[Tarou's Discretionary Trading Struggle Chronicle ~ USD/JPY Edition ~ Week of 22/6/6 Forecast]

Latest USD/JPY Forecast

It already feels humid enough that the rainy season might start, doesn’t it~ ><;

On days like this, the best is to sit back with a beer and take it easy while writing a blog ☆

Good evening~♪ I’m Tarou, having trouble keeping up with how fast a week passes☆

Really, a week feels faster than ever lately!

Even so, on Thursday and Friday my body feels tired, so I still feel the week is dragging, haha

It seems I’ll cling to Sunday again this week until the last moment ♪

So for this week's edition'22/6/6 Week Forecastlet’s begin☆

First, as usual, let’s review last week’s movements.

6/1 (Wed) 23:00 May ISM Manufacturing PMI

→ Forecast: 54.6 Actual:56.1

6/2 (Thu) 23:00 Durable Goods Orders [MoM]

→ Forecast: 0.4% Actual:0.5%

6/3 (Fri) 21:30 Employment Situation

→ Forecast: 326k Actual:390k

6/3 (Fri) 23:00 May ISM Non-Manufacturing PMI

→ Forecast: 56.8 Actual:55.9

~ A few comments about the indicator results ~

As rates rose, the yen weakened and the dollar strengthened, but

May ISM Manufacturing PMIcame out better than expected,

and the dollar strengthened rapidly!

It easily allowed for a 130 yen challenge and then waited for the jobs data.

Jobs dataalso came out higher than expected, furthering the yen weakness and dollar strength☆

ISM Non-Manufacturing PMIwas slightly worse than expected, but

it didn’t matterto the 131 yen challenge!

Not reaching it, I’m curious how it will affect the weekend!

~ Comments on last week Tarou’s entry ~

Last week was

【Aiming for a downward trend with selling entries as the main theme for this week as well!】

that’s right☆

Last week’s forecastwas a completemiss><; futile…

I made forecasts for ①②③, and all of them were selling-entry predictions.

Wow, I didn’t expect it to bounce back so quickly…

I learned the importance of predicting turning points for buying entries, even in a selling-dominant mood. I’ll turn this experience into a plus!!

Let me reset and thoroughly forecast this week as well!

Now, while looking at the chart,let’s look at this week’s forecasttogether♪

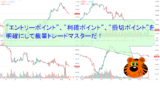

First, the daily chart☆

【Daily】

From the daily chart, you can see last week’s strong rally was quite remarkable!

From the May 9 high, it took about a month to fall,about 4.5 yenand in one week it has retraced that much… amazing!

After breaking around the high near April 20, it’s ideal to consider buying since buying pressure dominates.

So for this week’s forecast, the first focus is

the 131 yen challengeline—watch closely!

On the daily, it seems the challenge might succeed, but it’s hovering right at the edge and may pull back.

Early next week, could see a quick 131 yen challenge successperhaps, but

for a while, I think it will be movements around131 yento be mindful of.

If the 131 yen challenge succeeds, the next target would benew highs, but

the high is near131.35 yenso considering momentum, it could reach it quickly.

If prices start to drop at the start of the week, I’ll consider which lines and what judgments to apply, so let’s look a bit more in the 4-hour chart for details☝

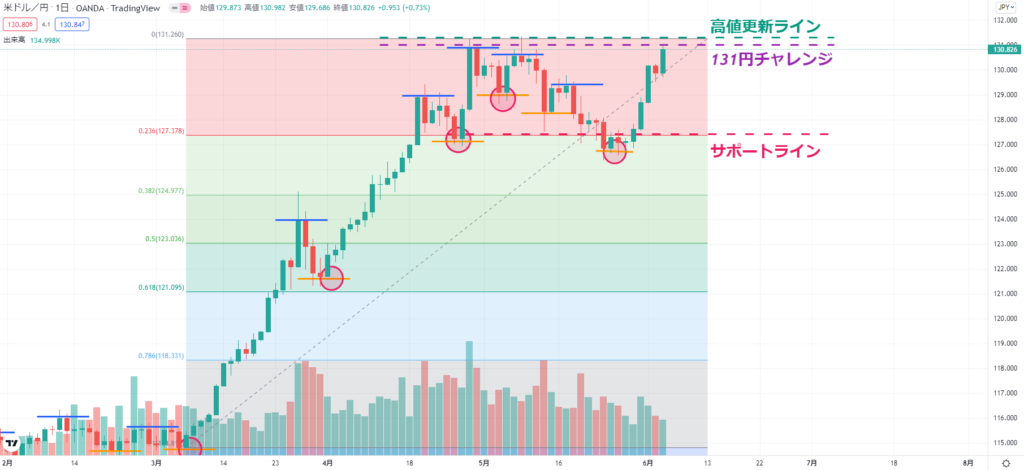

【4-hour chart】

If the market opens lower and the 131 yen challenge remains unsettled, the target value would likely be

the 130 yen line.

There is a good chance of further decline to this line, so at this pointreboundor

more downsidewill determinewhether to buy or sell entries.

However, Tarou sees the previous high around130.2 yenas a key marker!

If price stays above this line, creating a higher low,there’s potential for a solid 131 yen updateand a major new high, hence a bullish buy entry is preferred☆

Also, I added another line in the chart this time.

This is the sine wave connecting the previous high and last week’s low.Sine wave.

If the 131 yen challenge stalls or fails to beat previous highs and ends this week, next week could see renewed declines within this range, leading to a range-bound market, perhaps?!

I know this is a rather forced hypothesis, butyou won’t know until you forecast, so I’ve added it this time!

This week I’ll also keep an eye on this line to monitor the currency movements☆

So—Tarou’s entries for this weekare~☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week, aim for the 131 yen challenge and a new high!

I plan to enter with that mindset!

①If at the start of the week prices rise and the 131 yen challenge succeeds,

A bullish buy entry!!

Initial take profitwill be131.3 yen☆.

If it continues to rise, take another buy entry at that time☆☆

Stop loss is set slightly below the previous low at129.5 yen!

②If prices start to fall at the start of the week,sell entry!

Take profitwill be first130.28 yen☆.

There’s a possibility of stalling near the previous high, so take profit slightly early just in case☆

Yes,profit-taking is justice!!

Stop loss should be at a clear higher price point131.0 yen!

③If prices bounce near 130 and start rising,buy entry!

This would indicate a shift to an upward move after a correction, so I’d want to buy solidly!

Take profitis130.92 yen.

If 131 yen challenge fails again, take profits early☆

Stop loss130 yen seems reasonable.

There may be a false break to the downside, so it might be wise to stop at 130 yen☆

④If it drops below 129.5 yen,sell entry!

Take profitwill first be127.5 yen☆.

In this case, I expect a deeper move (around 126.5 yen),

and if you want a rebound line,Fibonacci23.6% linecould be cited.

Stop loss would be around the (sometimes unlucky)131.0 yenas a level!

At this point, I think it would be quite difficult to push back up to 131 yen.

If it returns, it may rise further, so this line seems appropriate for that reason as well.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now, as usual, I’ll finish by checking this week’s key indicators☆

6/10 (Fri) 21:30 May CPI [MoM]

Among this week’s high-priority indicators is the CPI!

In particular, since there aren’t many important indicators early in the week, I expect a technical movement.

Thank you for reading until the end today☆

Now, everyone, have a fantastic positing lifestyle this week too ♪

Comments on LINE are welcome^^♪

Last Week’s USD/JPY Forecast

If you’re curious about Tarou’s discretionary trading struggles from last week,

please do check it out♪ Here it is^^↓↓↓

Past USD/JPY Forecasts

If you want to see even more old struggles, please click here^^♪↓↓↓

How to Think About Entry, Take Profit, and Stop Loss Points

The following link summarizes Tarou’s basic approach to chart analysis☆

Since Tarou is a beginner, his approach evolves with experience

(growing, surely lol)

I will update and revise occasionally^^♪

“What’s this about? What’s the thinking behind it?”

and

“Come and see how the growth is going!”

Please feel free to come and check it out^^♪

How to Choose FX Accounts and Recommended FX Accounts

Now, after reading up to here, many of you may want to start trading in reality, right?^^

If so, you’re probably thinking which FX broker to start with☆

In that case, Tarou has summarized

”Recommended FX Accounts: If you’re starting FX, do this”

Would you like to read that^^b

I’ve organized six points to choose a broker☆

Please give it a read as well m–m

By the way, Tarou uses FXTF♪

If you’re not sure which broker to start with or

you want something easy to use,

you can register easily from the link below, so please give it a try^^♪

You’ll end up with the same FXTF as Tarou~☆

If you’re with the same FXTF as Tarou, I can teach you various things,

so please feel free to ask via LINE above♪↓↓↓↓