Cryptocurrency crash! Circuit breaker activated on bitFlyer's Lightning FX!

Hello everyone, big crash! BTCFX is still surviving.@xi10jun1here it is.

This week has been an incredible week. Almost all cryptocurrencies slammed, and it seems the margin call festival occurred. Don’t worry, I’m only lightly affected.

So, since the circuit breaker was seen again after a long time, let’s watch how bitFlyer’s Lightning FX behaves.

And as in the previous column, the column title has changed from “Relaxed! Bitcoin Trading Institute” to a new name, “[Weekly] Crypto Trading Life”! Thank you in advance for your continued support.

Note: This column is designed so that half of it can be read for free, a truly generous design. Of course, it would be very encouraging if you read up to the paid portion (updated weekly with a monthly fee of 400 yen, roughly 80-100 yen per column), and I’d be happy if you support it like a tip!

This week’s results (January 12, 2018 to January 18, 2018)

First, as usual, the results. I’ll announce the changes first.

- Last week (until January 11, 2018) assets: 59,464 yen

- This week (until January 18, 2018) assets: 59,009 yen

- Change: -455 yen

I tried trading at a calm moment after the crash, but perhaps because bitFlyer’s Lightning FX servers are weak, it was too slow for trading.

More participants have joined, so I’d like to request server improvements…

However, there were again expulsions due to margin calls. I sense Japan may soon regulate leverage and related matters, so I’d like to be careful about any crashes when such news comes out.

Now, for today’s column, since there was a big crash, let’s check the circuit breakers captured on bitFlyer’s Lightning FX.

Circuit Breaker Activated!

Even so, it seemed to last only a few minutes, so I could only manage to take a few screenshots. Access to Lightning FX was barely usable in the first place…

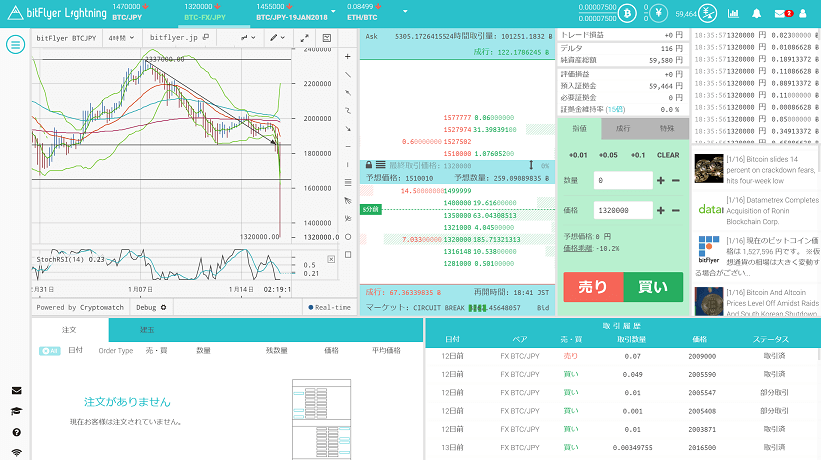

So, here is the screen.

It’s a mess. I can’t place positions like this…

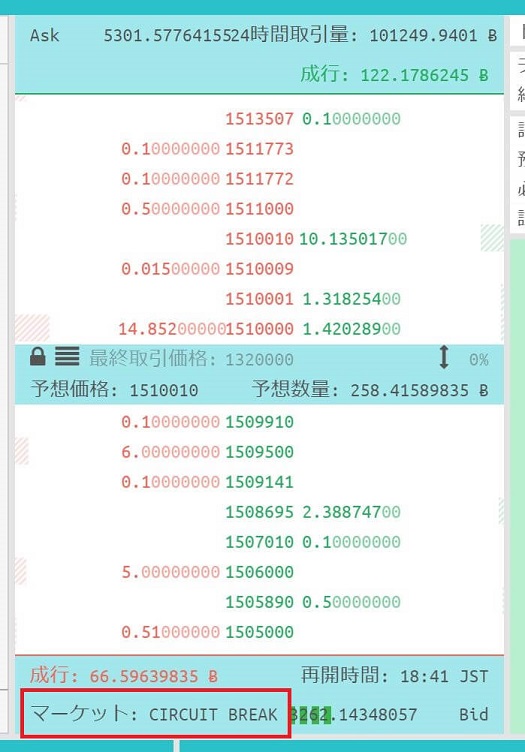

Let’s look at the order book.

At this point, you can’t place any orders. And even after the circuit breaker is released, it remained heavy and trading was not possible.

People say ‘profit from selling,’ but in reality, when such a large crash occurs, selling to profit isn’t feasible. Of course buying orders too.

By the way, regarding this week’s crash, Lightning FX on bitFlyer seems to have activated circuit breakers about 3–4 times.

Free Section Summary: Don’t Sell Recklessly in a Major Crash

In such a huge crash, it’s better not to approach at all. The volatility is enormous even if you trade normally.

From a chart perspective, it’s a downtrend. Even knowing that, when the actual drop occurs, orders don’t go in, or executions take time, and you end up losing—this is the difficulty of BTCFX.

So, even if you think, ‘Oh, if only I had sold there,’ there’s no use. Focus on making profits in the way you’re good at.

So, this paid column will discuss future outlooks.

Ending Corner 1: Latest Tax Information! Updated December 8, 2017

The National Tax Agency has updated the latest legal interpretation regarding bitcoin on their site.

According to this, profits gained by using Bitcoin are interpreted as “miscellaneous income.”

Therefore, profits from margin trading like mine are generally miscellaneous income. As I’ve noted in the end-of-section before, as per the blog post (→Bitcoin Margin Trading (BTCFX) for Tax Filing! Global Taxation of Miscellaneous Income? Separate Taxation? | Yutorise Generation Investor jun), it appears that loss-offsetting (loss carryforward) is not possible. I wish this could be addressed a bit differently….

Also, per NewsPicks comments by bitFlyer CEO Yuzo Kano (No.1524 Taxation when profits are generated by using Bitcoin - NewsPicks), if you bought Bitcoin for 100,000 yen and used it to buy something worth 500,000 yen, the 400,000 yen difference is recognized as profit.

When you use Bitcoin to purchase goods or services, if the price of Bitcoin at the point of payment is higher than at the time of purchase, that profit is recognized. Therefore, this also applies to purchases made with Bitcoin at FANCY, so beware.

And on December 1, 2017, a document on income calculation methods related to virtual currencies was posted on the National Tax Agency site.

Here it is →Income calculation methods regarding virtual currencies (pdf) | National Tax Agency

Note: Laws and tax interpretations may continue to change, so the method of filing and paying taxes may change. Before filing, be sure to check with the nearest tax office or a tax professional.

After all, profits from BTCFX remain miscellaneous income. I wish it would quickly become separate taxation with a 20% tax…

Ending Corner 2: In Planning

I’m thinking of writing new cryptocurrency-related news and information, but I haven’t come up with anything yet. I’ll post it here as soon as a plan is decided!

Note: The free portion ends here. The rest is detailed analysis and outlook, so it is paid. If you want to read more, of course, you can also support it as a tip. Thank you for your continued support!