The translation of the provided HTML content to English is: The difficulty of short selling positions in BTCFX and concerns about the future market

Hello everyone, unrealized gains! I’m happy that the KaiKai Coin (CICC), which I got for free, has risen@xi10jun1.

Bitcoin has become a bit heavy on the upside, but other cryptocurrencies have risen in its place. Thanks to that, KaiKai Coin is in the green.

Now BTCFX, I feel like a tricky seller has appeared, so I’ll write about that this time.

※This column is designed so that half of it can be read for free, a conscientious design, of course. Of course, it would be greatly encouraging if you read the paid portion (updated weekly, 400 yen per month, so about 80–100 yen per column), and I’d be happy if you subscribe as a tip!

This week’s performance (December 8, 2017 to December 14, 2017)

First, as usual, here are the results. I’ll present the changes first.

- Last week (up to December 7, 2017) assets: 59,924 yen

- This week (up to December 14, 2017) assets: 59,453 yen

- Change: -471 yen

As upside pressure has weakened, price range has become harder to capture. It moves up and down, but not as much as I expected, so stop orders get hit. That’s why assets stagnated this week.

Even KaiKai Coin started to rise, so I’m thinking of buying other currencies as well. At the same time, I wonder if I should also rename this column’s title…

So this time, I’ll describe one example of how to time BTCFX positions.

An example of timing by technical analysis

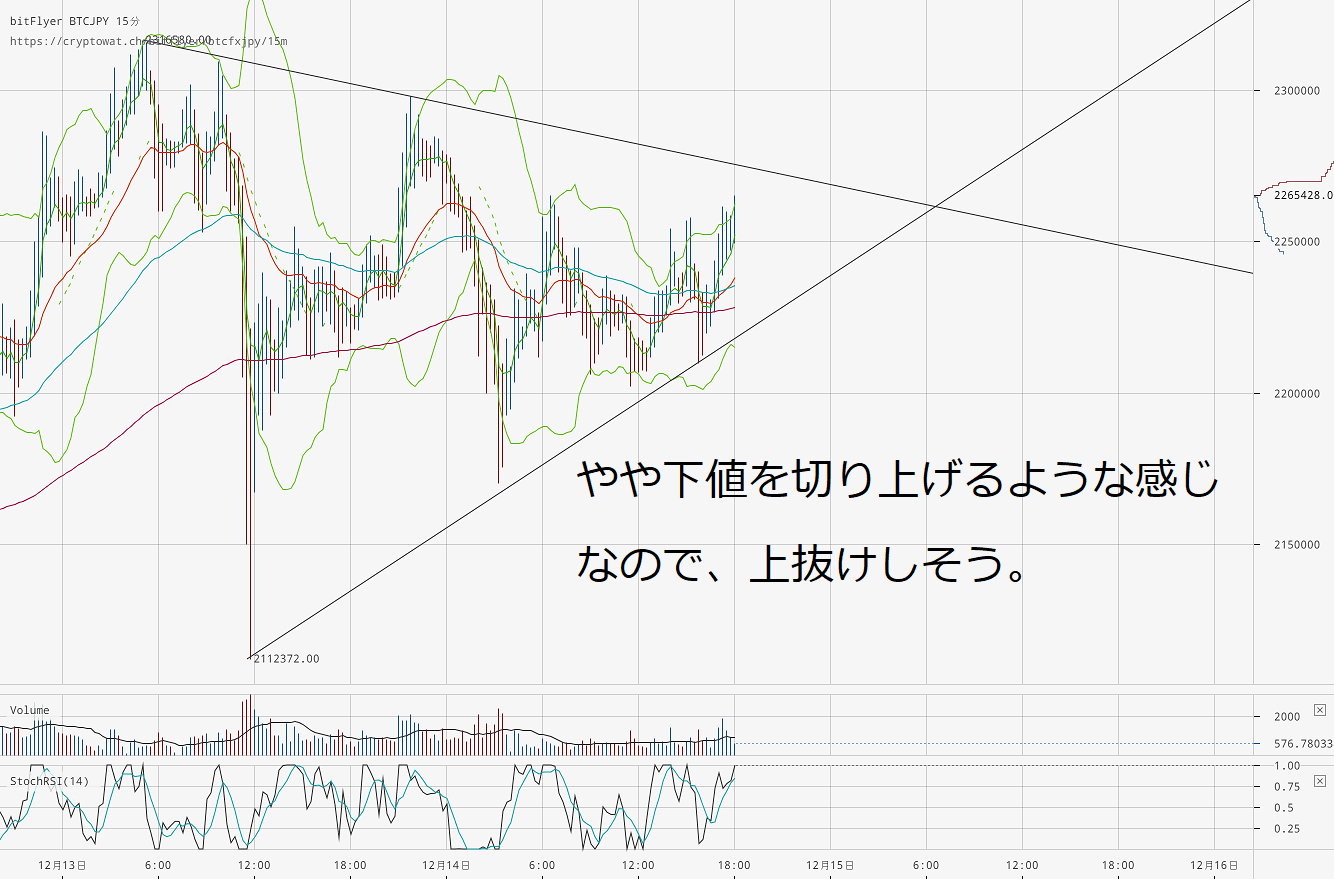

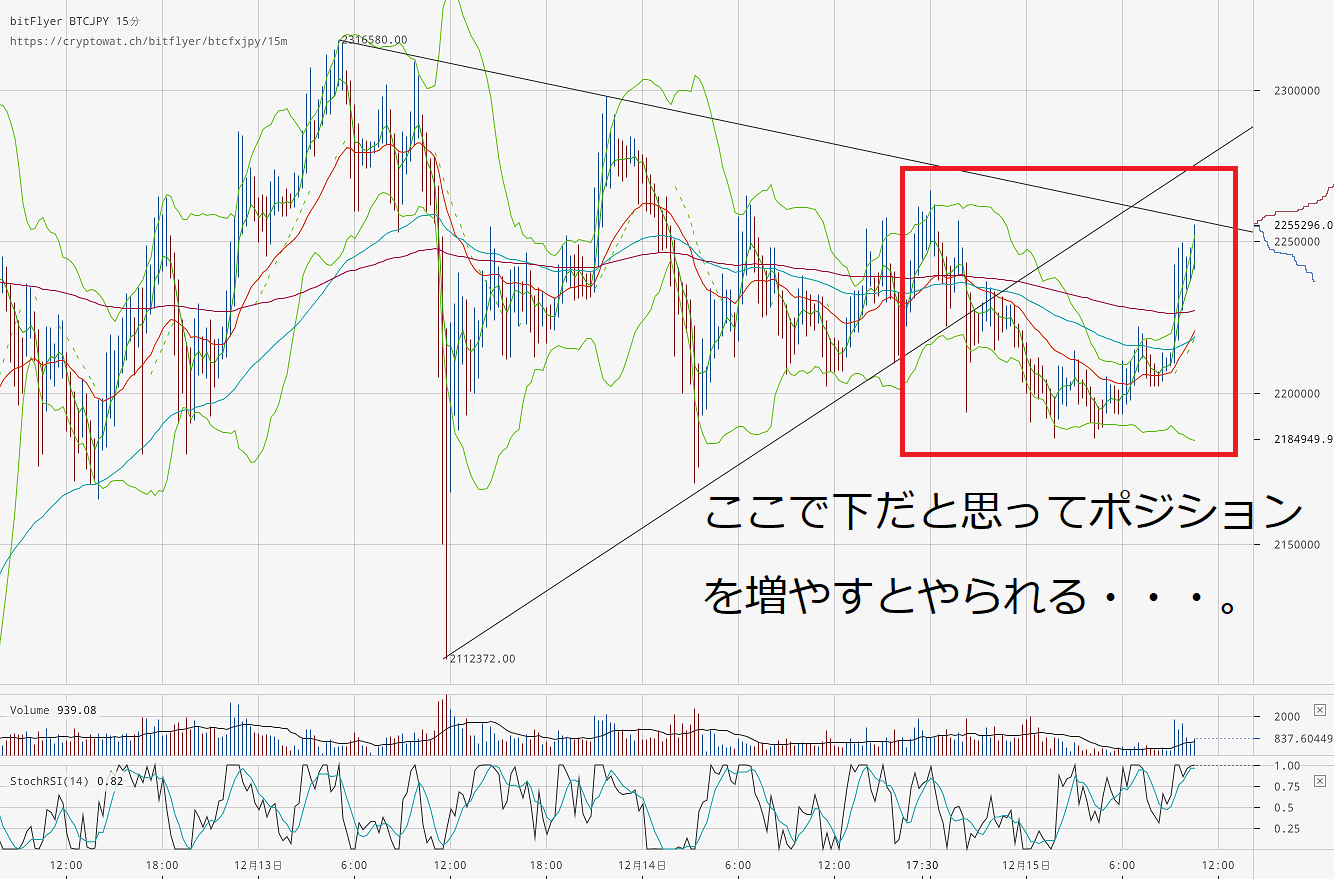

For now, please look at the image.

This is the 15-minute chart now, and you can see I’ve drawn a line. It’s drawn from the recent high and low in the price action.

We’ll take a position in the direction of whichever side breaks this line. At that time, we should have some sense of which direction the higher timeframes (1-hour to 4-hour) are leaning.

Now, what will happen?

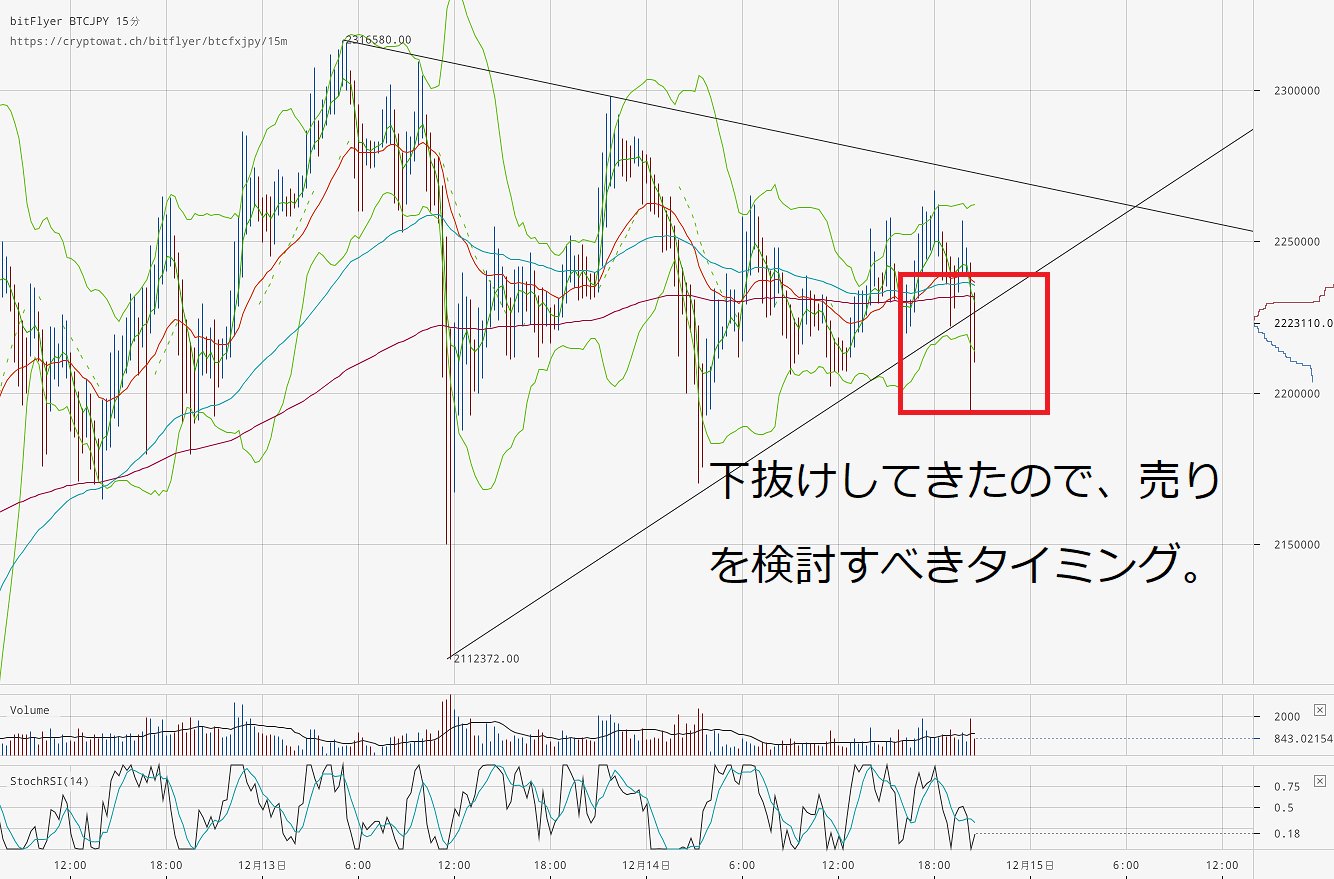

Ohh! Down! It broke to the downside!

Then it’s a short (sell) position. I had expected a big upward move from here, but if not…

Hmm, it did go down, but this sluggishness is tricky.

If it had dropped sharply at the start, fine, but it instead rebounds and triggers stop-loss orders. Then it falls again…

It resembles a false breakout, like the “head-fake” often seen in dollar-yen and other markets.

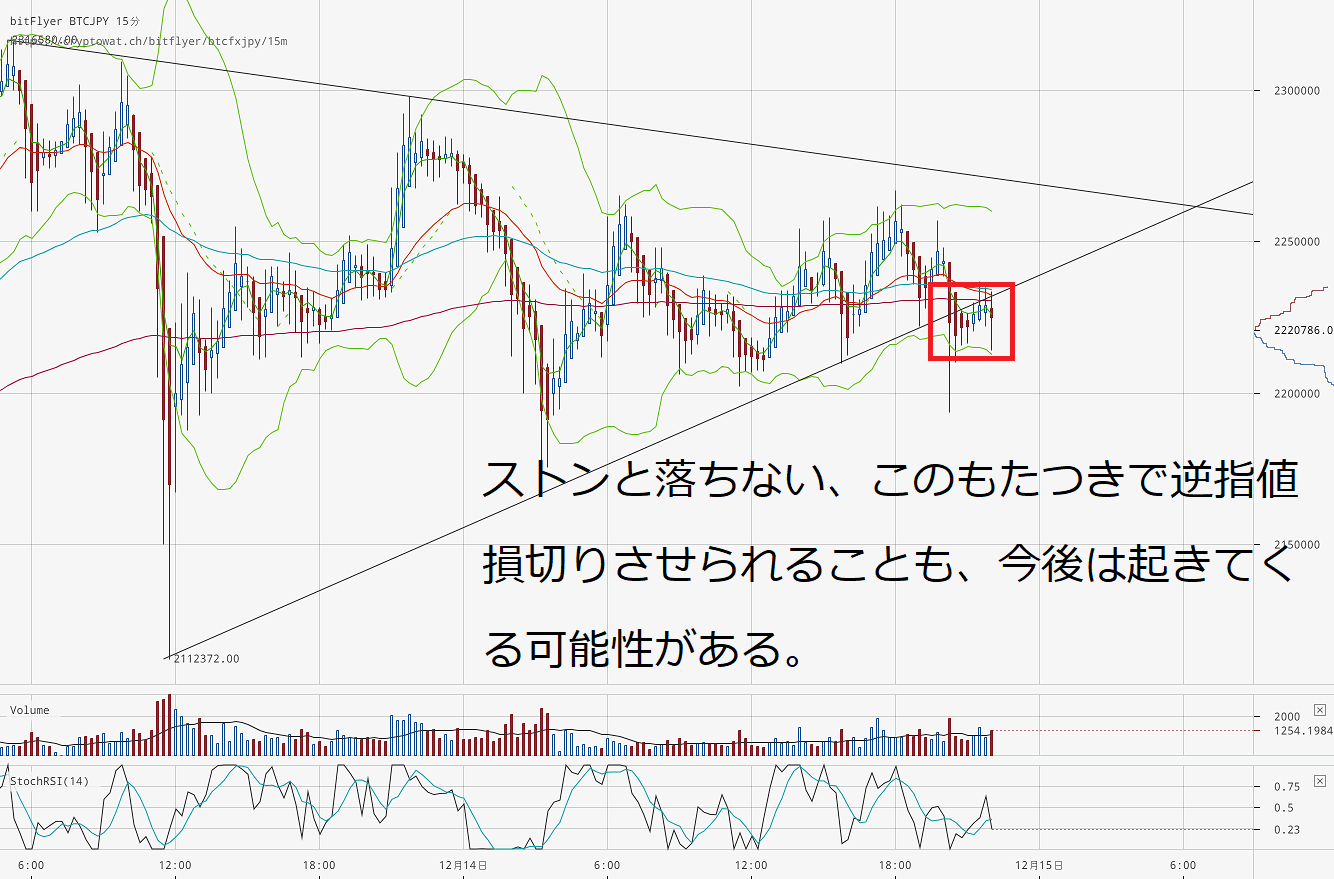

And the next day looks like this. It would be nice to take profits smoothly, but there are patterns where you try to extend unrealized gains and end up taking big losses…

Free takeaway: The technicals are starting to show quirks

BTCFX itself has a lot of sudden trades, but with futures, ETFs, and big traders entering, the technicals may stop working as well.

Since the overall uptrend continues, it might be better to buy and take profits rather than selling recklessly.

In any case, going forward, beware of false breakouts, stop-huntings, algorithmic trading (less common recently), high-frequency trading, and other erratic movements seen in normal stock markets and forex.

So for this paid column, I’ll discuss the outlook going forward.

Endnote Corner 1: Latest tax information! Updated December 8, 2017!

The National Tax Agency's site has updated the latest legal view regarding Bitcoin.

Here it is →No.1524 Taxation relations when profits are made by using Bitcoin | Income Tax | National Tax Agency

According to this, profits obtained by using Bitcoin are considered “miscellaneous income.”

So, like me with margin trading profits, they are generally miscellaneous income. As I have noted in the endnote before, as per blog articles (→Settling BTCFX taxes: Is miscellaneous income taxed under comprehensive or separate taxation? | Urban Generation Investor jun), it seems you cannot offset gains with losses. I wish this could be handled differently…

Also, according to NewsPicks comments by Yuuzo Kano, CEO of bitFlyer (No.1524 Taxes when using Bitcoin - NewsPicks), if you bought Bitcoin for 100,000 yen and used it to buy something for 500,000 yen, the 400,000 yen difference is recognized as profit.

When you spend Bitcoin on goods or services, if the price of Bitcoin at the time of payment exceeds the price when you bought it, that difference is recognized as profit. So this would also apply to purchases made with Bitcoin on platforms like FANCY, so be careful.

And on December 1, 2017, the National Tax Agency published a document about how to calculate income.

Here it is →Income calculation methods for virtual currencies (pdf) | National Tax Agency

※Since laws and tax interpretations may continue to change, which could alter how you file taxes or pay, please check with your local tax office or a tax professional before filing.

As expected, BTCFX profits remain miscellaneous income. I hope they will soon become separately taxable at 20%...

Endnote Corner 2: Try shopping with Bitcoin!

In fact, the overseas e-commerce site “FANCY” allows you to purchase goods with Bitcoin! It’s a bit costly for shipping, but they offer stylish items you won’t easily find in Japan.

For how to use FANCY, please refer to this blog post.

- →解説!FANCY (Fancy) account creation, registration, settings, and how to purchase | Urban Generation Investor jun

- →How to purchase (settle) items on FANCY with Bitcoin | Urban Generation Investor jun

※That’s all for free. The rest is detailed analysis and future outlook, so it is paid. If you want to read more, of course, you can subscribe as a tip; I’d be very grateful. Thank you for your continued support!