【Tarou's Discretionary Trading Struggles ~ USD/JPY Edition ~ Week 22/7/4 Forecast】

Latest USD/JPY Forecast

Good evening!!

July has arrived in the blink of an eye! The second half of this year starts now!!

But… every day is so hot, I’m already feeling summer fatigue…。

I wonder if I’ll have the stamina until the long summer vacation… (laugh

With the yen’s weakness and this climate, what on earth will happen to Japan~><;

Before I collapse from summer fatigue, this week’s forecast for’22/7/4 weeklet’s get started☆

First, as usual, let’s review last week’s movements.

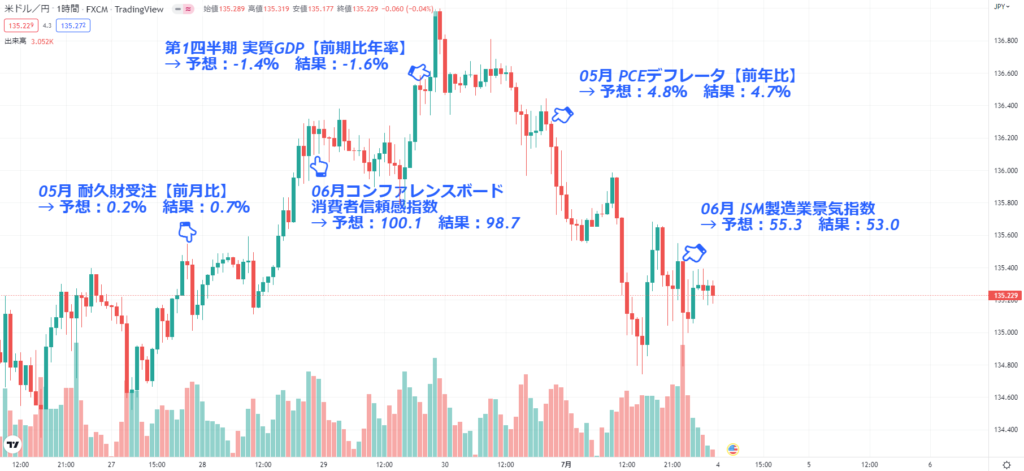

6/27 (Mon) 21:30 May Durable Goods New Orders【MoM】

→ Forecast: 0.2% Result:0.7%

6/28 (Tue) 23:00 Jun Conference Board Consumer Confidence

→ Forecast: 100.1 Result:98.7

6/29 (Wed) 21:30 Q1 Real GDP【Annualized QoQ】

→ Forecast: -1.4% Result:-1.6%

6/30 (Thu) 21:30 May PCE Deflator【YoY】

→ Forecast: 4.8% Result:4.7%

7/01 (Fri) 23:00 Jun ISM Manufacturing PMI

→ Forecast: 55.3 Result:53.0

~A few comments on the indicator results~

May Durable Goods Orders showing strong results and rate hikes by other countriescaused the first half of the week to move toward a weaker yen, and by 6/29 (Wed)the USD/JPY reached an all-time high near 137, even touching it?but all the other indicators for the week were worse than expected, and the price retraced toward the range at the end of the week.

As for the market outlook, could this be the end of this uptrend soon?!In midweek, perhaps it’s better to enter with a forecast in mind!Midweek adjustments might be better to enter with forecast in mind!Many may be thinking that now.There are probably more people thinking this way now.Many may be thinking so now.

This week's employment reportwill be a crucial pointThis week’s employment datawill be a significant pointThis week’s employment datawill be a crucial point..

~Comments on last week's Tara-entry~~Comment on last week’s Tara Entry~~Comments on last week's Tara Entry~

Last weekLast weekLast week

【【【Fundamental Buy Entry, but if a trend reversal is sensed, sell!Fundamental buy entry but sell if trend changes!Fundamental buy entry, but sell if trend reverses!】】】

that’s how it was☆was☆was☆

It was a very volatile and difficult week, but in Tara’s forecast,It was a very active and difficult week, but Tara’s forecast saysIt was a very active and difficult week, but Tara’s forecast says① and ② were triggered!① and ② were activated!① and ② were activated!That’s right☆That’s right☆That’s right☆

For ①①①About 50 pips or so was captured firmlyWe were able to secure a little over 50 pips!We were able to secure more than 50 pips!I think!I think!I think!

②,②,②,there may be those holding losses currently ><;

For those who checked Tara’s Twitter, togetherIf you checked Tara’s Twitter, when it dropped to 136 yen, you could have taken about 30 pips as profitIf you checked Tara’s Twitter, when it dropped to around 136, you could have taken about 30 pips as profitwhen it fell to around 136, about 30 pips was taken as profit...

But in the second half of the week, the range moved in an entirely different way, so it’s impossible to compare with the forecast.But the second half of the week moved in a completely different range, so a direct comparison to the forecast is not possible.But in the second half of the week, the range moved in an entirely different way, so a forecast comparison wasn’t possible.

Perhaps midweek forecasts would be better to enter!

Now, amid this volatility,this week's employment datawill be released!!

Let’s forecast carefully and enter appropriately♪

Now, while looking at the chart,this week's forecastlets go☆

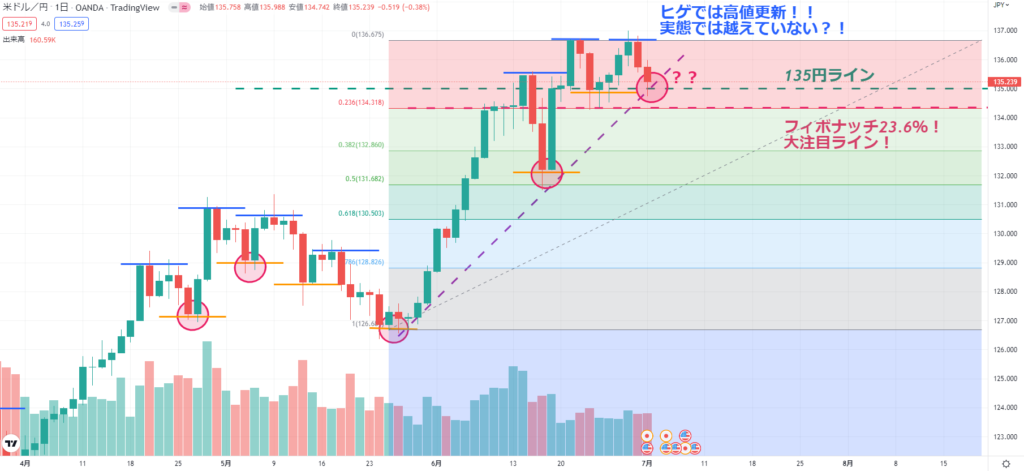

First, the daily chart☆

【1D】

The shadows are making new highs, but on the daily chart the body hasn’t clearly surpassed yet?!

135 yen supportand weekend adjustments,it also seems to be supported by the purple dotted line on the chart, buta double top could be possible…。

The movement in the early part of this week will be very important!

If thinking up, the key is to use this support to rise again and push to a new high!

If thinking down, the key is whether it can break below the Fibonacci 23.6% line!

That’s what I’m thinking.

This week, entering only after direction is clear may save a lot of avoidable damage!Be sure to stay warned!

I’d like Tara to be stricter, but please everyone be careful!

Now, as usual, let’s also look at the 4-hour chart ☝

【4H】

On the 4-hour chart, the same viewapplies.

The purple dotted line on the chart (current position) rebounds, and if it rises and makes a new high, enter long!If it falls below the Fibonacci 23.6% line, enter short!

On the daily chart, long entries looked quite unlikely, but when looking at the 4-hour chart in detail, if it reverses at the current line,the sequence of higher lows after breaking the high can begin,making a real possibility for a new high.

The ISM Manufacturing PMI worse-than-expected but not falling suggests this could be a key point!.

Neverthelesswatch out for impulsive buy entries!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week

Please enter only after the direction is clear!!

I will keep that firmly in mind as I enter!

①If the Fibonacci 23.6% line is brokenSell Entry!

Take profit targetis at Fibonacci 38.2% line132.8 yen☆

Stop loss will be the previous high and the current line135.3 yen.

②If the 4-hour chart’s previous high is surpassedBuy Entry!

It should be considered a high-price breakout attempt!

Take profit targetis137.1 yen☆.

A 140 yen challenge is also quite plausible, but as usual, “Take profit is justice”^^

(Same as last week’s commentw)

After observing the 137 yen break, take profits once, and if it moves beyond, re-enter long☆

※However, please beware of rapid reversals!

Stop loss should ideally be at the 23.6% line, but it’s quite deep, so at the start of this week the current value135.2 yenwill be used.

This week is a bit short, but with these two forecastsI want to enjoy entering^^♪.

If there are additional forecasts, I’ll post them on Twitter etc.☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now as usual, I’ll check this week's notable indicators to finish☆

7/06 (Wed) 23:00 Jun ISM Non-Manufacturing PMI

7/06 (Wed) 27:00June FOMC Minutes

7/07 (Thu) 21:15 Jun ADP Employment【MoM】

7/07 (Thu) 21:30 May Trade Balance

7/08 (Fri) 21:30 Jun Jobs Report

This week also has many indicators that reveal the U.S. economy!

June ISM Non-Manufacturing PMIis a key indicator that will shape early-week movement

June Jobs Reportwill be a major indicator for future moves!

It may be a cautious week, but let’s enjoy entering anyway♪

Thank you for reading until the end today☆

Please have the best posi-positivity life this week too♪

Comments on LINE are also welcome^^♪

Last Week’s USD/JPY Forecast

If you want to read Tara’s discretionary trading diary from last week too, you there! You should check it out♪ Here it is^^↓↓↓

Past USD/JPY Forecasts

If you want to see even more old diary entries, please click here^^♪↓↓↓

How to Enter, Take Profit, and Cut Loss Points

The following link summarizes Tara’s basic approach to chart analysis☆

Since Tara is a beginner, her approach and experience continue to evolve

(growing, I’m sure!)

I will update and revise it from time to time^^♪

“What’s this about? What’s the thinking behind it?”

and

“Let me check the growth and see!”

Please feel free to come and read more and more^^♪

How to Choose an FX Account and Recommended FX Accounts

Now, after reading this, many of you may want to start actual trading, right? ^^

If so, you’re probably wondering which FX broker to start with☆

In that case, Tara has summarized

”[Recommended FX Accounts] If you’re starting FX”

Why not read this^^b

It covers six points to consider when choosing a broker☆

Please do give it a read as well m–m

By the way, Tara uses FXTF♪

If you’re unsure which broker to start FX with, or

you find choosing brokers to be a hassle—tell me something easy to start with

Click the link below to register easily^^♪

You’ll end up with the same FXTF as Tara☆

With Tara on the same FXTF, I can share more tips, so please feel free to ask via the LINE above♪↓↓↓↓