Kokopelli USDJPY is on a hot streak! Mr. Katamike's 8 EAs performance comparison

Over 200 users in the first two months since launch!

‘Kokopelli USDJPY’

Kokopelli USDJPY Overview

Currency pair: [USD/JPY]

Trading style: [Scalping][Day trading][Swing trading]

Maximum number of positions: 1

Trading type: 1-lot operation

Timeframe used: M15

Maximum stop loss: 68 pips (variable between 48 and 68 pips depending on market conditions)

Take profit: Since trailing stop is used for profit-taking, there is no upper limit.

Single-entry position designed with a maximum stop loss of 68 pips and relatively low drawdown.

Currently, forward testing for nearly 3 months has yielded +331 pips.

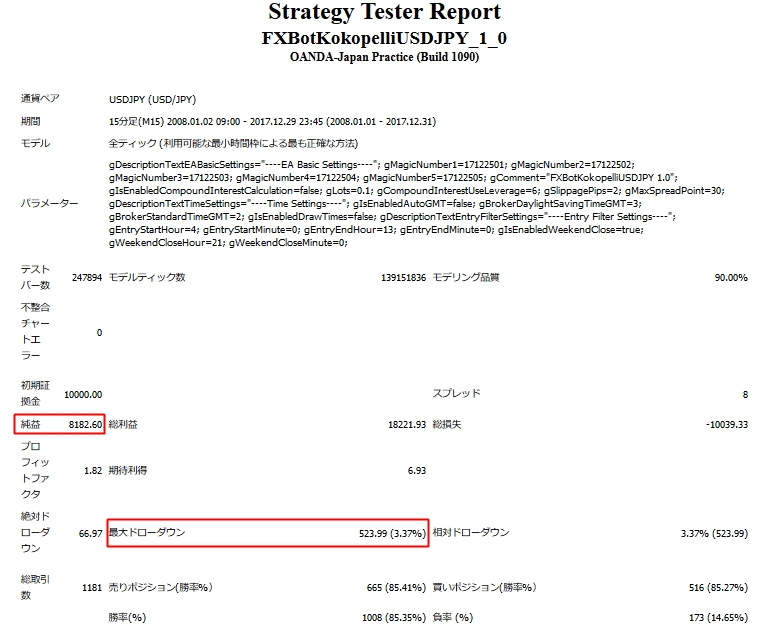

Backtest Analysis

2008.01.01-2017.12.31: 0.1 lot fixed, spread 8

Net profit: +$8,182

Maximum drawdown: -$523

Total trades: 1,181

The annual average number of trades is just under 120, which is somewhat low, but

it is a cost-effective EA that can be operated from 150,000 yen per 0.1 lot.

If operated on a 1,000,000 yen account with 0.6 lots fixed, the expected average profit is +$4,900,

with an expected annual return of +49%.

Monthly Profit/Loss

Looking at monthly profit and loss, there are months with little to no trading.

January and April seem to be a bit weaker.

Annual Profit/Loss

There were no negative years overall, but profits varied quite a bit by year.

It seems that years with higher volatility tend to yield larger profits.

If we consider 2008 and 2009 as special years,the average expected annual return over the last 8 years is +27%.

【katamike氏EA、ポートフォリオにするならどれが良い?】

Currently, “Kokopelli USDJPY” is exceptionally popular, but Katamike's other EAs also perform well, so you may be unsure which to choose.

Also, many would like to know which EA to pair with for a second one.

Therefore

Kokopelli USDJPY / Kokopelli EURUSD

Xenoblast USDJPY / Xenoblast EURUSD

Stable Point Getter USDJPY /Stable Point Getter EURUSD

Take Kuma USDJPY / Take Kuma EURUSD

We will compare eight EAs' 10-year backtests!

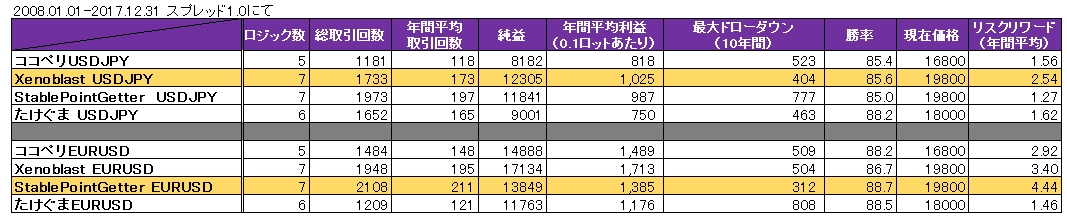

Please refer to the number of trades, maximum drawdown, and risk-reward.The USDJPY EA with the largest profit per 0.1 lot was Xenoblast USDJPY.

In addition, Kokopelli ranked third out of the four EAs in terms of risk-reward ratio.

Also, regarding EURUSD EAs,“Stable Point Getter EURUSD” yielded the largest profit and the highest risk-reward ratio among all eight EAs!From the backtest values, this might be the first recommended option.

【損益曲線でポートフォリオを検討!】

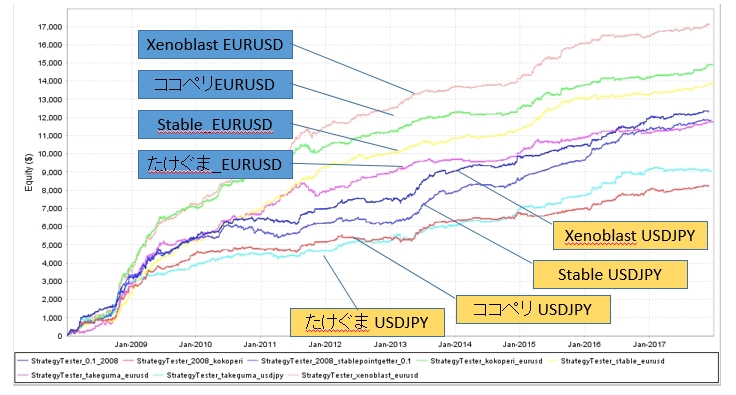

This is a comparison of profit/loss curves when all are operated at 0.1 lot over 2008.01.01-2017.12.31.

Since this is a 10-year backtest, the rankings could change if you consider five-year or two-year periods.

Also, this comparison is per 0.1 lot, so maximum drawdown is not taken into account.

Looking at the EURUSD EAs' profit curves, except for Stable Point Getter EURUSD, drawdowns occur at the same point in 2011.

Also, when comparing USDJPY EAs, only Take Kuma USDJPY has a different profit/loss curve from the others.

It may be beneficial to portfolio EAs with different profit curves, so including these two in a portfolio might be good.

The above is only a backtest comparison, so

compare with forward results and decide which suits your preference.

【合わせて読みたい】

Seven Logic Winners! Stable Point Getter with average annual return over 100%

Most popular!

Kokopelli USDJPY

In USDJPY, the profit potential is the highest!

The EA with the highest risk-reward ratio and the lowest drawdown among the eight EAs.