Win with seven strategies! Average annual return over 100% "Stable Point Getter"

【Stable Point Getter Overview】

Currency pair: [EUR/USD]

Trading style: [Day Trading][Scalping]

Maximum number of positions: 1

Timeframe used: M15

Maximum stop loss: 68 pips

Take profit: 16 pips

Forward testing has only been running for about a month, but with fixed 1.0 lot operation

+81 pips

so far.

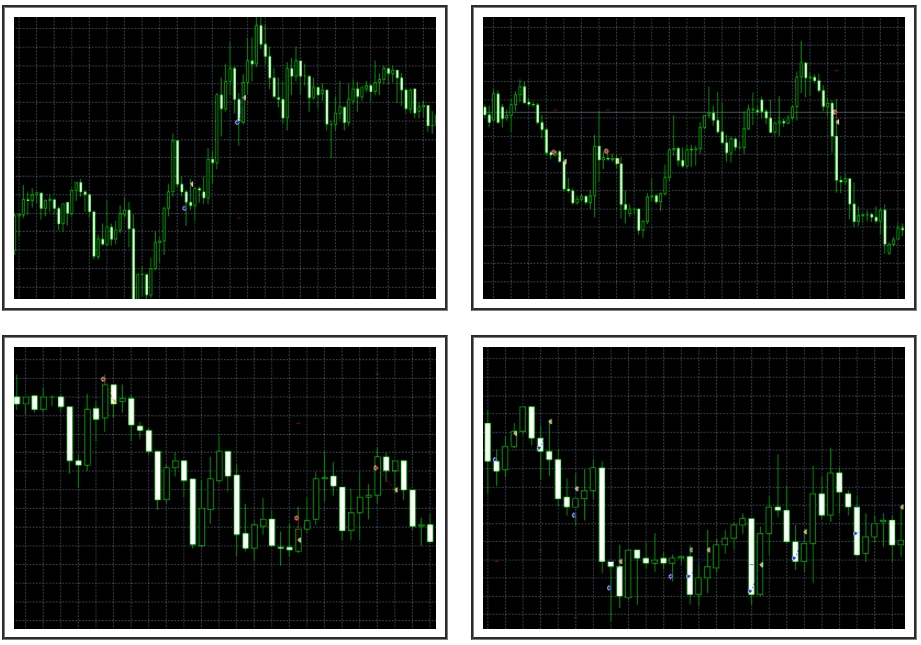

【Equipped with seven entry logics!】

While equipped with seven carefully selected logics, since the maximum number of open positions is 1, it covers the number of trades while

you can operate it with high capital efficiency.

Additionally, although the logics differ, the TP = 16 pips and SL = 68 pips are fixed, so the profit-and-loss curve has little variation.

It is designed to make the average annual return easy to estimate.

【Backtest Analysis】

2008-01-02 to 2017-12-31 (10 years)

Spread: 1.0

Fixed at 1.0 lot

Net profit: +16,200,000

Maximum drawdown: -450,000

Win rate: 88.7%

Number of trades: 2123

If you back-calculate from the maximum drawdown,With 0.7–0.8 lots per 1,000,000 yen, the maximum drawdown will be in the 30% range.

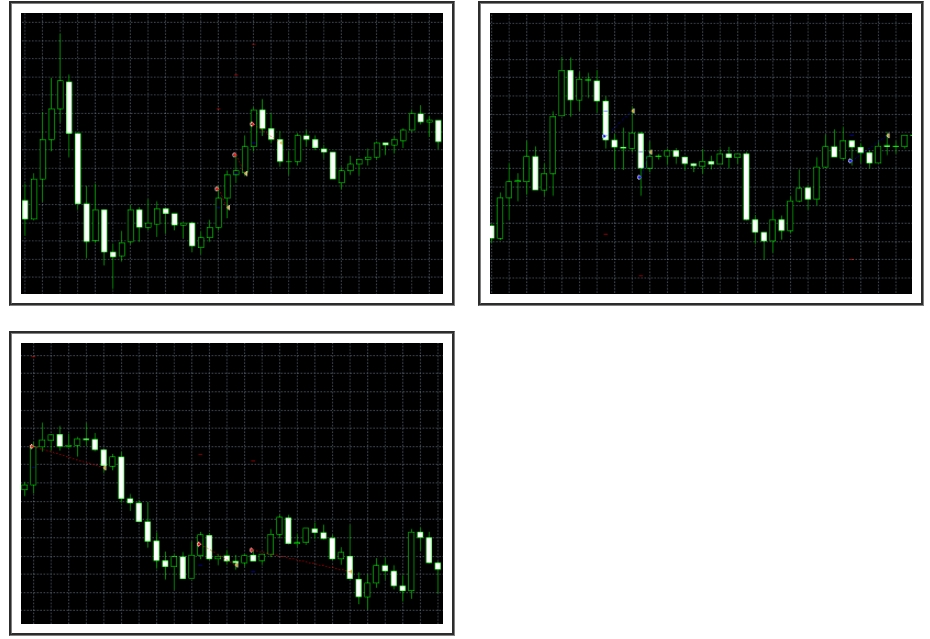

【Profit/Loss Chart】

It can be seen that the maximum drawdown occurred in 2014.

Typically stays in the 200,000 yen range.

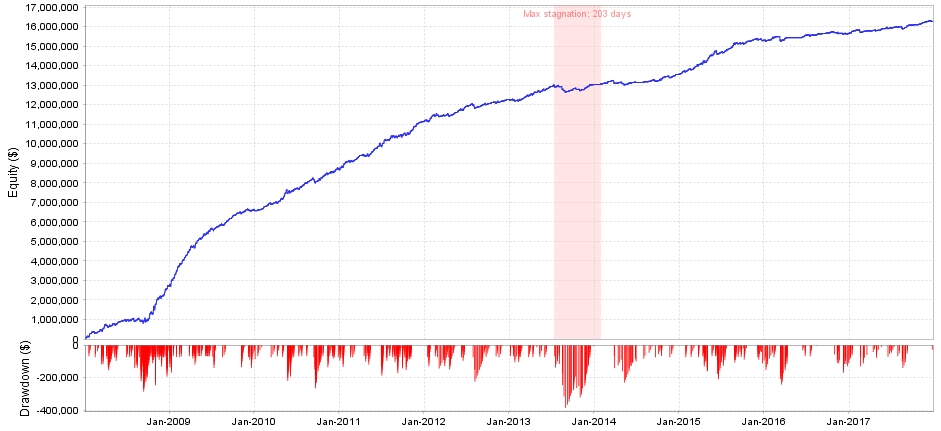

【Monthly Profit/Loss】

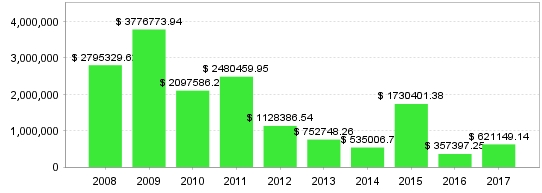

【Yearly Profit/Loss】

It seems to be a type that earns more profit in years with volatile markets, such as 2008 and 2009.

With a 1,000,000 JPY account and fixed 1.0 lot, annual gains range from +36% to +370%.

Even in the worst year, +36% is excellent!

On average over 10 years, it achieves an annual return of +160% — exceptional performance.

Considering a forward one-month return of +12%, that number could also become a reality!