[Tarō's Discretionary Trading Struggle Memo - USD/JPY Edition - Week 22/6/27 Forecast]

Latest USD/JPY Forecast

Good evening!!

Is summer arriving all of a sudden?! It’s humid in Japan, and from Friday the heat will be extreme><;

Even though it’s only June, I’ve got the AC cranked up!

(Because I can’t write good blogs unless the environment is comfortable! I’m spoiling myself(笑)

As I also posted on Twitter, last Friday night I hung out long and relaxed with university classmates for a long time♪ It’s still the COVID era, so it was home drinking though^^

It felt like I was back in my student days and it was incredibly fun☆

Lately I feel more mentally fatigued than physically fatigued.

With many people still working hard during the pandemic, it’s understood that we should take proper precautions, but we also need to build a lifestyle that allows for mental breaks☆

Tarou, who had a solid time out, will now start the usual Sunday evening blog editing(笑

Let’s get excited~♪^^

So this week’s’22/6/27 Week Forecastlets begin☆

First, as always, a quick check of last week’s movements.

6/21 (Tue) 23:00 May Existing Home Sales

→ Forecast: 5,410,000 units Result: 5,410,000 units

6/23 (Thu) 21:30 Current Account Balance Q1

→ Forecast: -$274.7 billion Result:- $291.4 billion

6/23 (Thu) 22:45 Jun PMI Manufacturing

→ Forecast: 56.2 Result:52.4

6/24 (Fri) 23:00 May New Home Sales

→ Forecast: 593 thousand Result:696 thousand

~A few comments on the indicator results~

Q1 Current Account Balance and Jun PMI ManufacturingBoth came in below expectations, causing a drop of over 1 yen. The dollar has risen sharply against the yen, but the US economy may not be in great shape.

On the other hand,May New Home Salessurpassed expectations and moved in a stronger dollar-high direction again, buteven though more than 100k better, it has not been able to recover to pre-release levelsaccording to the chart,the market seems skeptical. This is Tarou’s own forecast, though.

Howeverthis week’s releases will be highly watched, no doubt.

If US indicators continue to underperform, there could be a swift shift to USD weakness and JPY strength! Let’s watch the market closely and enter carefully!

~Comment on last week’s Tarou entry~

Last week

【This week, ride the uptrend while looking for a pullback entry point!】

That was☆

In terms of buying direction, the forecast was correct, but the pair rose past 136 yen, going outside the expected range, so the entry could not be made.

At the start of the week,① activated and that was it…

However, the range is different, and if you draw the Fibonacci line at the new high,② also activated.The 23.6% level is always watched, right?

From now on, even if the range changes, I’ll redraw the Fibonacci line and reevaluate☆

Despite an unexpected range, Tarou managed to trigger ① and take profits, so last week ended in the positive, indeed☆

Now let’s look at the chartthis week’s forecastStarting with the daily chart☆

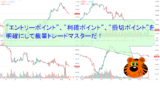

【Daily】

Additionally, as the high was updated, I redraw the Fibonacci line for this week as well.

Re-drawing showsFibonacci23.6%line has repelled twice.

Considering that, it may still beupward trend continues, but as noted in the indicator comments, Tarou is concerned about the lack of follow-through on Friday’s rebound.

If bad results continue and only a little good result comes out, it could be a sign that the trend is weakening—even though the reached high around 136.7 yen, there is skepticism about 136.7 yen.

Viewed as a week-long frame, the relation between yen and dollar due to rate differentials is unusual, so it may not mean the dollar is that strong…? In that casethe USD strength and JPY weakness may be near a turning point?Indeed.

This week also features the Fibonacci 23.6% line crossing with the purple dotted line, so I want to pay attention to whether it breaks below 23.6% or the purple dotted line.

With many indicators this week, I’m really looking forward to seeing how this evolves!

Now, let’s forecast in detail on the 4-hour chart☝

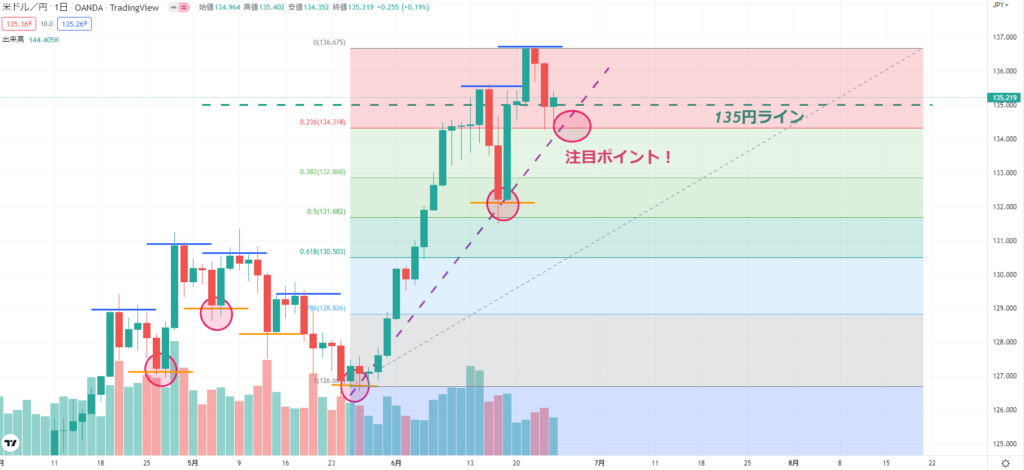

【4-hour Chart】

There’s a suspicious scent in the air?! I forecast, but given the current flow, it’s reasonable to expect the dollar to continue rising against the yen in the straightforward sense.

In that case, the key point remains the Fibonacci 23.6% line☆

~Forecast ①~

If it continues to rise at the start of the week, there’s a good chance of continuing the move, but even if it dips slightly, there is a saying that “what goes down must come up,” so the price may be supported at 23.6% and move higher again.

~Forecast ②~

In Tarou’s sensed pattern, it could be that 23.6% does not hold and the low from 6/16 is also broken and updated.

~Forecast ③~

It may move up to first as Forecast ①, but due to indicator results, it could drop and break the purple dotted line and the 23.6% line, aiming to update the 6/16 low.

However,the condition to consider this scenario is that it must not break the high set on 6/15, so watch carefully.

So,Tarou’s entry for this weekis~☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week,Base Cash Buy Entry, but if you sense a trend reversal, go for a sell!

I plan to enter with that in mind!

If it rises early at the start of the week or is supported at the 23.6% line,Buy entry

Take profitFirst target135.5 yen☆As a 4-hour chart forecast ①

Stop loss would be the low set early on 6/16133.8 yen.

②If ①’s take profit level is reached and it continues rising,buy entry!

It’s natural to consider an attempt to set a new high!

Take profitis137.1 yen☆as a target.

A 140 yen breakout is also possible, but as always “Take profit is justice” haha

If 137 yen breakout is confirmed, take profits once and thenre-enter for buyingagain☆

Stop loss would be around 23.6% line.134.3 yen.

③If the Fibonacci 23.6% line is broken below,Sell entry!

Take profitat Fibonacci38.2% level132.82 yen.Forecast for 4-hour chart is ②

At the 38.2% level, it’s likely to find support briefly, and if it drops below this line again after a small rebound, proceed with another sell entry. Take profit would be at Fibonacci 50.0%★

Stop loss is set at a single step boundary135.0 yen.

④135.5 yen line acts as resistance and if it breaks the purple dotted line, enter a sell!Take profit

at Fibonacci38.2%, i.e.,132.82 yen.Forecast for 4-hour chart ③. Re-entry is the same as ③!

Stop loss is also the same single step boundary135.0 yen.

This week I want to enjoy trading with thesefour forecasts^^♪

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now as usual, I’ll check this week’s notable indicators and finish☆

6/27 (Mon) 21:30 May Durable Goods Orders【MoM】

6/28 (Tue) 23:00 Jun Conference Board Consumer Confidence

6/29 (Wed) 21:30 Q1 Real GDP【Annualized QoQ】

6/30 (Thu) 23:00 May PCE Deflator【YoY】

7/01 (Fri) 23:00 Jun ISM Manufacturing PMI

There are a lot of indicators to gauge the US economy this week!

In particular, I think theJune ISM Manufacturing PMIis a key indicator to watch.

There seems to be a scent of trend reversal?!

Let’s sniff it out carefully, enjoy, and enter thoughtfully☆

Thank you again for reading until the end today☆

Everyone, have another great posi-positve life this week♪

Comments on LINE are also welcome^^♪

Last week’s USD/JPY Forecast

If you want to read Tarou’s discretionary trading diary from last week,

please check it out here♪ It’s this way below^^↓↓↓

Past USD/JPY Forecasts

If you want to see even earlier entries, please click here^^♪↓↓↓

How to Enter, Take Profit, and Stop-Loss Points

On the linked page, Tarou’s basic approach to chart analysis is summarized☆

Since it’s Tarou’s beginner trading diary, Tarou’s thinking evolves with experience

(growing, for sure!)

I’ll update and revise occasionally^^♪

“What’s this like? What’s the thinking?”

and

“Let’s check how you’ve grown!”

Please keep visiting ^^ ♪

How to Choose FX Accounts and Recommended FX Accounts

Now, after reading this, many of you may want to start trading for real, right?^^

If so, you’re probably thinking about which FX broker to start with☆

In that case, Tarou has compiled

”【Recommended FX Accounts】Start FX♪”

Why not read this^^b

It lists six points to consider when choosing a broker☆

Please read this as well m–m

By the way, Tarou uses the FX broker FXTF♪

If you’re not sure which broker to start with, or

you want something easy,

you can register easily from the link below, so please give it a try^^♪

It will be the same FXTF as Tarou~☆

If you’re with FXTF like Tarou, I can teach you a lot,

so feel free to ask via LINE above♪↓↓↓↓