[Tarou's Discretionary Trading Struggle Chronicle ~ USD/JPY Edition ~ Forecast for the Week of 22/6/13]

Latest USD/JPY forecast

Wow, business is busy… I have to come to work on Sunday, so I’ll try to write a bit of the blog on Saturday…

Currently announcing Sunday 3:30 now~。

It’s definitely going to be updated after final edits tomorrow after work lol

Please check on Twitter what time I updated!

Well then, even if work is忙 busy, the forex won’t wait for you!

I must make solid forecasts and push hard from Monday♪

Now for this week's'22/6/13 week forecastLet’s begin☆

First, as always, let’s review last week’s movement.

6/10 (Fri) 21:30 May CPI (Consumer Price Index) [MoM]

→ Forecast: 0.6% Result:1.0%

~ About the indicator results, a brief comment ~

May CPI (MoM)was higher than expected,

raising concerns about a deteriorating economy from rate hikes!

Stock selling could accelerate the dollar buy, sending the dollar higher~!

135 yen challenge since 2002is finally approaching.

For USD/JPY, it’s the highest price in 20 years, and the yen is weak against other currencies as well,

and reportedly has returned to around the value from about 50 years ago….

Will Japan be alright…。

~ Comment on last week’s Taro entry ~

Last week was

【This week try 131 yen and aim for a new high!】

★

Hmmm lol

As for forecaststhey are accurate,accurate, but

as of Monday, we broke through, soonly pattern ① triggered!

However, everyonelikely captured well, right?

I also tweeted thatTaro also grabbed 30 pips × 2 lots on Monday^^♪

If left alone, 130 pips × 2 lots could have been, but that’shindsight.

I didn’t incur a loss!

“Taking profit is justice”that’s the motto☆

If the forecast range deviates significantly at the start of the week,

it might be better to update the forecast again mid-way~^^

To avoid odd entries☆

In the future, I’ll also consider updating Taro’s midweek discretionary trading diary!

Now, while looking at the chart,let’s go to this week's forecast♪

First, the daily chart☆

【1 Day Chart】

From the end of May it has been rising steadily,and looking at this situation

the target value isthe 135 yen high point set in 2002,

with this momentum, it could be reached in an instant, but

above that,near 148 yen in 1998,

so, given the current flow, I think it’s unlikely to rise that much.

As for Taro’s forecast,a successful 135 yen challenge,

we’ll firstreturn to the Fibonacci23.6%line and thendecide whether to aim higher.

I expect the Fibonacci 23.6% line to be reached, but,

if the upward momentum does not stop, we might hit the purple line inside the chart slightly before and

then bounce higher again?!

But for Taro,

the favored scenario is a peak near 135 yen and a gradual decline thereafter.

This is a slightly more likely forecast.

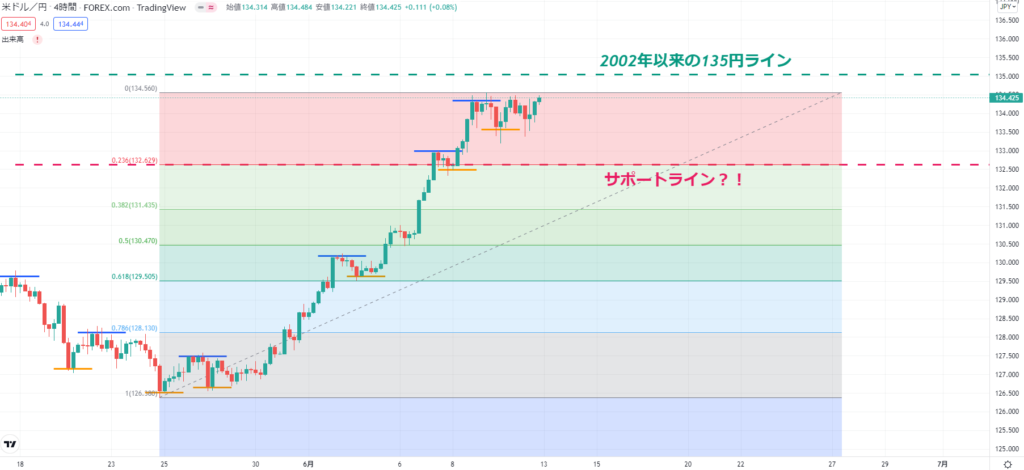

Let’s also look at the 4-hour chart ☝

【4-hour Chart】

Fuel up and suddenly attempt the 135 yen challengeseems possible, but

this would be the third time rebounding at 134.4 yen,

since CPI came in higher than expected, into the weekend on the rise,

so Monday may open a small gap, perhaps.

If this third attempt breaks this line, it’s reasonable to consider again the 135 yen challenge.

On the other hand, if it rebounds a third time, we may head toward the 23.6% line!

However this week, on Wednesday at 27:00June FOMCwill take place,

so a wait-and-see approach until then is possible, so“Take profits is justice”will be crucial for entries!

So~Taro’s entry for this weekis~☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week I’m aiming for a 135 yen challenge but with a tendency to sell more than buy!

I plan to enter accordingly!

①If it starts rising at the start of the week, I’ll consider it a 135 yen challenge andbuy entry!

Take-profit pointwill first be135 yen☆.

Stop-loss will be near the previous low133.5 yen.

②If it starts to drop at the start of the weeksell entry

Take-profit pointwill first be near the previous low133.5 yen☆.

FRB rate decision (FOMC)may keep us in a wait-and-see state,

soTake profits are justice!

Stop-loss will be near the previous high134.54 yen.

③If it falls below around 133.2 yensell entry

I think the target for the downside is the Fibonacci 23.6% line,

Take-profit pointis132.63 yen.

Stop-loss133.6 yenseems reasonable (slightly above the previous high).

This week I’ll enter with thesethree patterns☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now, as always, I’ll end by checking the key indicators for this week☆

6/15 (Wed) 21:30 May Retail Sales [MoM]

6/15 (Wed) 27:00 June FOMC

6/16 (Thu) 21:30 June Philadelphia Fed Business Outlook

6/17 (Fri) 22:15 May Industrial Production [MoM]

Because CPI results were higher than expected,

this week’sJune FOMCis even more noteworthy.

Volatile moves are possible, so it may be wise to adjust positions before the release.

After the release, once direction is clear, that is the smartest way to enter☆

I’d really like to tell Taro that, lol

Thank you for reading until the end today as well☆

Please have the best posi-Posi life this week too♪

I’m waiting for your comments on LINE too^^♪

Last week’s USD/JPY forecast

If you also want to read Taro’s discretionary trading diary from last week,

please take a look♪ here^^↓↓↓

Past USD/JPY forecasts

If you want to see even earlier entries, please click here^^♪↓↓↓

Entry, Take Profit, and Stop Loss Essentials

On the following link, I summarize the basic approach Taro uses for chart analysis☆

Since this is beginner Taro’s trading diary, his approach evolves with experience

(growing, I suppose!)

I will update and revise from time to time^^♪

“What’s this? What’s the thinking behind it?”

and

“Let me check the growth of it!”

Please feel free to come and see as it evolves^^♪

How to choose an FX account and recommended FX accounts

Now that you’ve read this far, many of you might want to start actual trading^^

In that case, you’re probably thinking which FX broker to start with☆

At such times, here’s aまとめ by Taro

”【Recommended FX Accounts】If you’re starting FX♪”

Why not give it a read^^b

It lists six points for choosing a broker☆

Please read this too m–m

By the way, the FX broker Taro uses is FXTF♪

If you’re not sure which broker to start FX with, or

you find choosing brokers a hassle—tell me a simple one to use—

you can register easily from the link below, so please try it^^♪

It will be the same FXTF as Taro’s☆

If you’re with the same FXTF as Taro, I can teach you various things,

so please feel free to ask via the LINE above♪↓↓↓↓