[Tarou's Discretionary Trade Struggle Diary ~ USD/JPY Episode ~ Week 22/6/20 Forecast]

Latest USD/JPY Forecast

Good evening☆

The humidity is extreme ><;

Taro here, who cleaned the filter because I think it's about time to use the air conditioner for dehumidification♪^^

(Well, you should write the blog firstw)

With that said, I'm editing the blog again from Sunday night, but let's not worry about it!

Let's enjoy it~♪^^

Now then, this week's’22/6/20 Week Forecastlet's begin☆

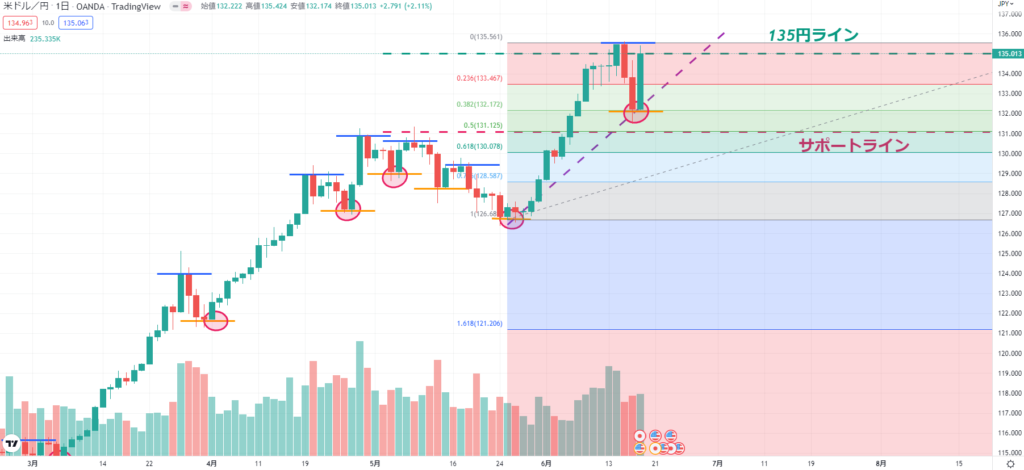

First, as usual, let's review last week's movements.

6/15 (Wed) 21:30 May Retail Sales【MoM】

→ Forecast: 0.3% Result:-0.3%

6/15 (Wed) 27:00 June FOMC Policy Rate

→ Upper bound rate_forecast: 1.75% Result:1.75%

→ Lower bound rate_forecast: 1.5% Result:1.5%

6/16 (Thu) 21:30 June Philadelphia Fed Index

→ Forecast: 5.9% Result:-3.3%

6/17 (Fri) 22:15 May Industrial Production Index MoM

→ Forecast: 0.3% Result:0.2%

~A brief comment on indicator results~

Start the week by successfully challenging 135 yen, and then enter a range-bound market, and then

late Wednesday night on the 15th, it rose further to 135.5 yen! After that

May Retail Sales MoMwas lower than expected, so the trend turned downward.

June FOMChad the expected result and didn't have a major impact,

the downward momentum prevailed, and at one point it dropped to 131.5 yen, about 4 yen from the peak.

Then suddenly it almost fully retraced! What a volatile week.

~Comment on last week's Taro entry~

Last week was

【This week, be aware of challenging 135 yen, but selling pressure dominates!】

that☆

As predictedwould be appropriate to say!

At the start of the week① was triggered, and in the latter half③ was triggered!

However, the subsequent surge was completely unpredictable… It’s impossible, right? (lol)

This is where strength shows itself“Profit-taking is justice”!

This time, Taro's forecastwas to hold positions greedily and only ① achieved?!

Or perhaps by weekend's rebound, keep a slightlynegative position?

Taro's catchphrasewould have earned60 pips at ① and 60 pips at ③☆

From now on,“Profit-taking is justice”will be kept as a motto to steadily grow profits♪

Now, looking at the chartsthis week's forecastgoes on♪

First, the 1-hour chart☆

【1-hour Chart】

Furthernew highs were reached, so I redraw the Fibonacci lines from the nearest low point..

In terms of body,Fibonacci38.2%lineis where it reversed.

Therefore, the uptrend should still be considered as continuing☆

Of course the last week's high is a key point, butthe move may temporarily pull back to form a new lowpoint, I predict.

If the uptrend continuesthenFibonacci23.6%line should provide a solid reversaland a new higher low point may be formed☆

Also, I’d like to anticipate a reversal near the purple dotted line on the chart^^

Fibonacci23.6%line goes below, stillbutFibonacci38.2%38.2%line could provide a strong rebound, I think, but since it has already dipped once, there is a meaningful chance it could drop furtherso be careful entering buys.

Ultimately,will form around the high point at the end of April, nearFibonacci50.0%lineas well.

If this line is breached, there is a high possibility of a major downtrend.

This week is still likely to be a week of uptrend for some,but given the ongoing weak US indicators after last week,the USD/JPY may soon shift away from yen weakness towards a change, I think.

That’s why this week’s indicators deserve close attention!

Now, let's also check the 4-hour chart to see current status☝

【4-hour Chart】

The view on the 4-hour chart remains the same.

In the early part of the week, where the low-up move forms will be watched.

And the level to watch for a reversal is still the Fibonacci 23.6% line; if it really reverses here, it will become a strong uptrend and could easily exceed the last week's high of 135.5 yen.

Even if it falls below the 23.6% line, there are several reversal timings near the chart’s purple dotted line (connecting low points) and the 38.2% line, so we want to enter smartly☆

So,this week's Taro entryis~☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week, I plan to ride the uptrend while looking for a pullback buy point!

and enter accordingly!

①If it starts rising early in the week, I’ll target 135.5 yen andbuy entry!

Profit-taking pointwill be first at135.5 yen☆.

Since it’s a peak-chasing move, you might hear “go higher!”, but it’s clearly a timing to set a low point and take profits early.

The stop-loss point will be near the previous high on the 4-hour chart134.4 yen.

targets are suggestingearly exit.

②If it starts lower at the start of the week, identify reversal points andbuy entry

a)Fibonacci23.6%23.6%lineto resume up move (reversal)buy entryand

Profit-taking pointis135.0 yen☆.

It would be a fairly solid uptrend, but because last weekend’s line is the prior high line, the 135 yen level will be watched. Even here,take profits firmlyand if it breaks through, re-enter to aim for 135.5 yen☆

Stop-loss should be around the 23.6% line, but since a wick could trigger a stop, set it slightly below at133.1 yen.

b)Fibonacci38.2%38.2%lineto resume up move (reversal)buy entryand

Profit-taking pointis the Fibonacci 23.6% line at133.38 yen☆.

Even though it reversed at the 38.2% line, the chart still shows a fairly deep drop.

23.6% could now act as resistance, and a further drop is quite plausible, so early profit-taking is advised.

The stop-loss should be near the recent swing low around131.4 yen.

If breached, I would expect moves down to the50.0%line..

③If the Fibonacci 50.0% line around 131.0 yen is breached downwards,sell entry!

If the 50.0% lineis breached as well, the trend would be fully downtrend.

This week, if this line is breached, it likely indicates bad indicator results, socombine with indicator releases to enter sells.

Profit-taking pointis Fibonacci61.8%61.8%at129.96 yen.

Stop-loss is Fibonacci38.2%line at132.1 yen.

This week we plan to enter via thesethree patterns☆

For those who tend to overtrade,consider selling during the pullback in pattern ②☆

However, keep in mind this is still a week of uptrend andearly stop-loss is essential!

※Taro is cautioning you!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now, as usual, let's check this week's notable indicators before finishing☆

6/21 (Tue) 23:00 May Existing Home Sales

6/23 (Thu) 21:30 Current Account (Q1)

6/23 (Thu) 22:45 June Manufacturing PMI

6/24 (Fri) 23:00 May New Home Sales

This week'sJune Manufacturing PMIis a key indicator to watch timing-wise.

Since last week results have not been good,if results come in below expectations again, it could trigger a downtrend!

Thank you for reading until the end today☆

Everyone, please have an amazing posi-positing life this week as well♪

Comments on LINE are also welcome^^♪

Last Week's USD/JPY Forecast

If you want to read Taro's discretionary trading diary from last week too,

please take a look here♪ This is it^^↓↓↓

Past USD/JPY Forecasts

If you want to see even more of his past diaries, here you go^^♪↓↓↓

How to Think About Entry, Take Profit, and Stop-Loss Points

In the linked page, I also summarize the basic approach I use when analyzing charts☆

Since this is a beginner Taro's trading diary, my thinking evolves with experience

(I’m growing, I’m sure lol)

I will update and revise occasionally^^♪

“What’s this like? What kind of thinking is this?”

and

“Let me check how I’ve grown!”

Please keep coming to read with that spirit^^♪

How to Choose and Recommend FX Brokers

Now that you’ve read this far, many of you might want to start trading for real haha^^

If so, you’re probably thinking which FX company to start with☆

In that case, Taro has compiled

”【Recommended FX Accounts】If you’re starting FX♪”

Would you like to read that^^b

I’ve summarized six points for choosing a broker☆

Please check this as well m–m

By the way, the FX broker I use is FXTF♪

If you’re wondering which broker to start FX with, or

it’s a hassle to choose—tell me a simple one!

You can register easily from the link below, so please give it a try^^♪

Same as Taro, you’ll use FXTF☆

If you’re with the same FXTF as Taro, I can help you with various things,

so feel free to ask from the LINE above♪↓↓↓↓