[Tarang's Discretionary Trading Struggle Diary ~ USD/JPY Edition ~ Week 22/5/30 Forecast]

Latest USD/JPY Forecast

Good evening☆ I’m Tarou, spending a weekend with surprisingly little motivation…

Sunday is about to end, so I’m immersed in despair…

If this continues, I won’t be able to update the discretionary trading diary! Oh no!

It seems progress is extremely slow, but let’s start right away!

Now then, this week’s edition’22/5/30 Week Forecastlet’s get started☆

First, as always, let’s review last week’s moves.

5/24 (Tue) 23:00 New Homes Sales

→ Forecast: 7.50M units Result:5.91M units

5/26 (Thu) 21:30 Q1 Real GDP

→ Forecast: -1.3% Result:-1.5%

5/27 (Fri) 21:30 PCE Deflator [MoM]

→ Forecast: 0.3% Result:0.3%

~ A few comments on indicator results ~

New Homes Salesmay be affected by rising interest rates, perhaps?

The results are significantly below forecast. However, this may be within expectations; before and after the release, the near-term lows were updated but momentum was weak, and prices recovered and moved into a range.

Thereafter,Q1 Real GDPandPCE Deflatorand other indicators were released, but there was no wind.

This seems to have beenadjustment week for this week’sjobs reportas it seems.

In the end, I’ll say the same as last week: this week also has high-profile indicator releases, so stay glued☆

~ Comments on last week’s Tarou entry ~

Last week

【Entry focusing on trend reversal and selling overall!】

☆

Last week's forecast alsohit the markas you might say☆

In particular④In the end, if the price breaks the supporting linea Sell Entry!

I think the entry matched the forecast well!

Profit-taking point was around126.5 yenafter a brief consolidation around that level in mid-April, which turned out to be an almost perfect fit☆ Did everyone manage to take profits as well? ^^

This week too, I will

consider entry conditions and reflect on entries

and continue☆

Now! Then, while looking at the chart, let’s go over this week’s forecast♪

First, the daily chart☆

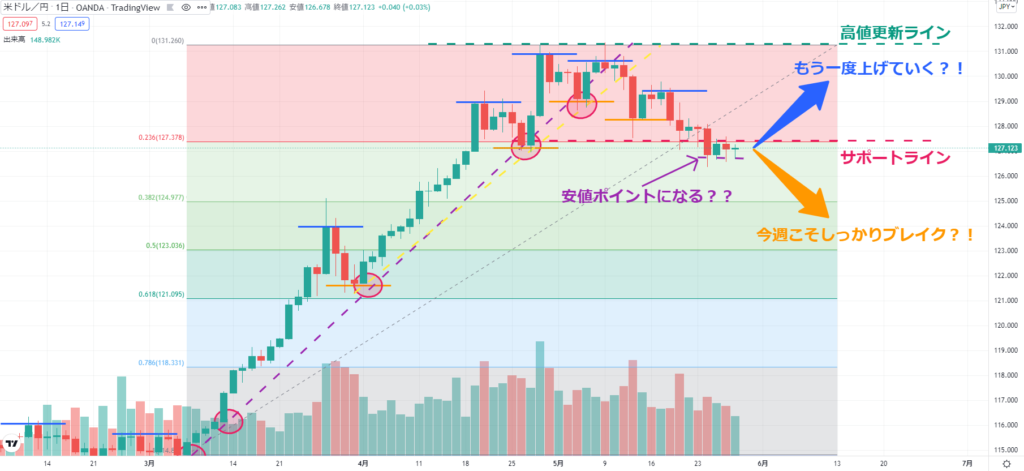

【Daily Chart】

The line that had been a support level up to last week has broken!

But the downside momentum isn’t very strong yet, and on the daily chart it remainsin a rangeconsolidation.

If it starts rising at the open next weekthe purple dotted line on the chart will be the near-term low pointandthis week it seems aimed at finding the high point.

On the other hand, if it starts falling at the open, the purple dotted line will not be the near-term low point,and we may see a larger drop—a full-blown break..

Tarou’s forecast is

the range will continue at the open, and move sharply after the latter-half indicators are released.

On Fridayemployment datais also due, so until thena wait-and-see approach is expected.

Now! Let’s take a closer look at the 4-hour chart for more detail☝

【4-hour Chart】

Looking at the 4-hour chart, it clearly shows adownward trendis in place.

On the daily chart, it’s still in consolidation,so while there is a real possibility of a sharp move higher in the yen,the selling-entry biased flow is unmistakable..

The upside point early in the week isthe previous high around127.5 yenline.

First, we need to overcome this to have a strong rise.

Buying entries should wait until this line is crossed.

The downside point early in the week is, likewise,the previous low around126.5 yen line

Here, it becomes a key question whether it will hold as support and bounce again, or break through.

If it is supported and rises,employment data releasewill be between126.5–127.5 yenand oscillate until then.

On the other hand, if it breaks, the next low would be aroundthe intersection line of the purple dotted line on the chart125.8 yen, which Tarou believes could become the next support.

If it goes down after the start of the week and follows the lower-down flow described above,

around 125.8 yen, then rebound to wait for the employment data around 126.5 yen

that’s the expectation!

With that said~Tarou’s entries for this weekare~☆

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This week too, enter-selling with a focus on a downtrend!

I plan to proceed accordingly!

①If the market starts rising at the open,wait until 127.5 yen!

I’d like to enter a buy, but aiming for the pullback should yield solid profits this week.

②In addition to ①, if it slides, enter selling!

Profit targetfirst126.5 yen☆.

Stop loss is at the level slightly above the rise line127.6 yen

③If 126.5 yen breaks,enter selling!

After taking partial profits at ②, if it falls further, that’s a strong selling entry☆

Profit targetis the 4-hour chart purple line intersection at125.8 yen.

Stop loss would be better at 126.7 yen just above the breakout line.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Now as usual I’ll check the key indicators for this week and wrap up☆

6/1 (Wed) 23:00 May ISM Manufacturing PMI

6/2 (Thu) 23:00 Durable Goods Orders [MoM]

6/3 (Fri) 21:30 Employment Situation

6/3 (Fri) 23:00 May ISM Non-Manufacturing PMI

This week there is a highly anticipated employment report, so in the first half we may stay cautious and move decisively in the second half, so enter with care☆ no one wants to be left behind!

Thank you again for reading to the end today☆

Now everyone, have an amazing posi-posit life this week too♪

Comments on LINE are also welcome^^♪

Last Week’s USD/JPY Forecast

If you want to read Tarou’s discretionary trading diary from last week too,

please take a look♪ Here it is^^↓↓↓

Past USD/JPY Forecasts

If you want to see even more past entries, please click here^^♪↓↓↓

How to Think About Entries, Profit-Taking, and Stop-Loss Points

On the linked site, Tarou’s basic approach to chart analysis is summarized☆

This is Tarou’s beginner trading diary, so Tarou’s thinking evolves with experience

(growing, indeed! LOL)

I will update and revise occasionally^^♪

“Hm, what’s your thinking?”

or

“Let me check your growth!”

Please keep coming to read^^♪

How to Choose and Recommend FX Brokers

Now that you’ve read this far, many of you may want to start actual trading, right?^^

Those who are in that situation are probably thinking which FX broker to start with☆

In that case, Tarou has compiled

”[Recommended FX Accounts] If you’re starting FX”

Would you like to read it^^b

It summarizes six criteria for choosing a broker☆

Please read this too m–m

By the way, Tarou uses FXTF as his broker♪

If you’re not sure which broker to start with, or

you find choosing one a hassle—teach me the easiest option, please

Because you can register easily via the link below^^♪

Tarou uses the same FXTF as me!

If you’re with the same FXTF as Tarou, I can teach you a lot,

so feel free to ask via LINE above♪↓↓↓↓