『WAVE for USDJPY』 Capturing the moment when the market has gone too far!

Risk-Reward Ratio 3.26

Scalping with a maximum stop loss of 5 pips!

Low maximum drawdown, so you can start with a small amount of capital.

『WAVE for USDJPY』

【EA Overview】

Currency pair: [USD/JPY]

Trading style: [Scalping]

Maximum number of positions: 4

Operation type: Compounding and Simple Interest

Timeframe used: M1

Maximum Stop Loss: 5 pips

Take Profit: Infinite (Trailing Stop)

What’s amazing is that the maximum stop loss is only 5 pips.

With 4 positions, the maximum loss is 20 pips (stop-out pips).

【Over 1 year of forward performance】

In forward operation since November 2016, over 14 months the results are:

(with compounding)

Profit: 72,688 JPY

Maximum drawdown: 22,311 JPY

Average profit: 1,215 JPY

Average loss: 1,760 JPY

Maximum loss: 6,834 JPY

Total trades: 290

Win rate: 67%

This indicates profits are more than three times the maximum drawdown,

an unusual scalping EA with small losses and large profits.

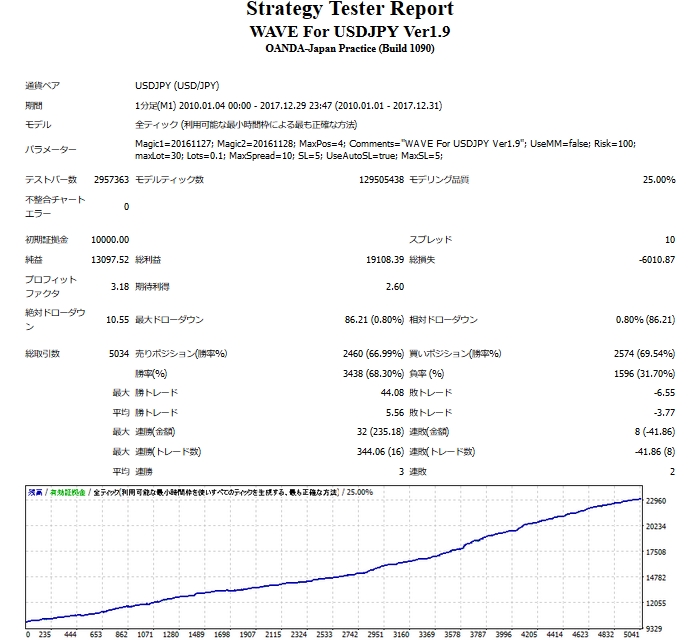

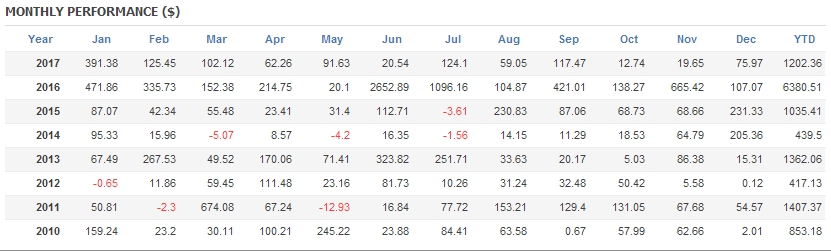

【Backtest Analysis】

The Wave for USDJPY uses compounding as the default, but simple interest is also available.

(In the case of simple interest operation)

Spread 1.0 pips (default spread filter 0.8)

Backtest results for eight years from 2010-01-01 to 2017-12-31 are shown here.

With a maximum drawdown of $86 per 0.1 lot, earning $417 to $6,380 per year,

this can be said to be a fairly high-performing EA.

However, in backtests it fixed at 0.1 lot; forward with compounding

the profit is just under $800, so forward results tend to be worse.

【Trading Example】

Why is there a discrepancy between backtests and forward tests?

Let's look at a trading example

It was a type that enters on counter-trend during sharp price moves, aiming to capture profits on a pullback.

In such cases, on a demo account the spread would widen and the number of entries would decrease...

【Conclusion】

Because it enters on counter-trend during volatile moves, choose your broker/account carefully.

Regarding fx-on forward as well, since it's a demo account, spreads may be wide.

Rent a VPS near the broker's server to speed up communications, and increase the maximum number of positions with parameters

to make entry easier, you could achieve results closer to the backtest by such tweaks.

If you do so, there is a possibility it could become the best EA!!

If using compounding, you can start with around 100,000 yen!