Is Bitcoin in a continued downtrend? Google Trends also shows a decline in search volume!

Hello everyone, here’s the final tax return! I’ve finally finished my tax return this week@xi10jun1.

At Binance, the global cryptocurrency exchange in China, there’s been a controversy over customers’ cryptocurrencies being sold illegally without authorization.

Just like Coincheck, the risks of exchanges in this area are still evident.

※This column is designed so half of it can be read for free. Of course, it would be very encouraging if you read the paid portion (updated weekly, 400 yen per month, so about 80–100 yen per column), and I’d be glad if you subscribed as a tip!

This week’s results (March 2, 2018 to March 8, 2018)

First, as usual, the results. I will announce the changes first.

- Last week (until March 1, 2018) assets: 62,218 yen

- This week (until March 8, 2018) assets: 62,168 yen

- Change: -50 yen

I wanted to trade a bit more, but I was busy with the tax return, so I could only trade little by little...

Besides, the market mood was bad. When the market mood is generally bad, I don’t trade, so I hope next week will be a bit calmer.

Of course, I always want to trade, but the market isn’t kind enough to let you earn profits just by trading when you want to.

So this time I will write about the factors that made the mood turn negative, focusing on interest in cryptocurrencies and Bitcoin.

Interest level detectable by Google search

First, please take a look at this.

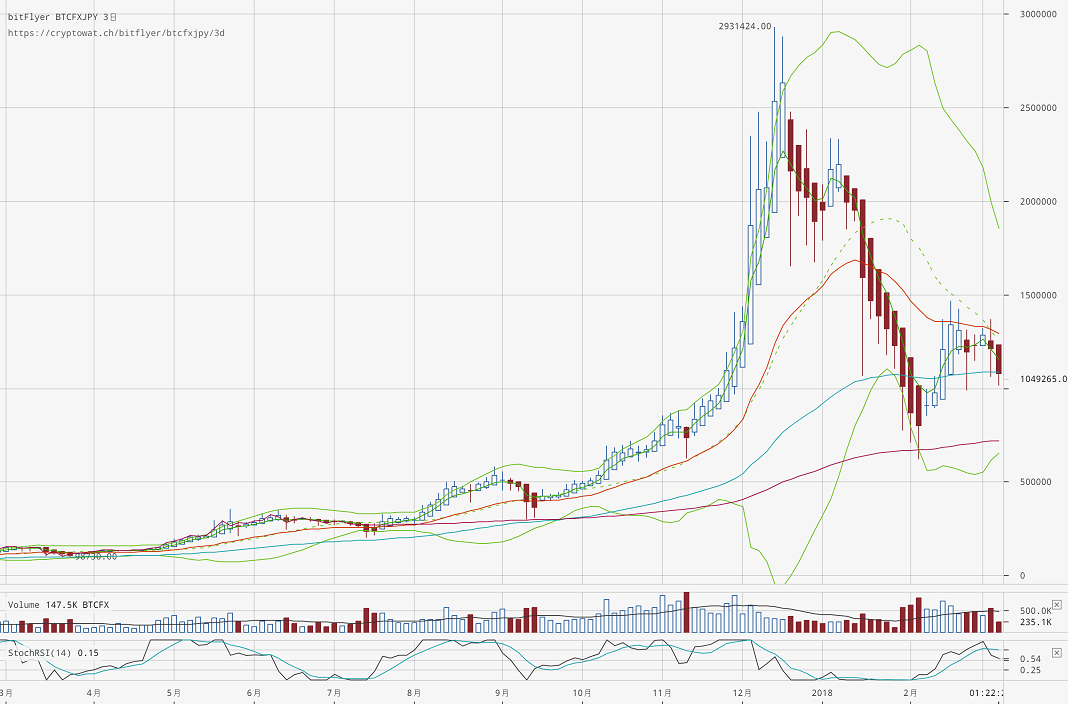

This shows Bitcoin price movement over the past year, displayed on a 3-day chart.

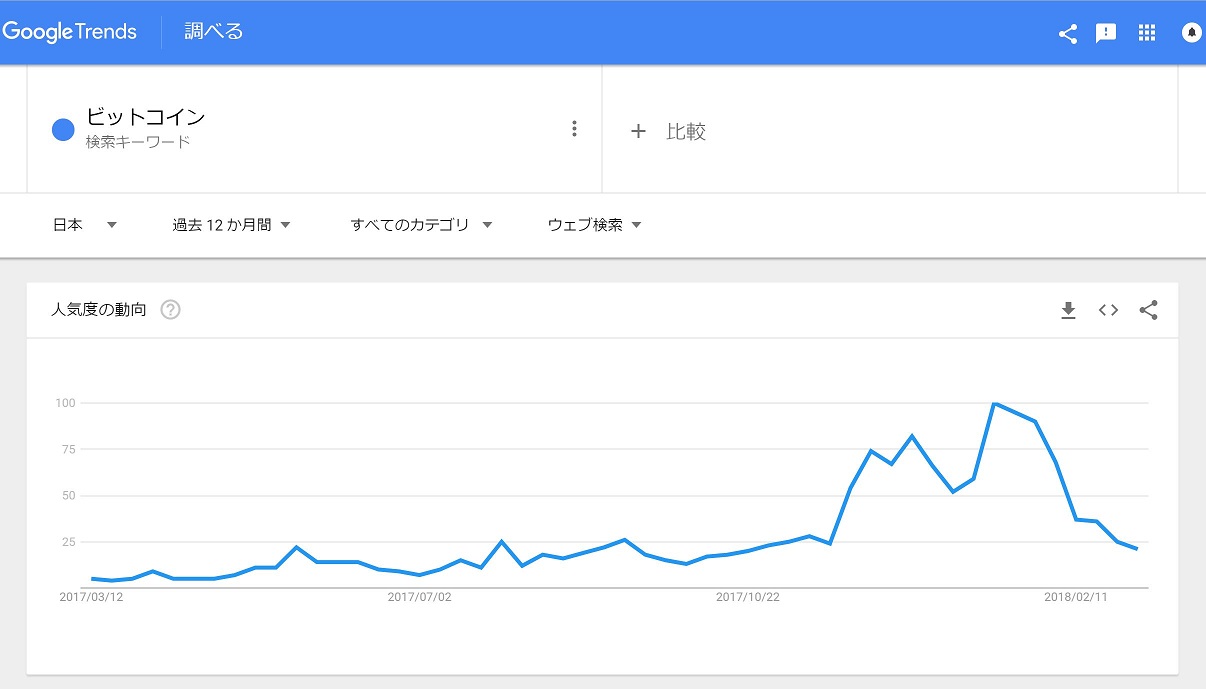

Next, using Google Trends, I examined Bitcoin search volume. It shows that

there is a surprisingly strong correlation. When Bitcoin’s price rises, searches increase; when it falls, search volume decreases.

Interestingly, Bitcoin reached its all-time high around mid-December, but search volume peaked around mid-January, about a one-month lag.

Coincheck started TV commercials in mid-December, and DMM Bitcoin’s TV ads began mid-January, suggesting that cryptocurrency awareness rose in January. Of course, including the Coincheck controversy.

Free summary: Markets always move ahead of the general public

There’s a notion that the “ordinary people who had no interest end up at the peak when they start investing,” but that happens only after numerical indicators (stock price rises or a friend making money) appear, so you fall behind and lose money.

People who learned about cryptocurrency from TV commercials may be suffering big losses by now. But what you should regret isn't the losses themselves, but your own lack of insight for not evaluating them earlier (dismissed as “Bitcoin and cryptocurrency are shady”).

The market always moves ahead of the general public. The presence of numerical results and the amount of opportunity are inversely related, so it’s important to understand this properly.

So in this paid column, I will discuss the future outlook.

End corner 1: Latest information on taxes! Updated February 9, 2018!

The National Tax Agency’s site has updated the latest legal views regarding Bitcoin.

Here it is →No.1524 Taxation on profits from using Bitcoin | Income Tax | National Tax Agency

December 1, 2017 Addendum: A document on how to calculate income has been posted on the National Tax Agency site.

Here it is →About income calculation for virtual currencies (pdf) | National Tax Agency

※Please note that laws and tax interpretations may change, affecting how you file taxes. Before filing, be sure to check with your nearest tax office or a tax accountant.

February 9, 2018 Addendum: Tax calculation services for cryptocurrency are appearing in many places. BitFlyer released that by using a service called CRYPTACT, profits from trading history can be calculated.

BitFlyer release here →Notice of renewal of “Trading Report” and about taxes on Bitcoin and other cryptocurrencies (pdf)

CRYPTACT here →https://tax.cryptact.com/

CRYPTACT is free to use and supports 15 exchanges (domestic: bitFlyer, Zaif, bitbank, coincheck, GMO Coin; overseas: Binance, Bitfinex, Bittrex, Changelly, CoinExchange, Cryptopia, HitBTC, Kraken, Poloniex, Quoine) and 1,680 types of cryptocurrencies, enabling calculation of cryptocurrency-related income across multiple companies.

However, as mentioned in BitFlyer’s release, the responsibility for filing taxes based on service results lies with the user, the exchange operators, Cryptact, EY Tax Corporation, and myself. Please file your taxes at your own risk.

End corner 2: In planning

I’m thinking of writing about new cryptocurrency-related news and information, but I haven’t thought of anything yet. I will post here as soon as a plan is decided!

※Free portion ends here. From here on, it will be detailed analysis and future outlook, so it is paid. If you want to read more, please subscribe; tips are also greatly appreciated! Thank you for your continued support!