Another "Forward Test"

Backtesting is ultimately based on past data—a very practical mindset, staying vigilant against the “optimization trap” that can occur when actually buying and selling.

For example... imagine analyzing price movements over the past year to find a tendency like “if this kind of movement occurs, it will rise sharply in the short term,” and then formalizing (mathematizing) that into a rule.

The more you are aware of competition from others, the more you tend to adopt a short-term perspective and pick up偶然の現象 to assume it will recur in the future.

What you need to be especially careful about is“the most recent past”.

Not only when there is a long period of data, but also you tend to think that “the recent trend = still valid = can profit soon.”

Therefore, after verifying past movements, instead of immediately starting real trades in the main account, you consider doing a small-scale live trading to conduct a “final polishing test.”

This is called“forward testing”.

Even this is something practitioners have long done as “trial trading,” not a new idea, but in the world of system trading that tends to lean heavily toward calculations, it is deliberately labeled “forward testing” to eliminate blind spots.

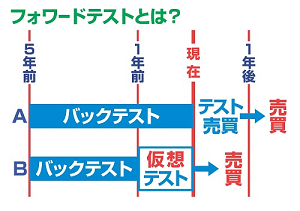

The forward testing above consists of

“verification with past data” → “live-test trading with limited quantity”

but there is another approach to forward testing based on a different idea.

“Verification with old past data” → “re-verification with the most recent past data”

as a method.

For example, suppose you have five years of stock price data.

With the logic (basic rules) that would be profitable in these five years, jumping straight into real trading is dangerous… from this double caution, the previous section described “conducting a live test with a small quantity” (Forward Test A).

Another method is to determine the most suitable settings from four years of data (five years ago to one year ago), excluding the most recent year, and then test those settings with the most recent year’s data.

Treat the most recent past year as a “fictional future” (Forward Test B).

When seeking the optimal value (the setting that yields the most profit), i.e., when deciding the trading formula, you do not look at the most recent past year.

Therefore,you avoid the common mistake of curve fitting, where the setting happens to be profitable by chance.

There are things you can only know through actual trading tests, but this is a way to reduce the risk of simply setting parameters to match past movements.

In theory, it allows you to start real trading earlier.

× ![]()