[Immediately Useful Article★] Analysis and Strategy for USD/JPY and EUR/USD from Monday, May 16

Week 2 of May was

a period where indicators and materials

did not matter and conditions remained

high volatility as usual

At the end of the week

stocks and bonds

showed a rapid rebound

The VIX fear index

is still at a high level

but has fallen rapidly

and closed at 28.87

Overall market volatility remains high

Will it rise further in the latter half, like March and April?

Let’s proceed with caution

and stay on guard☆

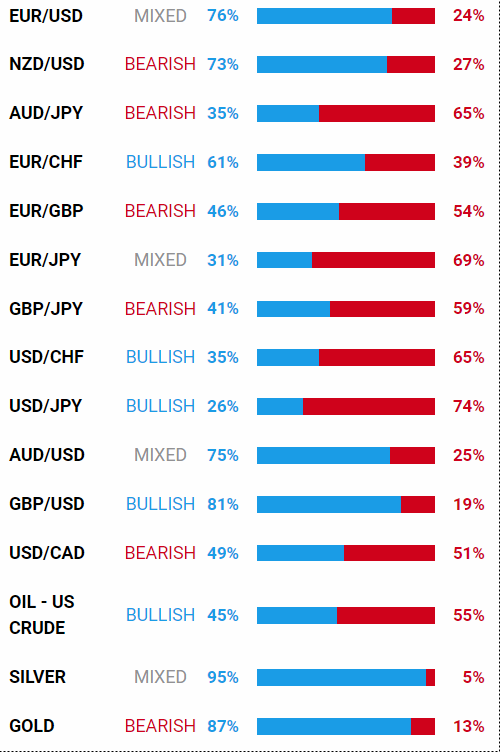

【Sentiment Analysis】

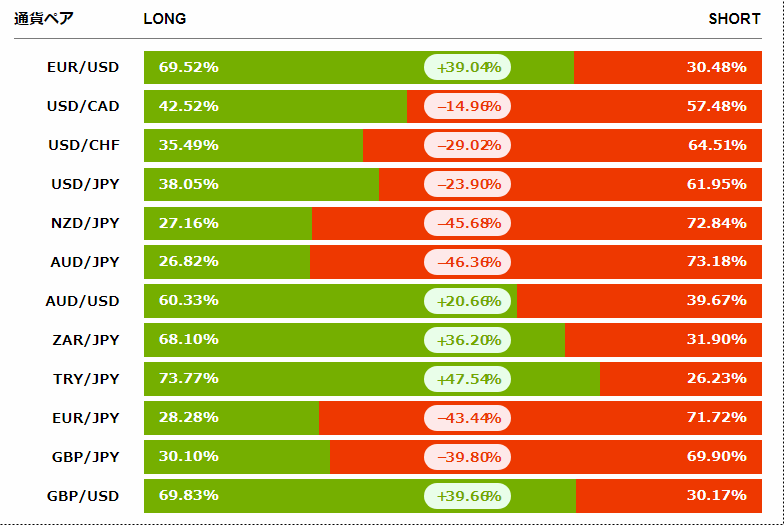

【Position Ratios】

Dollar/Yen

Long about 74%

Short about 26%

Euro/Dollar

Long about 76%

Short about 24%

Other currency pairs

as shown in the photos

Photo ①

UK's largest IG Group

Global Data

Photo ②

Swiss Bank Group

Ducas Copy

In the FX market

they boast the largest trading volume

Euro/Dollar

Dollar/Yen remains counter-correlated

a situation that supports the persistence of the trend

【Dollar/Yen】

The hourly chart's trend direction is