1-minute chart scalping with a risk-reward ratio of 4 or higher! "RSICntEA"

Over 90% return in 10 months of forward testing!

1-minute chart, single-position scalping 'RSICntEA'

【RSICntEA Overview】

Currency pair: [USD/JPY]

Trading style: [Day Trading][Scalping]

Maximum number of positions: 1

Used time frame: M1

Maximum stop loss: 130 pips

Take profit: Variable

Other: Compounding feature available

As the RSI in the name suggests, this is an RSI-based mean-reversion EA.

【Forward Analysis】

Performance over 10 months of forward testing

Average monthly trades: 37

Win rate: 84%

Gained pips: 800 pips

Maximum drawdown is 198 pips,

with a risk-reward ratio of over 4, making it a highly profitable EA.

Actually, because the default lot size is 0.01 lots (1000 units),

the earnings may seem small, but with 0.1 lots you would earn about ¥80,000, and with 1.0 lots about ¥800,000.

【Trade Example】

Being a mean-reversion EA, it catches reversal points well.

SL is fixed at 130 pips, but TP is not fixed.

It uses breakeven exits according to market conditions to limit losses.

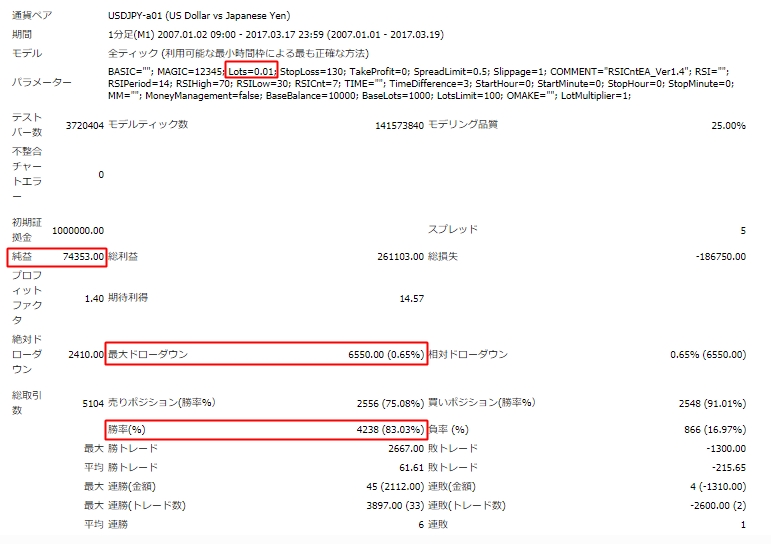

【Backtest Analysis】

Backtests with fixed lots from 2007 to 2017 show

Spread: 0.5 pips

Lot: 0.01

Net profit: +¥74,353 (7,400 pips)

Maximum drawdown: ¥6,550 (655 pips)

as shown.

If you set allowable drawdown to around 30%, 0.5 lots per ¥1,000,000 seems acceptable.

With ¥100,000, you can operate with 0.05 lots.

Under that scenario, the profits would be five times higher, so after 11 years you would reach +¥3,710,000,

Annual return is about +36%.

【Compound vs Simple Interest Test】

Eight-year backtest with 0.5 lots per ¥1,000,000 using simple and compound interest

Spread is 0.5 pips.

In the simple interest case,

maximum drawdown is $2,564, and net profit is +$13,859.

Average annual return is +$1,979.

Next, with compounding, set to 5,000 currency units per $1,000.

With compounding, the relative drawdown is $9,053, or 23% of the account.

Net profit is +$22,668,

Annual average profit is +$3,238 per year.

There is a difference of over $1,000 per year between simple and compound!

Since the win rate is high at 84%, compounding yields better returns!

However, in compound mode, the relative drawdown stays within 30%, but the absolute amount grows, so

please stay mentally strong...

If you tolerate a 30% drawdown, 0.6 lots per ¥1,000,000 might also be okay (o^―^o)

Finally, I would like to look at how much performance varies by year and by month.

【Simple Interest 0.5 Lot Fixed - Annual Profit/Loss】

There is quite a bit of variation year by year.

【Monthly Profit/Loss】

Compared to the 2017 forward test, the forward performance is actually better than the backtest.

Perhaps forward performance could be better?!

Finally, as a caution, the EA's spread filter defaults to 0.5 pips, so

the smaller the USD/JPY spread, the easier it is to profit.

A 1-minute chart scalper with a maximum drawdown of 30% and around 38% annual return!