Gotou-day strategy with four currency pairs! '510Gotoubi_V2' offers low risk with an annual return of +24%

There is a dollar-buying strategy on five- and ten-day Gotō days in forex trading.

Gotō days refer to the 5th, 10th, 15th, 20th, 25th, and 30th days,

and on these days there is a tendency for actual dollar buying by import/export firms heading toward the 9:55 fixing rate.

This strategy can, of course, be applied discretionarily, but the rule does not always apply,

and after a few losses it can be discouraging.

The idea is to perform what is a bit cumbersome and hard to keep doing with discretion via system trading!

This is the concept of this EA.

Also, because it is limited to Gotō days, the low trading frequency emphasized in system trading may be a concern, but by running it across four currencies it offsets the low number of trades.

Now, let's quickly analyze the forward performance and backtests.

【510Gotoubi_V2 概要】

Currency pairs: USDJPY, EURUSD, AUDUSD, GBPUSD — four currency pairs

Timeframe used: M5

Maximum stop loss: under 2%, varies by situation; drawdown also under 10%

Take profit: varies by situation (trailing stop)

★ Dollar buying on Gotō days (5th and 10th days)

Early-morning pullback aiming with Bollinger Bands

Having a clear entry logic and risk management is reassuring, too.

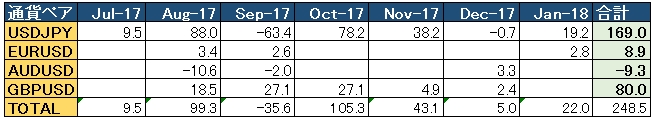

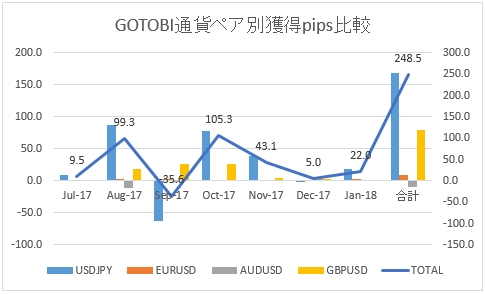

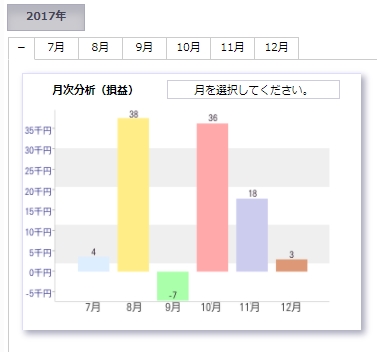

【Forward results】

Forward period: July 2017 – (five and a half months)

Pips gained by currency pair

The pip gains for USD/JPY stand out. The anomaly of Japanese companies is indeed strong.

Of course there are months with losses, but by running across multiple currency pairs,

we increase trading opportunities and profits.

Also, Gotoubi_V2 uses a lot size to ensure the maximum loss per trade stays within 2%,

so the pip gains and P/L may differ.

The cumulative P/L is here

Over a total of five months to half a year, +100,000 yen, return +11%

With a maximum drawdown of 27,000 yen and net profit of 100,000 yen, this design offers a good risk-return ratio.

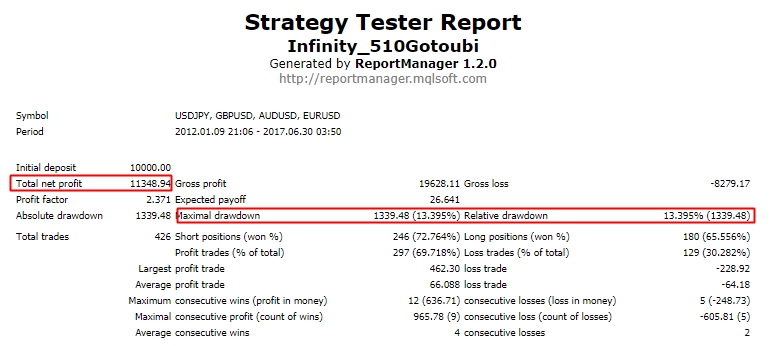

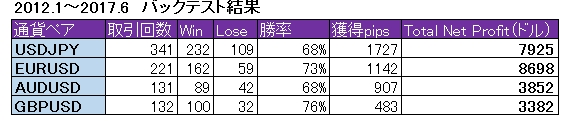

【Backtest Analysis】

Composite backtest results for four currency pairs

From 2012 to 2017In five and a half years, +113%

With compoundingMaximum drawdown is 13% of account balanceand it is a very low-risk EA.

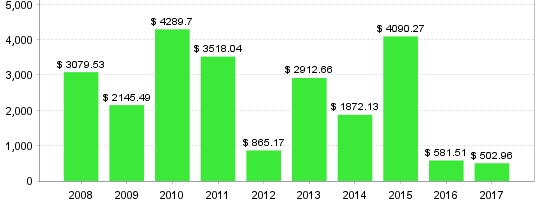

【Annual Profit/Loss (USD)】

Annual return is$581 to the high thousands in the best yearwith some variability, but this is an excellent profit rate, isn’t it.

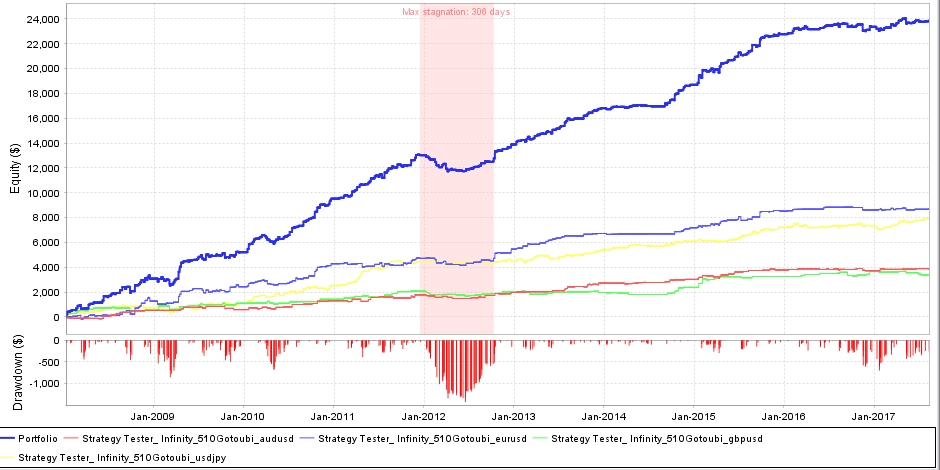

【Profit/Loss by Currency Pair】

Thick blue: Portfolio

Thin blue: EURUSD

Yellow: USDJPY

Red: AUDUSD

Green: GBPUSD

as shown.

You might think USD/JPY is best, but in the five-year backtest EURUSD yields the best return.

Looking at win rates and trade counts by currency pair, USD/JPY has many trades but slightly lower win rate,

EURUSD has slightly fewer trades but higher win rate and larger gains.

【Leverage adjustment enables even more profit-driven operation】

With the default settings,For four currency pairs, maximum drawdown of 15% with an expected annual return of +24% is expected.

By adjusting parameters, higher risk and higher return operation is possible.

Why not consider incorporating Gotō day trading as one of your strategies?

Special campaign until January 31, 2018!

39,800 yen ⇒ 19,800 yen