Euro-dollar swings in the high range, riding out the volatile market with buy/sell signals! USD/JPY and the U.S. stock market change as anticipated!

After the year-end and New Year market, participants have finally started moving in earnest!

Last week was a week of U.S. events from President Trump's State of the Union address to FOMC and employment data

in the U.S. market, and the notable dollar scene—the USD/JPY pair

saw a rebound from the lower end of the long-term support line, closing near the 110 yen level

and ended the session at that level.

Moreover, it became clear that market participants have begun to move decisively in various financial markets.

Previous article

“Market participants will start injecting capital more seriously from here on!”

On the other hand, the other focus currency, the Euro/Dollar, is still holding in the high price range

and is transitioning at a long-term resistance line, but while handling U.S. events it remains near the high range

and has shown volatile up and down movements.

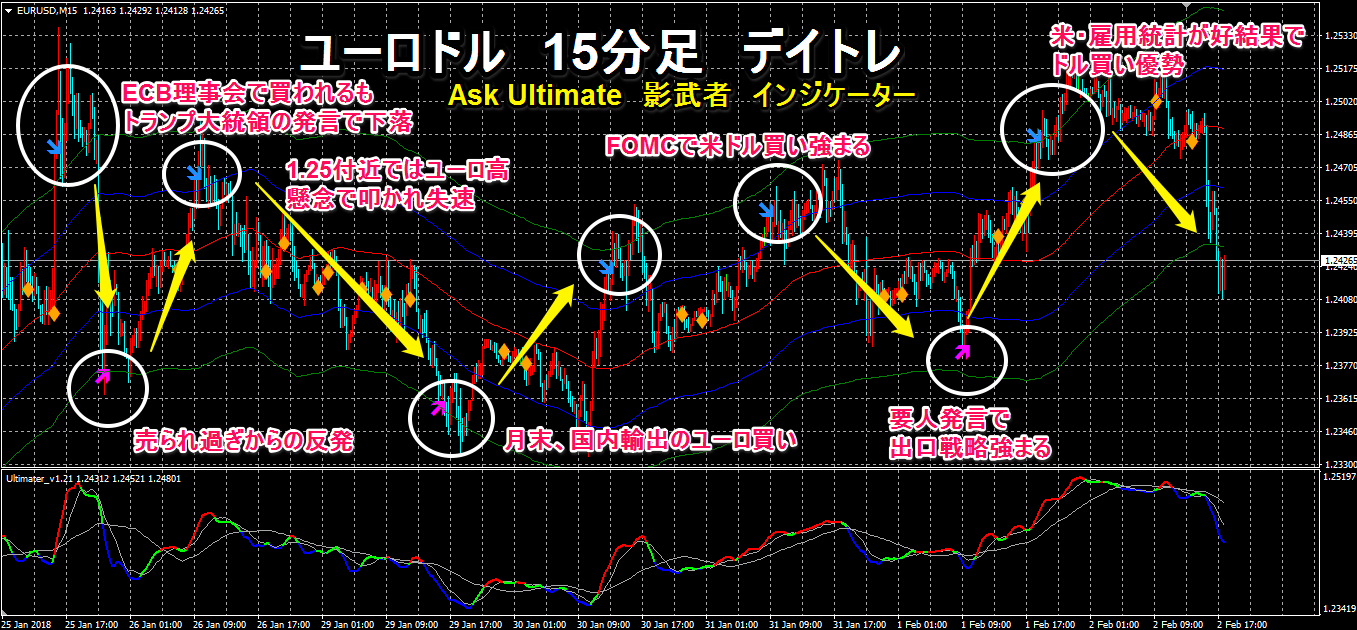

The chart shows“Ask Ultimate – Shadow Warrior”in Euro/Dollar 15-minute day trading

the market from the ECB meeting to the U.S. employment data.

The price movement has handled the events along with buy/sell signals!

Click the image to enlarge! The indicators are“Ask Ultimate – Shadow Warrior”/“Forex Kick” development product

Unlike the USD/JPY, the Euro/Dollar shows larger price swings, currently peaking in the 1.25 area

and is experiencing daily swings of over 100 pips, making it ideal for day trading

with this level of movement.

The monthly movement we have been watching has now broken above the Ichimoku cloud top, but

if this month's close pushes back into the cloud, it is expected to become near-term resistance, so

the continuation of the upside resistance is in focus, and with each market moving decisively,

we want to ride this wave successfully!

In the stock market, especially U.S. stocks have fallen since last week, recording historic declines.

At first glance, it seems the market may be entering a phase of correction after an unusually abnormal market run.

The timing of the move started after the year-end and New Year market, around the U.S. President's State of the Union address,

so it seems this was precisely the moment of change.

However, it has not been the case that the forex market followed the same pattern; even with the U.S. stock decline, the USD/JPY rose from the low and

ended the session around the 110 level, showing a decoupling trend, so

in such market conditions a technically-driven approach across currencies can be a viable strategy.

Strong for USD/JPY! “Battle Zone Trade” Giveaway Campaign!

Limited sale!

“Forex Kick” trading technique!

● For each currency pair, entry and exit times are fixed!

● At each time period, participants rapidly rotate! Grasp the flow of the day!

■ About summer and winter time zones ■ One week ■ One month ■ Yearly market flows

● Trading technique “Tokyo morning session is hot! The yen market: this is the origin of the battle!”

● Trading technique (long-term positions)

● Ask Ultimate MAX / Shadow Warrior set product

Additionally, a Battle Zone Trade indicator that is strong for USD/JPY as a gift!

Go to product details page

★Read previous “Market Compass” articles

★Daily updates! “Forex Kick” strategy blog