【This Week's Trade Review】GBP/JPY January 17, 2022 - January 21, 2022 Result

This week is a three-game losing streak. -74.8 pips.

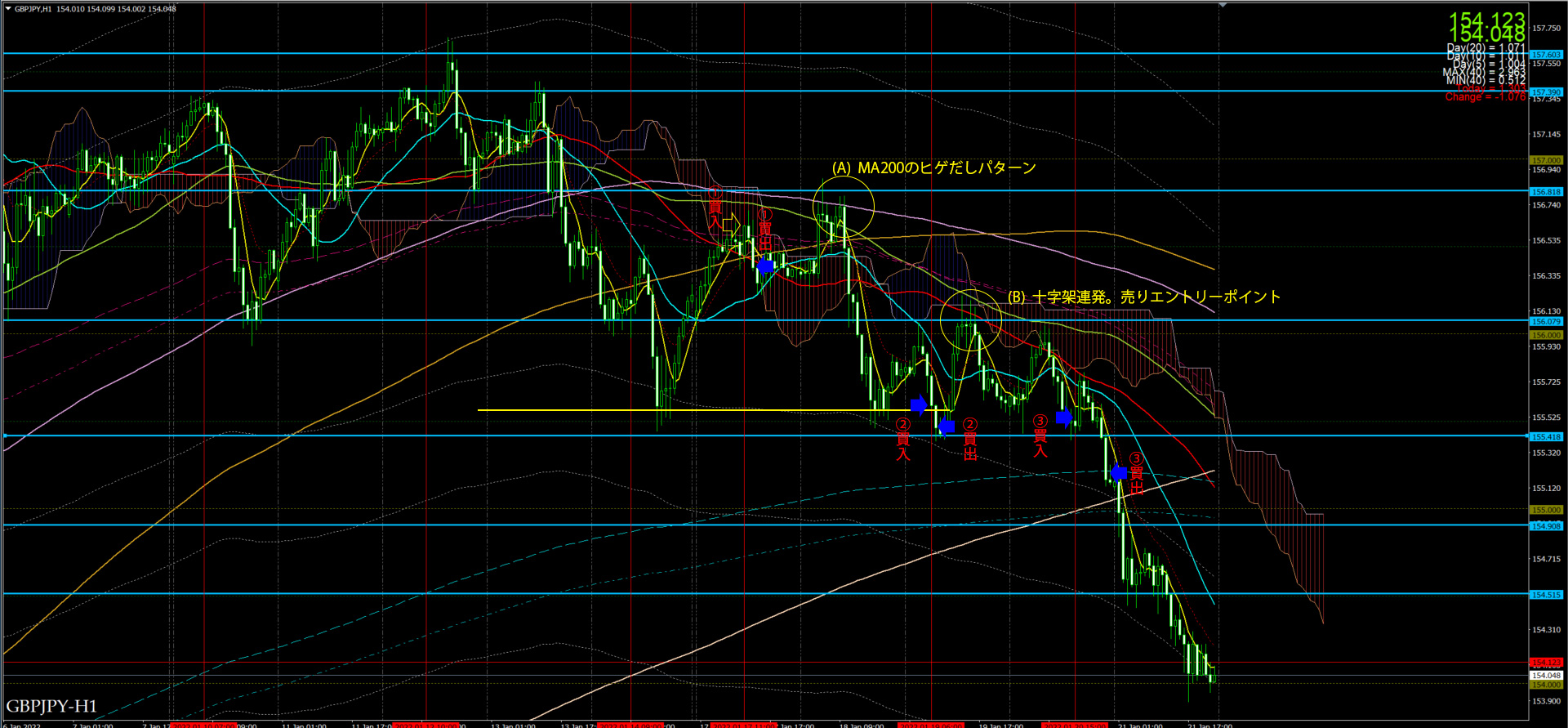

1-hour chart

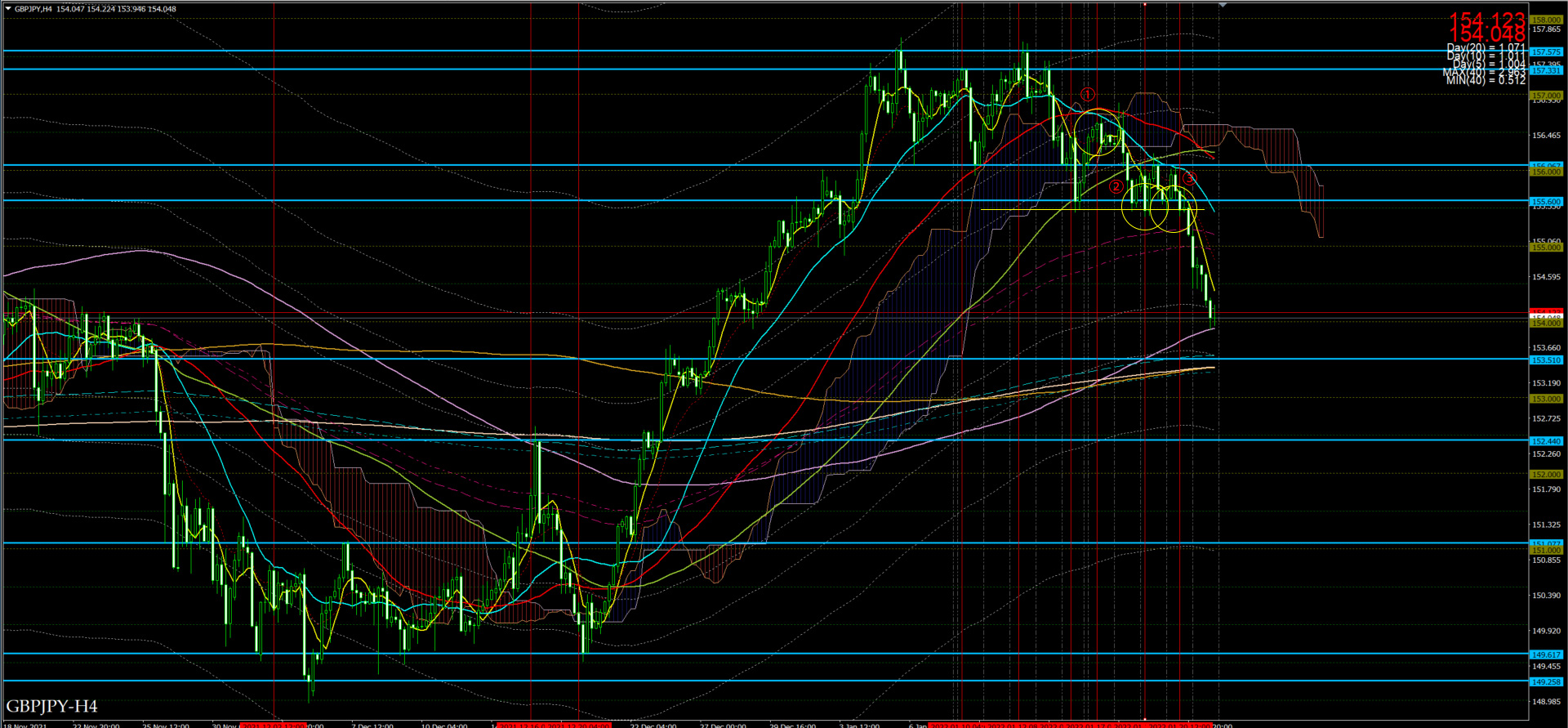

4-hour chart

【 Market Result ① 】

Entry (buy) 1/17 19:00 GBP/JPN 156.662

Exit 1/17 20:57 GBP/JPN 156.366

Profit/Loss -29.6 pips

I thought I had broken above the recent high, so I entered long. But the price fell, triggering a forced stop and I exited with a loss.

【 Market Result ② 】

Entry (buy) 1/19 14:09 GBP/JPN 155.572

Exit 1/19 15:01 GBP/JPN 155.47

Profit/Loss -10.2 pips

I judged a precise breakout and entered long. However, because the close price broke below, I manually cut losses.

Nevertheless, afterward price rose. If I hadn’t cut losses here...

【 Market Result ③ 】

Entry (buy) 1/20 22:55 GBP/JPN 155.491

Exit 1/21 5:46 GBP/JPN 155.141

Profit/Loss -35.0 pips

【 Overall Review 】

This week is a three-game losing streak. -74.8 pips.

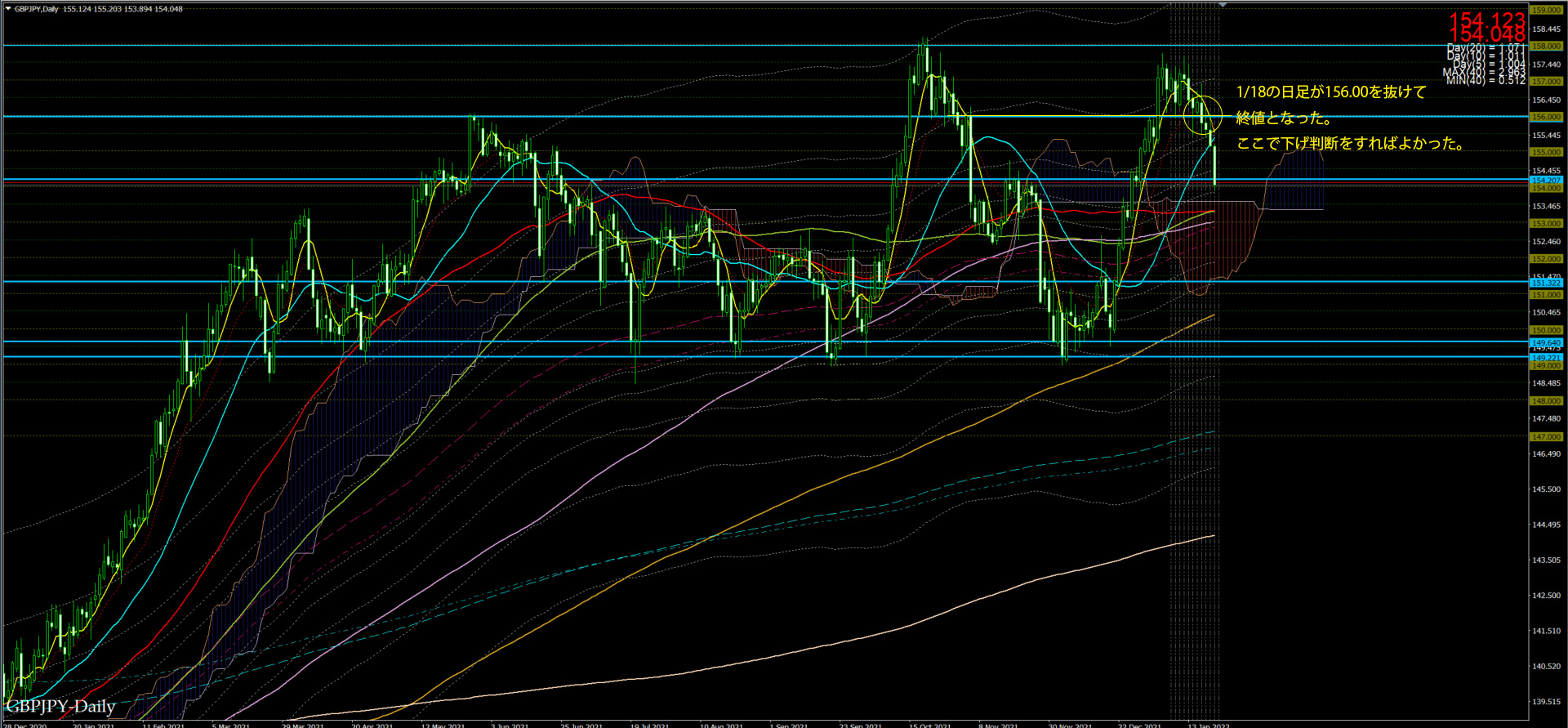

On 1/18 the daily close broke below 156.00 to close there. This was the point to switch to a bearish outlook.

I had been watching the 1-hour and 4-hour charts and missed the match-up.

Also, I did something different from my basic method by entering on a breakout like in Result ①. I got burned by letting greed take over.

Fewer methods (more limited) reduce the number of loss opportunities.

(A) is a 200 MA, or a prior MA100 shadow pattern, where I could have entered on a sell here.

(B) is a sequence of crosses, where a sell entry would have been appropriate.

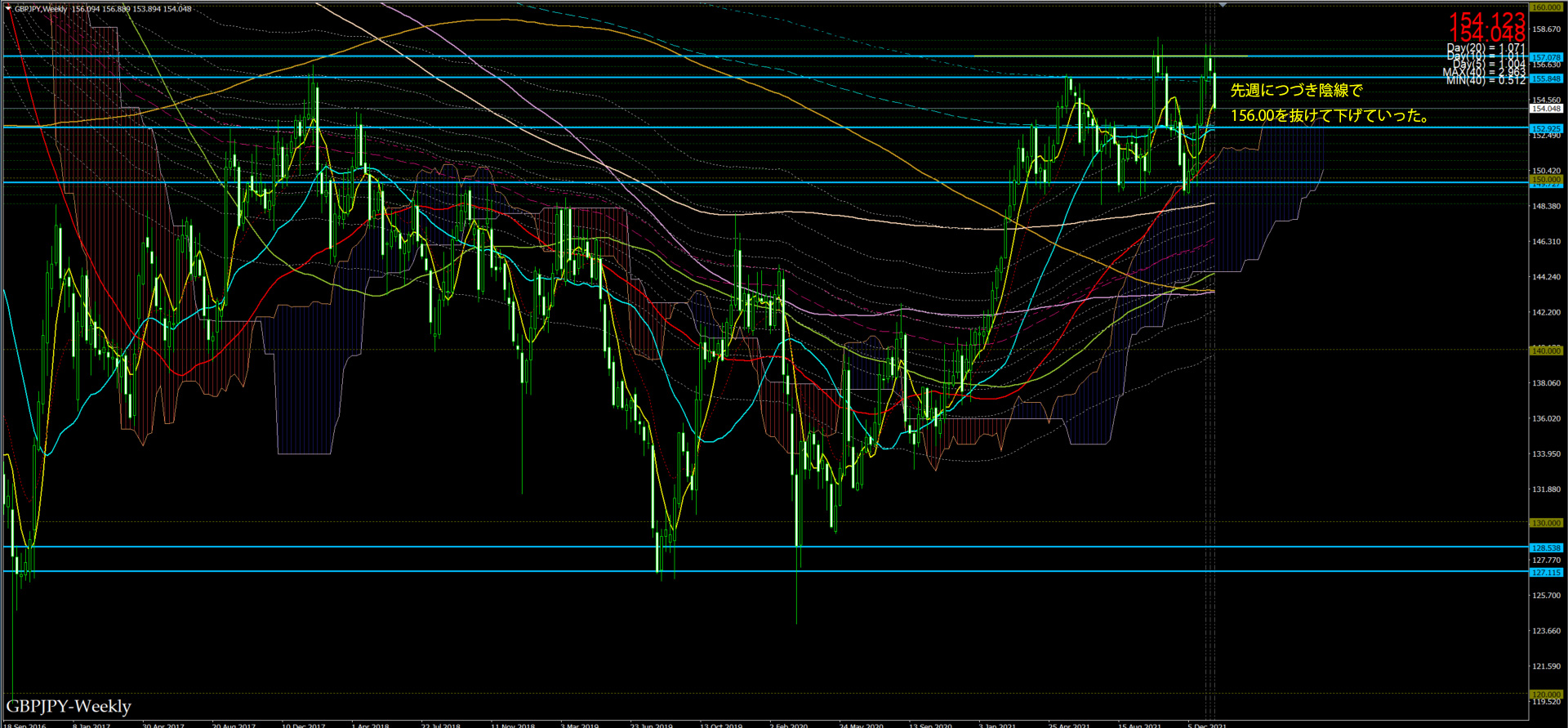

Looking at the weekly chart, it remained a bearish candle as last week. Did the momentum start after breaking 156.00?

Looking at the daily chart, the daily close on 1/18 broke below 156.00; the bias to the downside should have been switched.

------------------------------------------------------------

I am working on trading based on Imawachi-sensei’s “close-price trading method.”

※ The Donpisha pattern is when the candle’s close is at roughly the same level as the most recent close (often forming a double bottom or triple top), treated as resistance and used for entry.

※ The Shadow-Shadow pattern is when the close aligns closely with MA100, MA200, or MA300, and I enter hoping for a reversal.

For Imawachi-sensei’s close-price trading method, please also refer to the following:

------------------------------------------------------------

EA that enters on close price “OwarineDeEntry”

× ![]()