Discretionary trader's methods turned into an EA! Part 2 "MassyBo"

8-month forward return +71%!

Risk-reward ratio 2.34

Discretionary trader's method turned into an EA,

An orthodox single-position EA

WeMArinassyBollingerUSDJPY5mV2

Short for 'MAssyBo' (Massibo)!

【EA Overview】

Currency pair: [USD/JPY]

Trading style: [Swing Trading][Scalping]

Maximum positions: 1

Timeframe used: M5

Maximum stop loss: 200 (Buy=200 pips,Sell=130 pips)

Take profit: 160 (Buy=110 pips,Sell=160 pips)

Notes: settlements by internal logic (technical, breakeven, trailing (ATR included)); with compounding feature

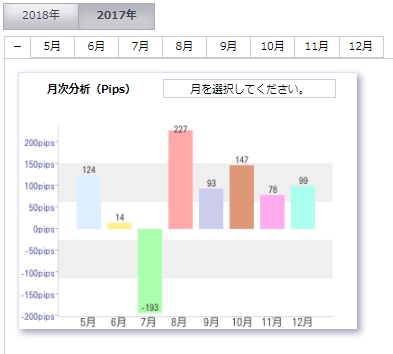

【Forward Analysis】

During the 8-month period from 2017.5 to 2017.1,+804 pipsearned!

Return on the recommended margin is +71%, andan annual return of 100% is not a dream for a well-performing EA!

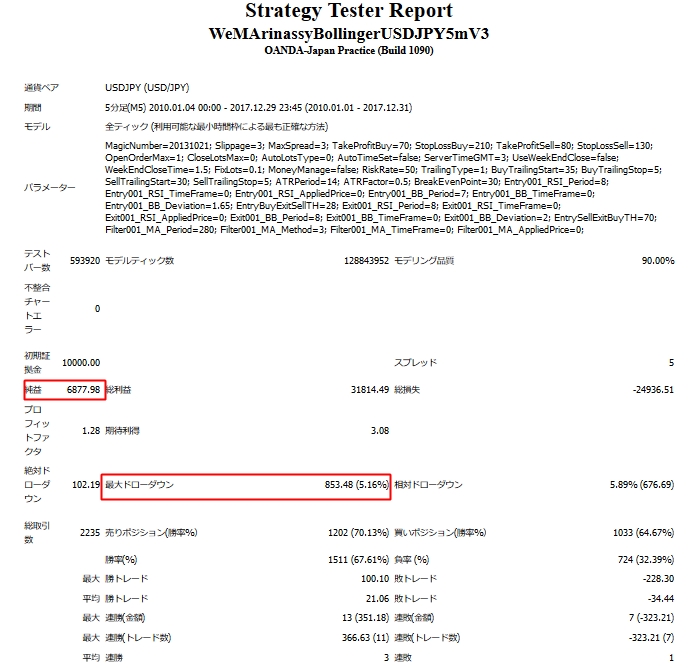

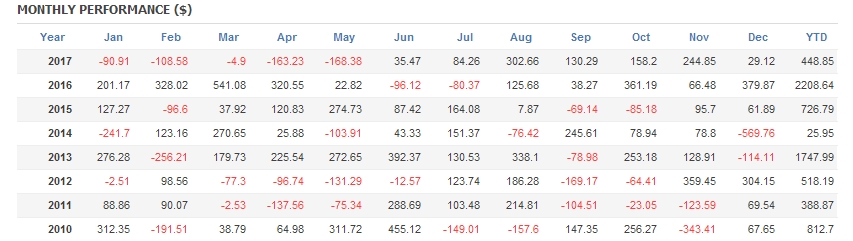

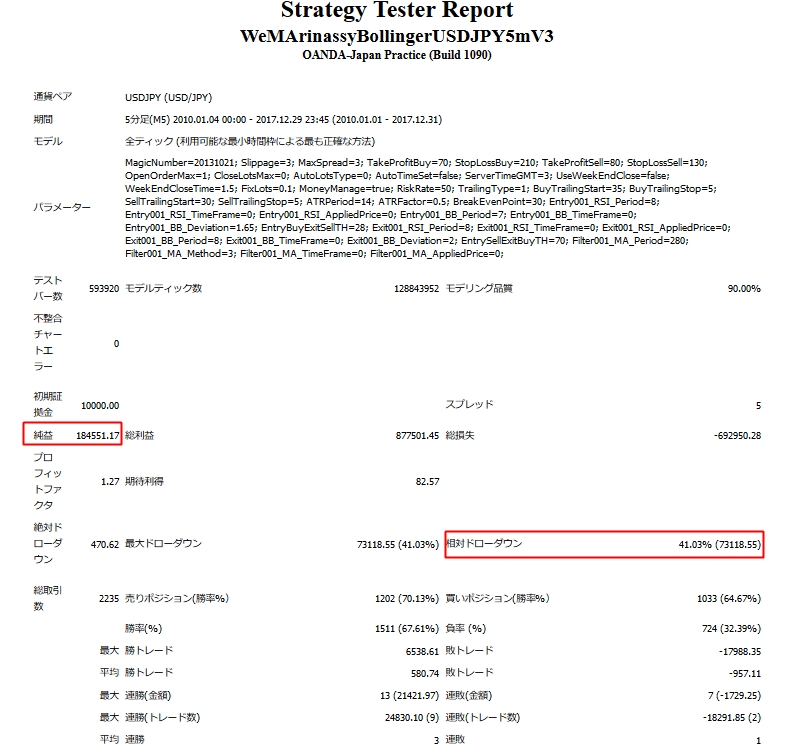

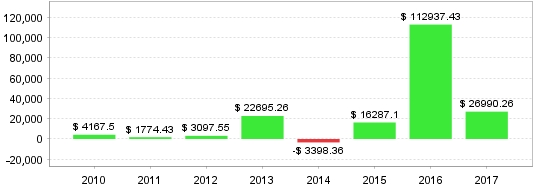

【Backtest Analysis】

If you adjust the lot size so that the maximum drawdown is around 30%,annual average +57%is achieved!

【Backtest Detailed Analysis】

With 0.1 lot operation, you can safely operate starting around 250,000 yen.

Maximum drawdown is 41%, so it might be a bit high risk?

WeMArinassyBollingerUSDJPY5mV2