"Virtual Currency Mining Investment" as a Tax-Saving Measure

<A Investment Method Where You Can Use Profits Paid in Taxes as Purchase Costs for Cryptocurrency Mining Machines>

One of the reasons cryptocurrency mining is an excellent investment method is

that you can use 100% immediate depreciation under the “Small and Medium Enterprise Management Strengthening Tax System.”

This is cited as a technique for individuals to reduce taxes on their main income through side hustles.

The topic of solar power generation has drawn attention as a technique to reduce taxes for individuals.

Solar power facilities lost their tax exemptions starting in 2017, and 100% immediate depreciation is no longer allowed; however, with cryptocurrency mining, you can treat the equipment purchase as an expense.

For amounts up to 3 million yen, fixed asset depreciation can be aggregated,

and if exceeded, you can use the Small and Medium Enterprise Management Strengthening Tax System (for corporations and individuals) to

achieve 100% immediate depreciation.

The Ministry of Economy, Trade and Industry offers this tax incentive as part of the “Small and Medium Enterprise Management Strengthening Tax System.

When people hear about tax incentives, they often imagine corporations, but the “Small and Medium Enterprise Management Strengthening Tax System” can also be used by individuals.

The Small and Medium Enterprise Management Strengthening Tax System is a scheme that, for small and medium enterprises whose management improvement plans have been approved, allows special depreciation (immediate depreciation) up to the amount of the asset acquisition to improve the profitability of small businesses.

For example, if a corporation earning 40 million yen in profit invests 41.8 million yen in equipment,

this system makes 100% immediate depreciation possible.

Also, if depreciation exceeds the limit, it can be carried forward to the next business year!!

※For corporations with capital or investment funds of1 hundred million yen or less

※Indicates individuals who continuously employ 1,000 or fewer people

Since you are using taxes that would have been paid, it is essentially the same as getting the machines for free.

If you implement this investment while ensuring cash flow, it is undeniably No Risk and has only benefits.

To tell the truth,many people are not aware of this tax-saving method as much as you would expect.

When it comes to cryptocurrency, topics tend to focus on price movements.

As mentioned above, the 100% immediate depreciation for solar power generation is already no longer allowed.

With mining machines, it is not clear when such measures might be taken.

Early movers have undoubtedly noticed this point.

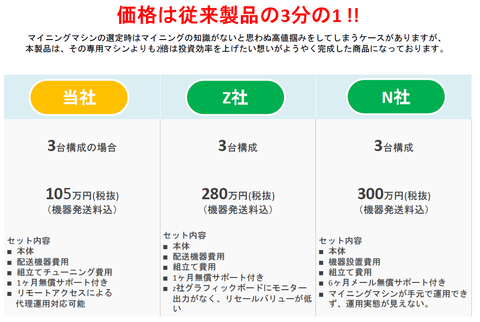

【Product Information】

Mining Investment That Can Be Started Immediately

Fully automatic collection device with over 50% annual interest!