Small, choppy Bitcoin market! What is important to determine the direction without rushing?

Hello everyone, this is NEM! I have started holding NEM@xi10jun1.

The crash panic seems to have settled down at last. This week, in the first half, it dropped again sharply, but it has since steadied and continued with small movements.

On the other hand, with DMM entering the cryptocurrency space and bitFlyer partnering with Yamada Denki, business is steadily moving forward.

And, continuing from the last column, the column name has changed from “Relaxed! Bitcoin Trading Institute” to the new “[Weekly] Cryptocurrency Trade Life.” Thank you for your continued support.

*This column is designed so that you can read half of it for free. Of course, it would be very encouraging if you read up to the paid portion (updated weekly, 400 yen per month, so about 80-100 yen per column), and I would be happy if you could subscribe as a donation-like support!

This week’s results (January 19, 2018 to January 25, 2018)

First, as usual, the results. I’ll announce the changes first.

- Last week (through January 18, 2018) assets: 59,009 yen

- This week (through January 25, 2018) assets: 60,348 yen

- Change: +1,339 yen

This week I captured a bit more. By aiming for a rebound, the buying paid off, and I finally returned to the 60,000 yen range!

After that, access to bitFlyer’s Lightning FX became unavailable for longer periods, making it hard to trade... I’d like to see the server side strengthened continue to be a request.

But I’d like to improve the trading environment soon. I might try DMM Bitcoin as well. Margin trading isn’t just for Bitcoin; it can be done for Ethereum and Ripple too, right?

However, as of January 26, 2018, the leverage is fixed at 5x, so with 1 BTC at 1,000,000 yen, the required margin is 200,000 yen, and for the minimum trade size of 0.01 BTC, a margin of 2,000 yen is required. I’m torn.

Now, today’s column is about how to trade in a low-movement environment.

What is needed to wait for opportunities in stillness

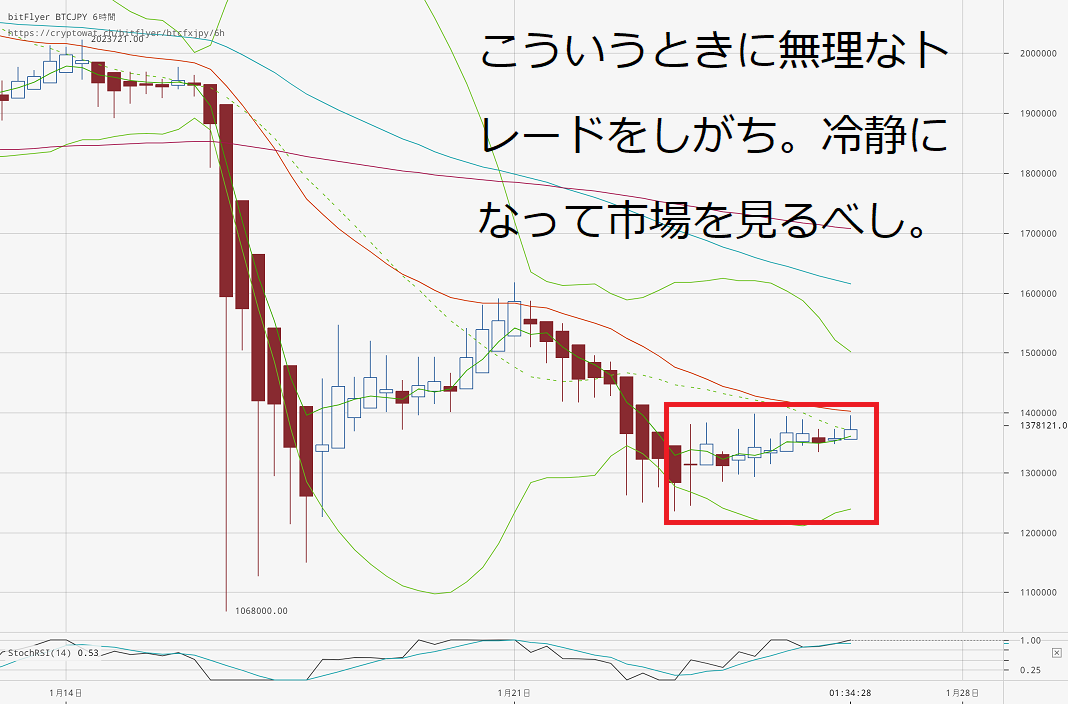

Anyway, I’ve pulled up a 6-hour chart at this point.

As you can see, the latter half of the week shows continued low movement.

Even so, when you look at the price range, it’s around 100,000 yen in movement. Because of Bitcoin’s high volatility, this kind of situation feels unsatisfying.

The question is which way this will move. Will it break lower or rebound?

Technically, it looks like it might break lower. The rebound angle after the drop is weak, and it’s moving almost horizontally.

But this is viewed on a 6-hour chart; if you look at it on an hourly chart like the paid portion, the scenery changes again.

In any case, in such times, you should look at the whole picture. If you only look at longer timeframes, you won’t know when to buy; if you only look at short timeframes, you’ll lose sight of the big picture.

Let’s sit and wait for the opportunity.

Free takeaway summary: Waiting for opportunities without rushing is also a trading skill

Trying to perform at the best possible level for every trade often ends in failure.

The market has its waves, so when you think, “Oh, today the price movement is small,” or “This isn’t a favorable pattern,” it’s a technique to gracefully close the screen.

Profit alone tends to be the focus, but first, survive, and be mindful not to incur unnecessary losses. This alone can protect your assets.

So this paid column will discuss future outlooks.

Endnote 1: Latest information on taxes! Updated December 8, 2017!

The National Tax Agency’s site has updated the latest legal opinions regarding Bitcoin.

That is here →No.1524 Taxation on profits from using Bitcoin | Income Tax | National Tax Agency

And on December 1, 2017, the National Tax Agency posted a document on how income is calculated.

That is here →Method of calculation of income related to virtual currencies (pdf) | National Tax Agency

※Please note that laws and tax interpretations may change, which could alter how you file tax returns and pay taxes. Before filing, be sure to check with your nearest tax office or a tax accountant.

After all, BTCFX profits remain miscellaneous income. I hope they will soon be classified as capital gains with a 20% tax...

Endnote 2: Planning a new project

I’ve been thinking about writing more cryptocurrency-related news and information, but I haven’t come up with anything yet. I’ll post here as soon as a plan is decided!

※ The free portion ends here. From now on, there will be detailed analysis and future prospects, so this will be paid. If you want to read more, of course, a donation-style subscription is greatly appreciated and励みになります (will be encouragement). Thank you for your continued support!