Over 3 years of forward performance!

The definitive low-drawdown EA that continuously updates profits

'White Bear Z USDJPY'

Re-discover the charm of 'White Bear Z USDJPY'!

What is the most efficient way to manage funds?

We’ll explain the differences between simple and compound interest strategies!

【White Bear Z USDJPY Overview】

Currency pair: [USD/JPY]

Trading style: [Day trading][Scalping]

Maximum number of positions: 3 Others: adjustable between 3–5

Operation type: Compounding (also available with simple interest)

Timeframe used: M5

Maximum stop loss: 60 pips

Take profit: 7 pips

Entry allowed time: 3:30–8:00 (Japan time)

【Eliminate maximum risk with a variety of filters!】

The culmination of the White Bear series, which has evolved in response to user feedback

White Bear Z。

・Do not enter on Monday mornings

・Forced liquidation at the specified time on Friday (no weekend positions)

・If there is a movement larger than the specified pips, do not enter at the designated time

These safety features are included.

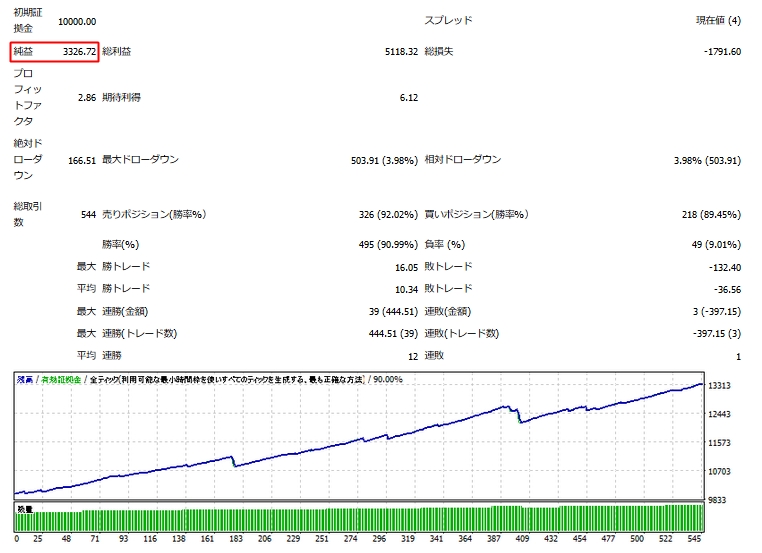

【Forward Analysis】

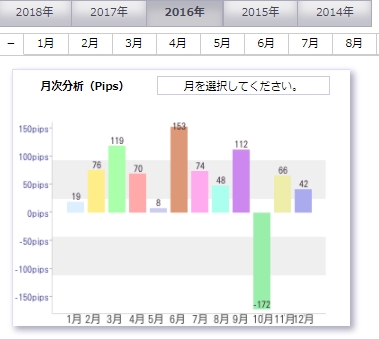

Looking at the results so far, there was a relatively large drawdown in October 2016

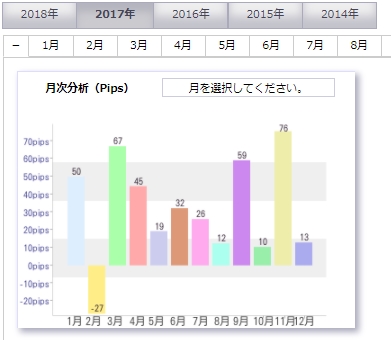

but profits were recovered over about six months, and since 2017 it has shown a steady uptrend.

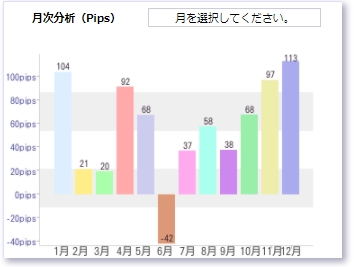

(Pips earned in 2015)

In 2015, +674 pips earned,

Profit was 115,000 yen.

(Pips earned in 2016)

Despite a large drawdown, 2016 achieved a total of +617 pips, a great performance.

Profit was 117,000 yen.

(Pips earned in 2017)

2017 didn't bring large gains often, but was steady at +382 pips.

Because of compounding, even with fewer pips, the profit was 78,000 yen.

Even with compounding, it grows gradually at around 0.2 lots against a 1,000,000 yen account,

not much different from fixed in terms of growth, though…

Moreover, against a maximum drawdown of 42,700 yen, the cumulative profit is 350,000 yen, which is excellent.

【Backtest Analysis】

Now that forward performance is established, let’s check with backtests to see if there is any divergence from forward results.

Default settings (AutoGMT is false in backtests),

2014.9~2017.12.31 forward and backtests covering roughly the same period

Spread (current value)

Almost no deviation from forward….!!!

It is rare for the P/L curve to match this closely.

The reason is that it uses fixed TP and SL without trailing stops”

It seems to be because the backtest was run on the same Oanda account as the forward measurement.

In that case, backtests become more trustworthy, making it easier to predict long-term maximum risk and expected returns.

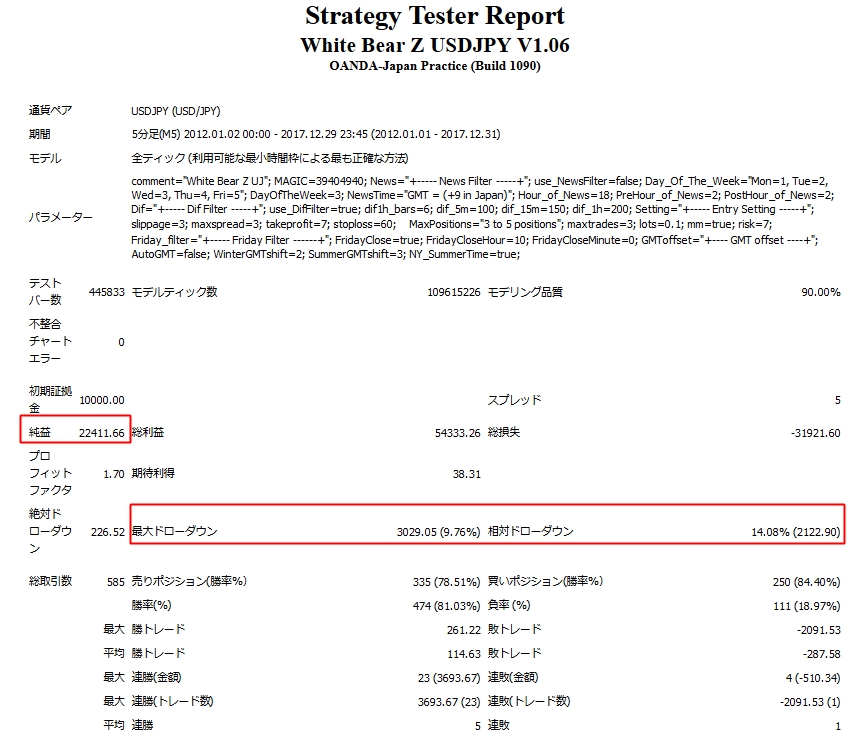

【Ways to maximize profits!】

With default parameters, RISK = 1.0.

<Parameter: How to think about RISK value>

RISK = 1.0,the maximum loss per position is designed to be 1% of the account funds.

Since there can be up to 3 positions, for a 1,000,000 yen account the maximum loss is about 30,000 yen; with a losing streak it could be a bit larger.

That would make the maximum drawdown too small to be efficient, so we ran a backtest with

RISK = 7 for compounding.

Backtest period: 2012.01.01-2017.12.31 (6 years)

Net profit 22,411 dollars

Maximum drawdown 3029 dollars

Relative drawdown 14%

Relative drawdown 14%, so there is still room.

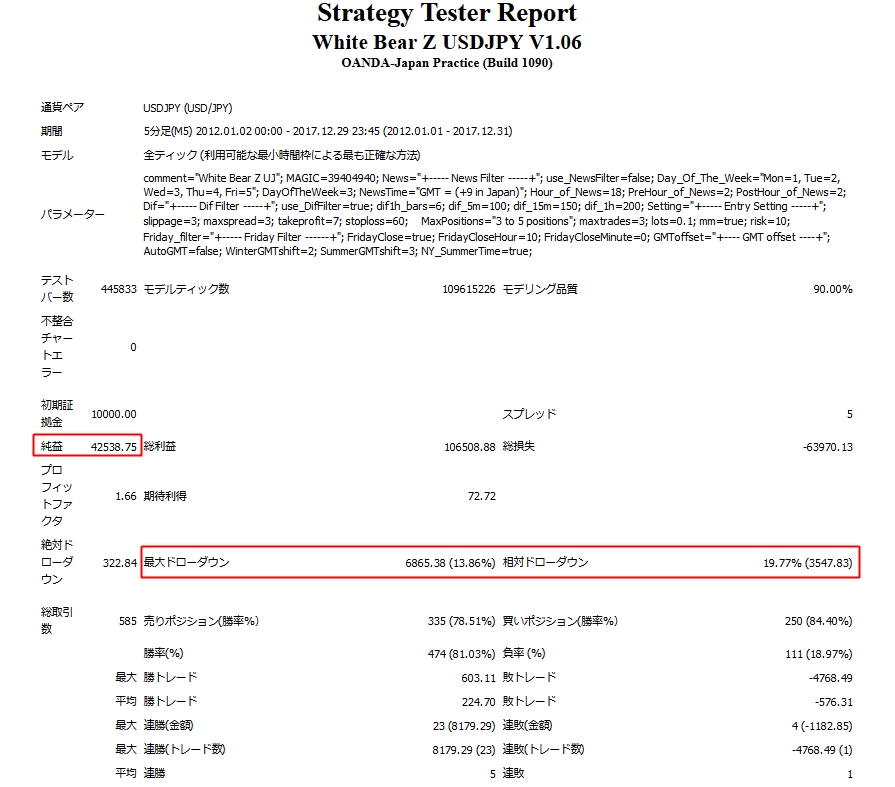

Risk10 looks safe as well!RISK=10

Net profit 42,538 dollars

Maximum drawdown 6,865 dollars (13.8%)

Relative drawdown 19.77%

That’s it!

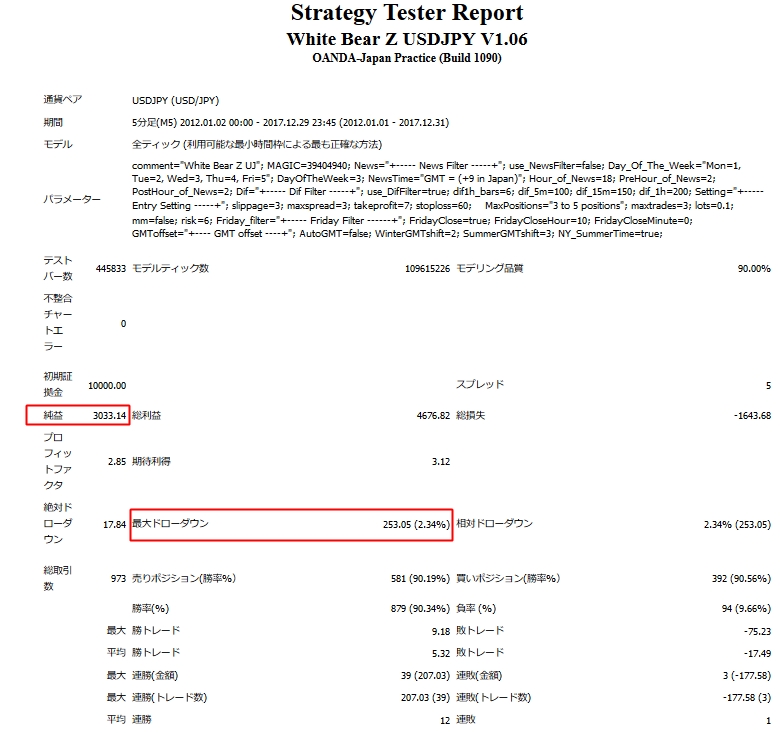

【Fixed Lot Case】

For a high-win-rate EA, fixed lot sizes have little advantage, but

it is useful to gauge how many pips can be earned annually in backtests.

2012.01.01-2017.12.31 (6 years)

Spread 0.5 pips

0.1 lot fixed

Maximum drawdown: 253 dollars

Net profit: 3033 dollars

Maximum drawdown per 0.1 lot is tiny!

With up to 3 positions, even 0.1 lot per a 200,000 yen margin seems perfectly fine.

(Leverage 25x, margin 120,000 yen + max drawdown 30,000 yen)

(Monthly profit/loss)

It’s amazing that the annual average gain maintains around 500 pips.

There is no year-to-year variation; negative months occur once a year, at most twice.

【Control RISK value to earn efficiently!】

We found that even with RISK = 10, it can be operated safely and profits increase substantially,

Please try increasing the RISK value and operating.

Don’t leave it at the default settings!

TP = 7 pips, so lower spreads yield more favorable results.

I am once again impressed by the stability of White Bear Z. It’s a long-standing popular EA, as expected!

White Bear Z USDJPY