Technical indicators: appearance and readability are the most important! 【FX/cryptocurrency/Nikkei 225】

<A Technical Indicator that Makes Market Tops, Bottoms, and Reversals Visible at a Glance>

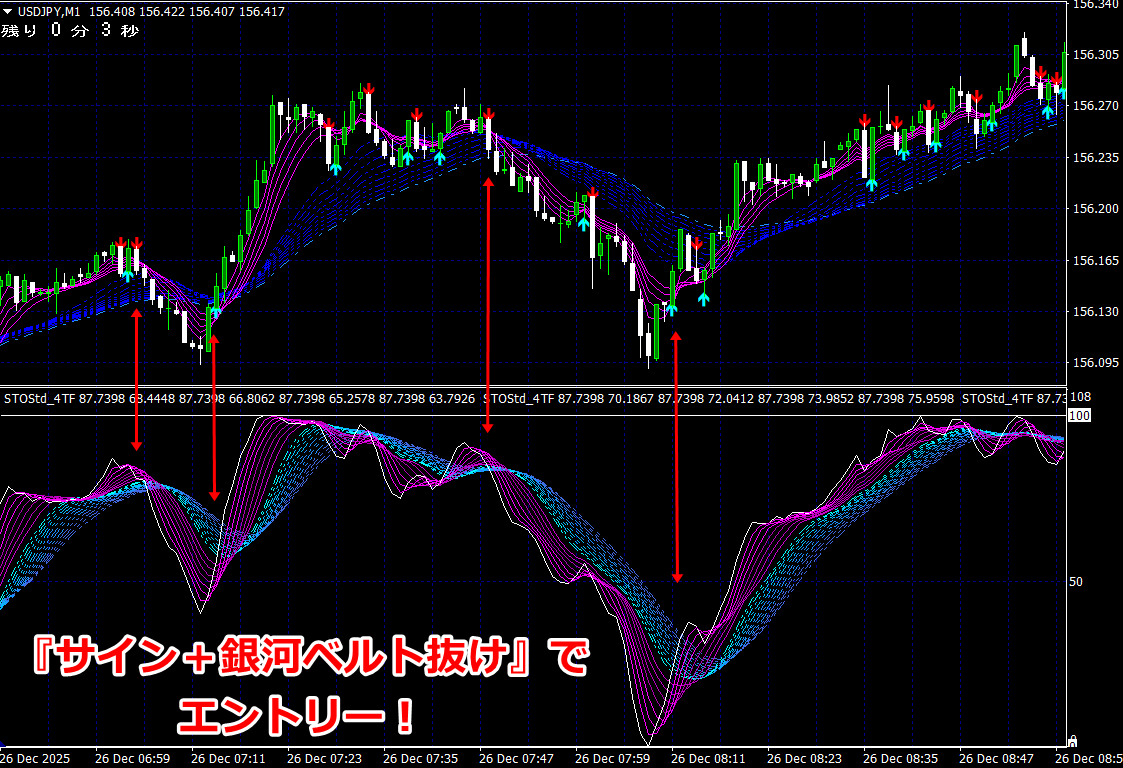

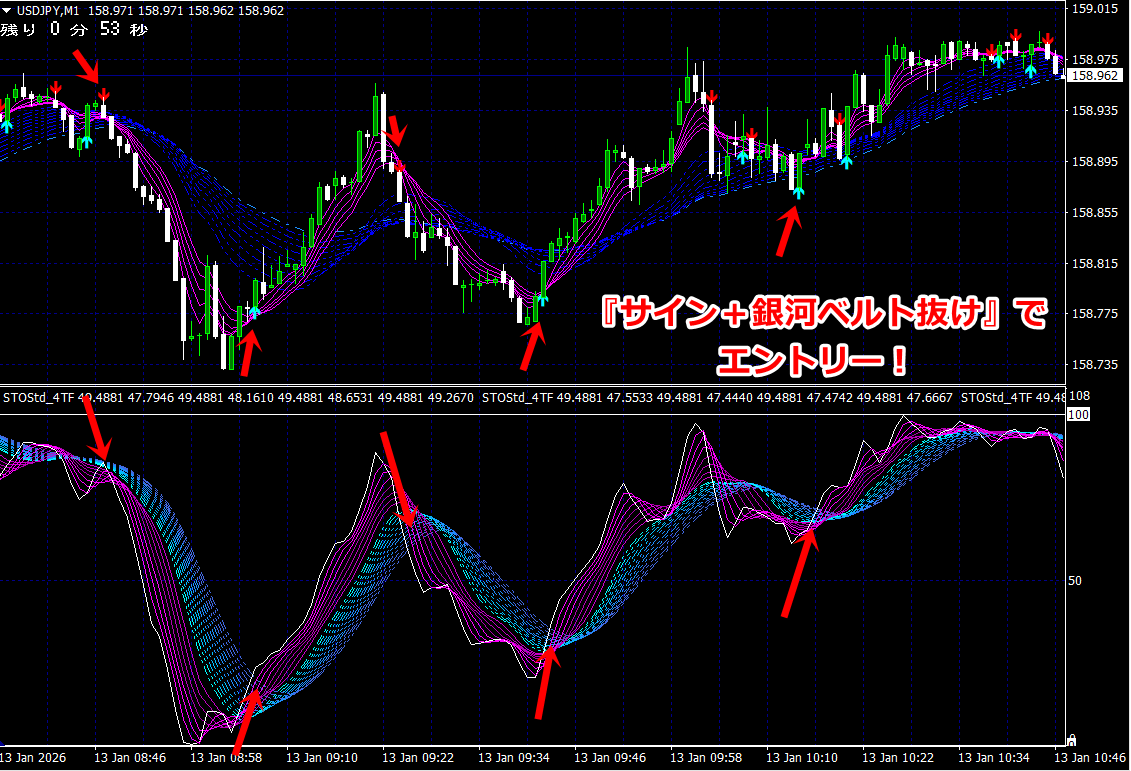

The convergence points of the technical indicator lines become the reversal points (tops and bottoms).

What about today’s USD/JPY? Bitcoin? The Nikkei stock average rising? How high will it go?

Or, where will today’s decline stop?

Determining market tops and bottoms is difficult, and in many cases practically impossible.

However, if you can determine tops and bottoms with extremely high accuracy, …

With only the upper chart’s candlestick chart, at that moment you cannot determine whether it is a top or bottom.

However, if you view it together with the two types of indicators below,in real timethat moment is

largely an “upper-range top” or almost a “bottom-range bottom,”

as in the figure abovein a very clean formandappearancecan be inferred easily just by looking at it.

Key points of technical indicator analysis are

・Clear and easy-to-see reversal points

・Few false signals

・Timings that aren’t delayed

These three points are essential.

This original method’s technical indicator, when viewed visually, differs clearly in effectiveness from other classical indicators such as MACD or RSI, which have many false signals.

Trading signals for buy/sell are also simple.

“Blue linesurpassgreen・redsignal to enter,

white signalto take profit!”

That’s all there is to it.

Capture market tops and bottomsTrading Signals Indicator