Nanpin EA New Wave! Reduce unrealized losses with contrarian and trend-following 'GOLD_RULE'

Six months of forward operation, 37% return; realized P/L +460,000 yen.

Auxiliary Nanpin EA 'GOLD_RULE'

Currency pairs: [EUR/GBP][GBP/USD][EUR/USD][EUR/JPY][USD/JPY]

Trading style: [Nanpin]

Maximum number of positions: 40

Operation type: 1-lot

Maximum lots: 60

Timeframe used: M30

Maximum stop loss: 300 pips

Take profit: 10 (Trailing Stop method)

Hedging allowed

The forward operation currency pair will be 'EURJPY'.

Other currency pairs can also be traded if desired.

【What is Auxiliary Nanpin?】

Nanpin/Martingale is a method that holds multiple positions in the opposite direction of the movement by increasing the lot size,

and closes profits when a reversal occurs.

This method tends to increase profits smoothly when it’s winning, but

・Unrealized losses can swell significantly, and if you cannot withstand them, the account may blow up

・Requires a large account balance

There are such drawbacks.

This 'GOLD_RULE' EA adds a feature to hold positions in the trending direction even while in drawdown, offsetting unrealized losses to aim for total profit.

(Trading image)

【How much capital is needed?】

Nanpin/Martin strategy grows the account funds indefinitely as long as there is ample capital and the account does not fail.

However, forex market movements are not that simple; there are rapid rises and falls and there are times when they don’t return immediately.

There are many such situations.

In fact, this 'GOLD_RULE' also lacks an auto-close feature, so you must cut losses yourself to some extent.

For long-term operation, you need to devise strategies such as closing positions when drawdown reaches a percentage of account funds.

The required account funds depend on currency pairs and expected operating years (assumed operating years), but with default settings

EURUSD for 2 years of operation yields a maximum drawdown of 1.5 million yen

USDJPY for 2 years of operation yields a maximum drawdown of 2 million yen

which can be inferred from backtest values.

【Annual return up to 100% depending on currency pair】

That said, Nanpin EA is undeniably a very powerful method for increasing funds.

Considering that some currency pairs can double in a year, it might be worthwhile to include it as one of your strategies.

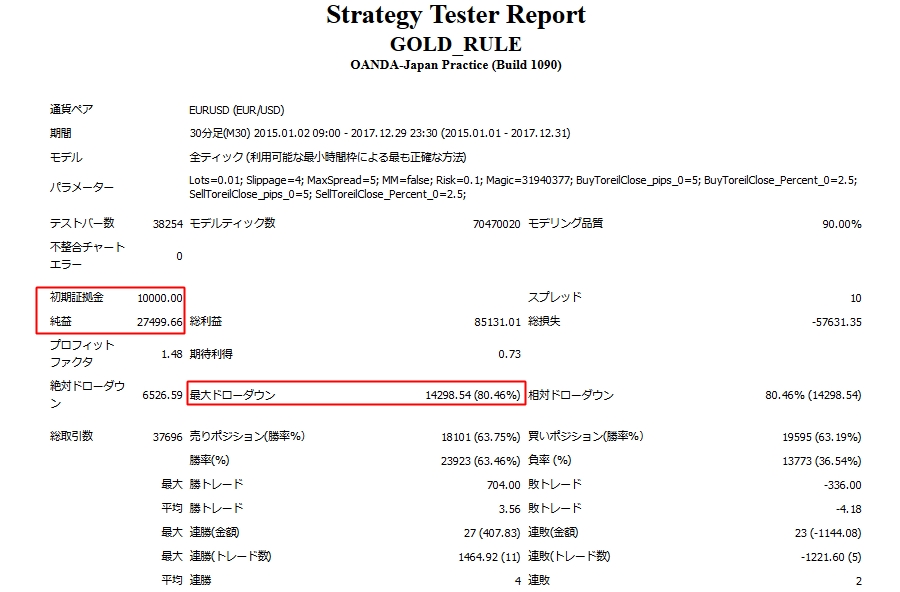

For example, if EURUSD was operated for 3 years from 2015 to the end of 2017

In three years, an increase of +2,700,000 yenwas achieved.

Maximum drawdown of $14,000so you'd want about 3,000,000 yen in account funds to be safe, though…

This maximum drawdown varies by currency pair and period, so for various currency pairs

long-term backtesting is recommended.

This EA can offer substantial profitability depending on currency pair choice and timing.

<Nanpin/Martin EA Tips…>

Even with unrealized losses, when the account balance doubles or triples, recover the principal and operate with the mindset that it’s okay if there is no surplus capital, right?!