Analyze individual securities with MT4! We'll teach you securities with consistent trends — "Optimization of the entire First Section market"

=========【Developer Introduction】============================

Works-eM

I am leveraging my long accumulated software engineering history in trading. In my main business, I specialize in database construction, corporate process improvement, refactoring, and the like. My trading style is based on automated trend trading. Also, rather than focusing on investment technique per se, I value the regularities of market conditions and fundamental principles. Therefore it is a steady, incremental-profit approach, with an overall win rate a little over 40%—a steady-with-big-move (the big move corresponds to trends).

We aim to convey these points to users, and after you are convinced and understand, we expect it will likely become a valuable plus to your own trading. After all, I myself had no investment sense at all, and I am like this now.

============================================

The regularity of price movements essentially exists in the market conditions for each instrument. They differ per instrument.

I will show you the results of a market-wide optimization that you cannot see anywhere else.

The focus is on enduring regularities

(Sales units: among all 3,900 listed Japanese stocks, 200–250 per product)

Content that discretionary traders would most want to see

It will inevitably be a value-added element to your trading life.

[Product contents]

Optimization implemented in November 2017

Industry: Electrical equipment (260 companies) among them

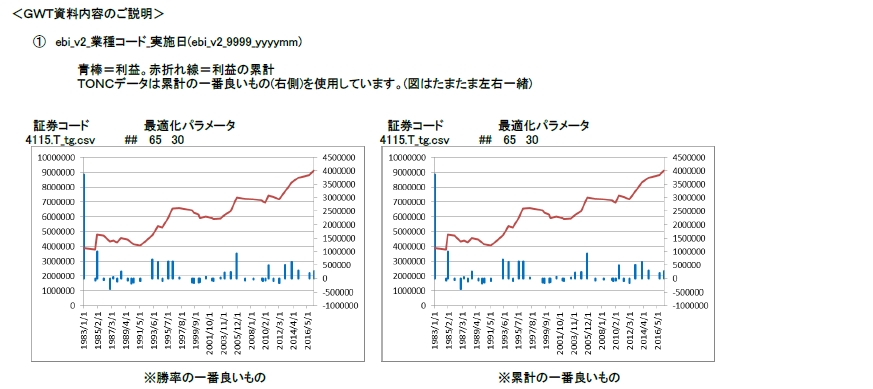

① Evidence of the complete profit curve

② Three favorable TONC stocks

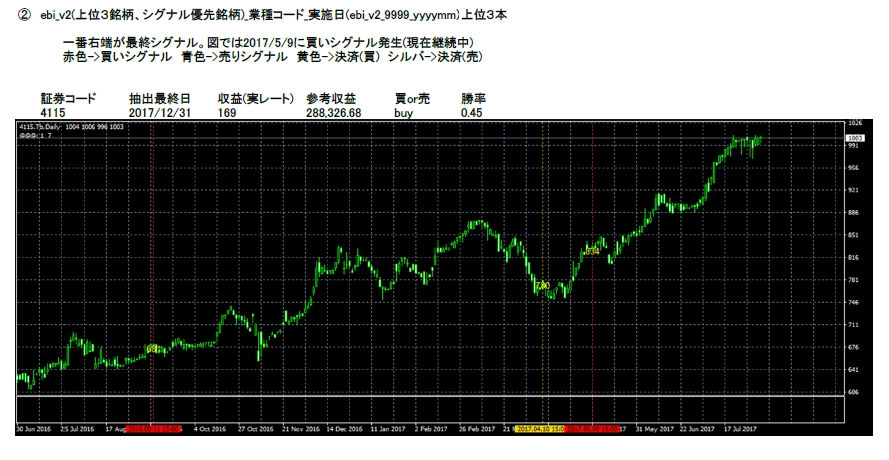

③ Three priority-signal stocks

④ TONC relationship diagram (for stocks in ②): profit curve, parameter matrix, TONC diagram

⑤ Trading charts for all periods (stocks in ② and ③, MT4-based)

⑥ OHLC data and templates for trading charts (for MT4)

(Reference image)

More details here

Market-wide optimization for a subset of listed markets (including 260 stocks)