Ten years without defaults, achieve stable profits with a carefully selected averaging-down EA! 'NPstcR'

Contrarian Averaging Down + Trend Following

Profit big while keeping losses down!

"NPstcR"

Currency pair: [USD/JPY]

Trading styles: [Day trading][Scalping][Swing trading]

Maximum number of positions: 11

Used timeframe: M5

Maximum stop loss: 500 pips

Take Profit: 5

"Divergence is what is called 'counter-movement phenomenon' in Japanese."

This divergence is a phenomenon observed in oscillator-type technical indicators; in simple terms, it is when the technical indicator moves in the opposite direction to the actual price.

This divergence is said to indicate the end of a trend.

However, there are cautions with this divergence.

Divergence is only a sign that the trend may end, so divergence can persist while price continues to set new highs and lows.

Therefore,In this EA, even if divergence appears, it won't enter immediately. It uses its own logic to decide entry.

If the price moves against after entry, it will average down.

Some may worry that averaging down will enlarge losses or lead to bankruptcy. However, markets do not continue to fall or rise forever. When prices go down, they go up; when they go up, they go down. Therefore, in this EA we time entries to ensure profits even when averaging down.

However, the market is alive, so averaging-down trades can fail at any time. Therefore, we do not operate on compounding.

Please withdraw profits or transfer them to a separate account when using this EA.

The logic is on the USDJPY 5-minute chart, using stochastic divergence and its own logic to determine the trend and enter,

If the price declines from the entry point, it will average down.

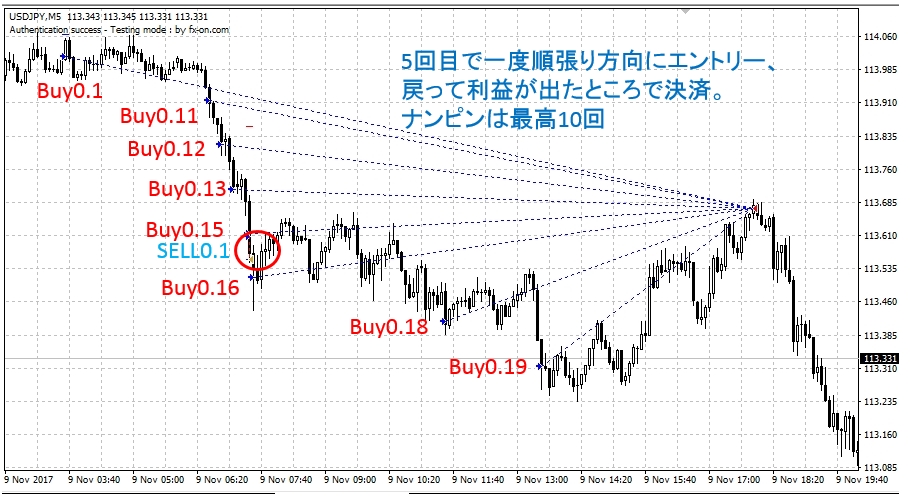

The fifth averaging-down (default) will hedge (take both sides).

The number of averaging-downs serves as a sell signal, and with the additional logic it enters sell entries to profit.

* Short positions are not averaged down.

【Trading Example】

The point of this EA is not just entering based on price movement, but

RSI divergence is combined with its own logic as an entry filter, entering at points with a high likelihood of reversal.

Thus the maximum number of positions is 11 (10 contrarian, 1 trend-following), but most reversals and take-profits occur within 10 positions.

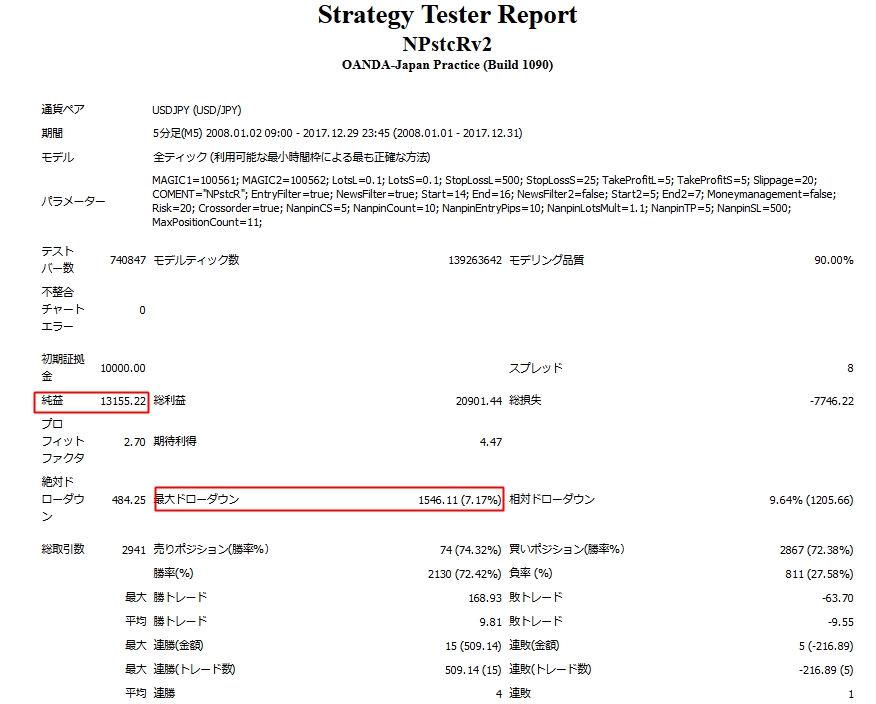

【Backtest Analysis】

For an averaging-down EA, the maximum drawdown is a concern. So how large is it?

Default: 10-year backtest from 2008 to 2017

Default lot: 0.1

Net profit: +$13,155

Maximum drawdown: $1,546

Total profit: 20,901; total losses: -7,746

The risk-reward ratio is above 2, making it an ideal design.

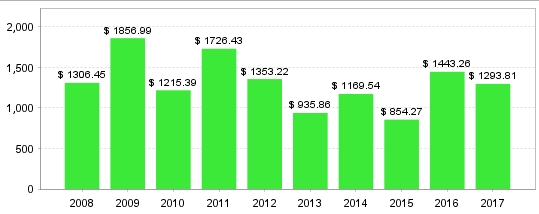

【Monthly Profit & Loss】

Due to the EA's nature (closing positions when total becomes positive after averaging down),there are no negative months!

That means that over the past 10 years, none of the 10 positions were ever stopped out.

Annual profit is around $1,000 and very stable.

Theoretically, with a stop loss of 500 pips, if it moves more than 500 pips without returning, maximum loss may occur.

However, in these 10 years there have been no such opportunities, and the maximum drawdown per the backtest is

Approximately $1,500 for an initial lot of 0.1.

The recommendation is $5,000 with 0.1 lots, but

If you anticipate scenarios more severe than the backtest, $10,000 with 0.1 may also be acceptable.

Even with such cautious operation, the average gain is about $1,300, so it is good performance.

Also, as the seller says, if the principal doubles, you can withdraw it for now, and you can continue to operate with peace of mind

you can continue to operate.

A word of caution about averaging-down can sound scary, but by carefully selecting entries it succeeds in keeping the maximum drawdown low.

This can be called an EA.

Recommended for those who want to finish each month with a profit!

Additionally, backtest results with small amounts and high leverage are

on the sales page, so please check them!