No deviation from backtesting! An EA with over 50% annual return and one trade per day '梓弓'

Gained 730 pips in 10 months of forward testing!

A single-position EA trading daily with ultra-low drawdown, '梓弓'

【梓弓 概要】

Currency pair: [USD/JPY]

Trading style: [Day trading]

Maximum number of positions: 1

Usage timeframe: M5

Maximum stop loss: 1000 (closed by internal logic)

Take profit: 1000 (closed by internal logic)

No hedging

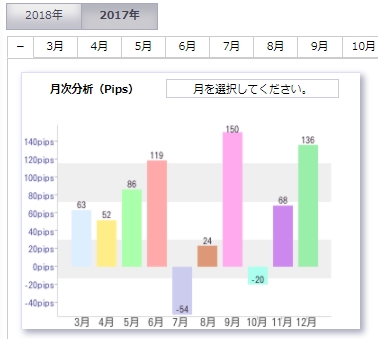

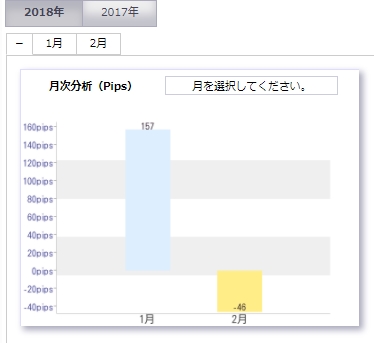

【Forward Analysis】

In 2017, +624 pips gained

In 2018, though only a little over one month, +111 pips gained

Forward testing for just under 10 months+730 pips gainedand a strong performance!

Moreover, notably,maximum drawdown is 11,900 yen (110 pips)!

Because it uses one position, it is designed for easy capital management.

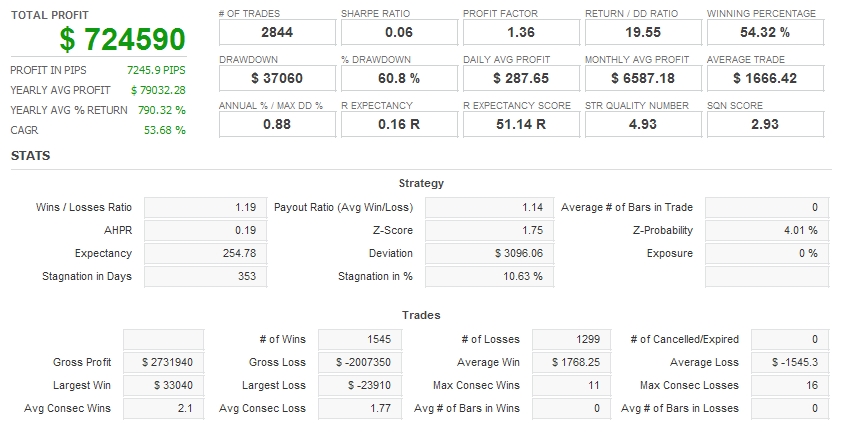

【Backtest Analysis】

Backtest results from 2008-2017

(Backtest with spread 10 (1 pip))

(Note: Although quoted in USD, the backtest is in yen.)

Average annual pips gained: 790 pips.

Since forward 10 months produced 730 pips, it is not inferior to a backtest with a spread of 1,

and there is little divergence between backtest and forward performance.

The 10-year average win rate is 54%, and since the average profit is 1,768 yen with an average loss of 1,545 yen,

it's a losing-but-profitable type of EA.

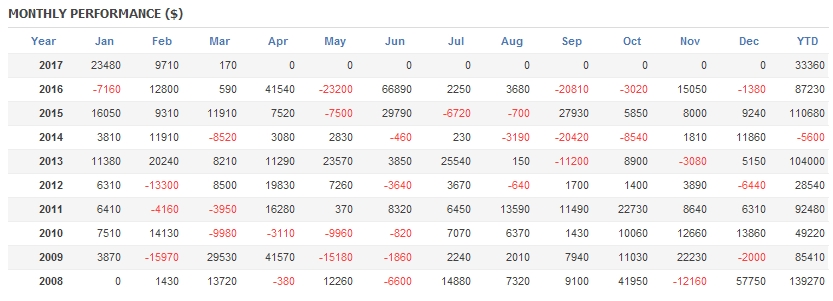

Looking at monthly performance, there are months with losses several times a year, and 2014 shows a slight negative.

However, this small negative is because many USDJPY accounts have spreads of 1 or less; in real operation, it is likely to post a positive result.

■ What is the expected annual return for a maximum allowable drawdown of 30%?

For a 1,000,000 yen account, with 0.1 lot trading the maximum drawdown would be about 50,000 yen, so

it's OK to raise to 0.6 lots (six times).

0.1 lot operation is possible from around 150,000 yen.

The annual expected profit for 150,000 yen is 79,000 yen, which yields an annual return of +52%!

× ![]()