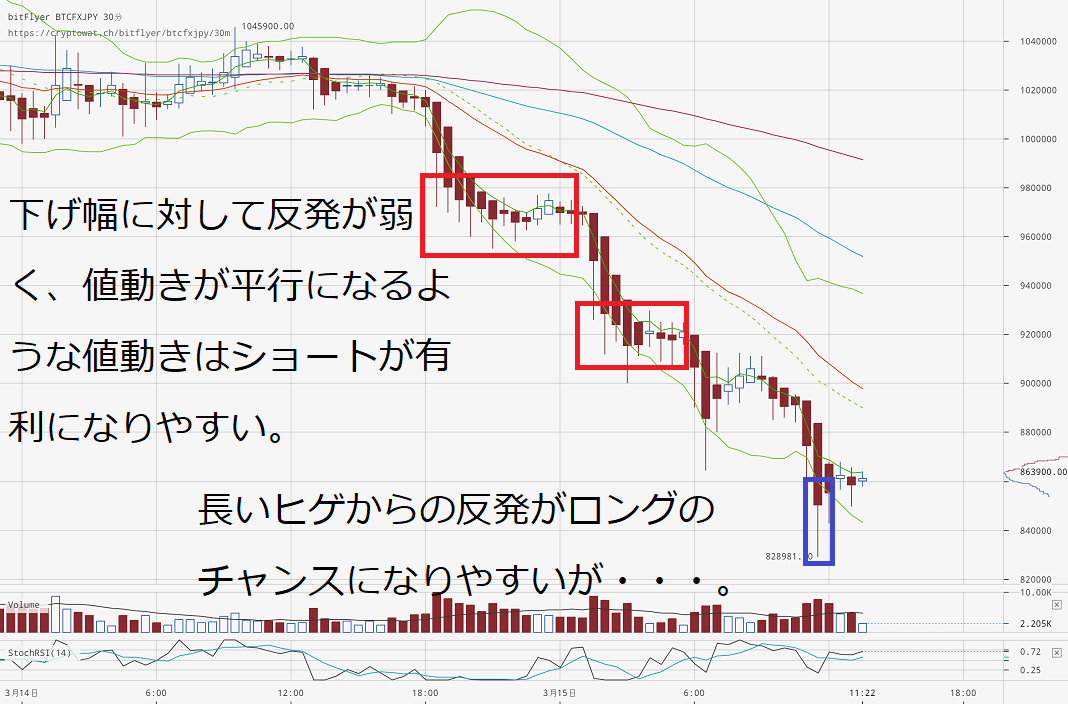

Yesterday’s 30-minute chart.

As in the red box, when the price declines and then moves sideways without a strong rebound, it’s a chance to target the next drops (the second and third declines).

A rule of thumb: if the rebound is less than half of the decline, consider going short.

For example, if it falls from 1,000,000 yen to 900,000 yen, and the price hovers (moves sideways) in the range of 90–95 hundred thousand yen without rising above that, that’s a shorting opportunity since the rebound is less than half the drop.

Of course it’s not absolute. However, when aiming for the first drop to the second/third, this price action helps determine whether to take a position and how large to size it.

In other words, the strategy is: enter short on the first drop, if the second drop comes and there’s no rebound, short again and monitor; if there is a rebound, take profit; if a third drop comes, take profits suitably.

And when a move breaks through moving averages or Bollinger Bands, as in the blue box, it’s better to take profits.

In the image the price moves sideways again, but after such long wicks a sharp rebound often occurs, so don’t overstay and lock in the gains.

Free Summary: Shorts Require More Calm Judgement Than Longs

If you miss the first drop and panic into a short, you can get caught in a large rebound and incur losses.

Because there can be a rapid rebound right after the first drop.

Shorts require more calm judgement than longs. If you want to profit in a down market, master short selling calmly.

So this paid column will discuss future outlooks.

Ending Corner 1: Latest Tax Information! Updated February 9, 2018!

The National Tax Agency’s site has updated the latest legal views regarding Bitcoin.

Here it is →No.1524 Taxation when profits are generated by using Bitcoin | Income Tax | National Tax Agency

December 1, 2017 Update: A document on income calculation methods was posted on the National Tax Agency’s site.

Here it is →Methods for calculating income related to virtual currencies (pdf) | National Tax Agency

※There is still a possibility that laws and tax interpretations will change, and that filing and payment methods may change. Before filing, be sure to check with your local tax office or a tax accountant.

February 9, 2018 Update: Tax calculation services for virtual currency are appearing in many places. BitFlyer released that a service called CRYPTACT can calculate profits from transaction histories.

BitFlyer release here →Notice of renewal of "Trading Report" and taxes on Bitcoin and other virtual currencies (pdf)

CRYPTACT here →https://tax.cryptact.com/

CRYPTACT is free to use and supports 15 exchanges (domestic: bitFlyer, Zaif, bitbank, coincheck, GMO Coin; overseas: binance, bitfinex, bittrex, changelly, CoinExchange, cryptopia, HitBTC, kraken, poloniex, Quoine) and 1,680 types of cryptocurrencies, enabling calculation of cryptocurrency-related income across multiple companies.

However, as noted in BitFlyer’s release, we do not bear any responsibility for the results of using the service for filing a tax return. Filing taxes is the user’s responsibility.

Ending Corner 2: In Planning

I’ve been thinking about writing about new cryptocurrency-related news and information, but I haven’t come up with anything yet. I’ll post it here as soon as the plan is decided!

※ Free ends here. From here on is detailed analysis and future outlook, so it is paid. If you want to read more, of course, you can subscribe as a tip, and I’d be very encouraged. Thank you for your continued support!