【This Week's Trade Review】GBP/JPY January 10, 2022 - January 14, 2022 Results

This week: 2 wins, 1 loss. +57 pips.

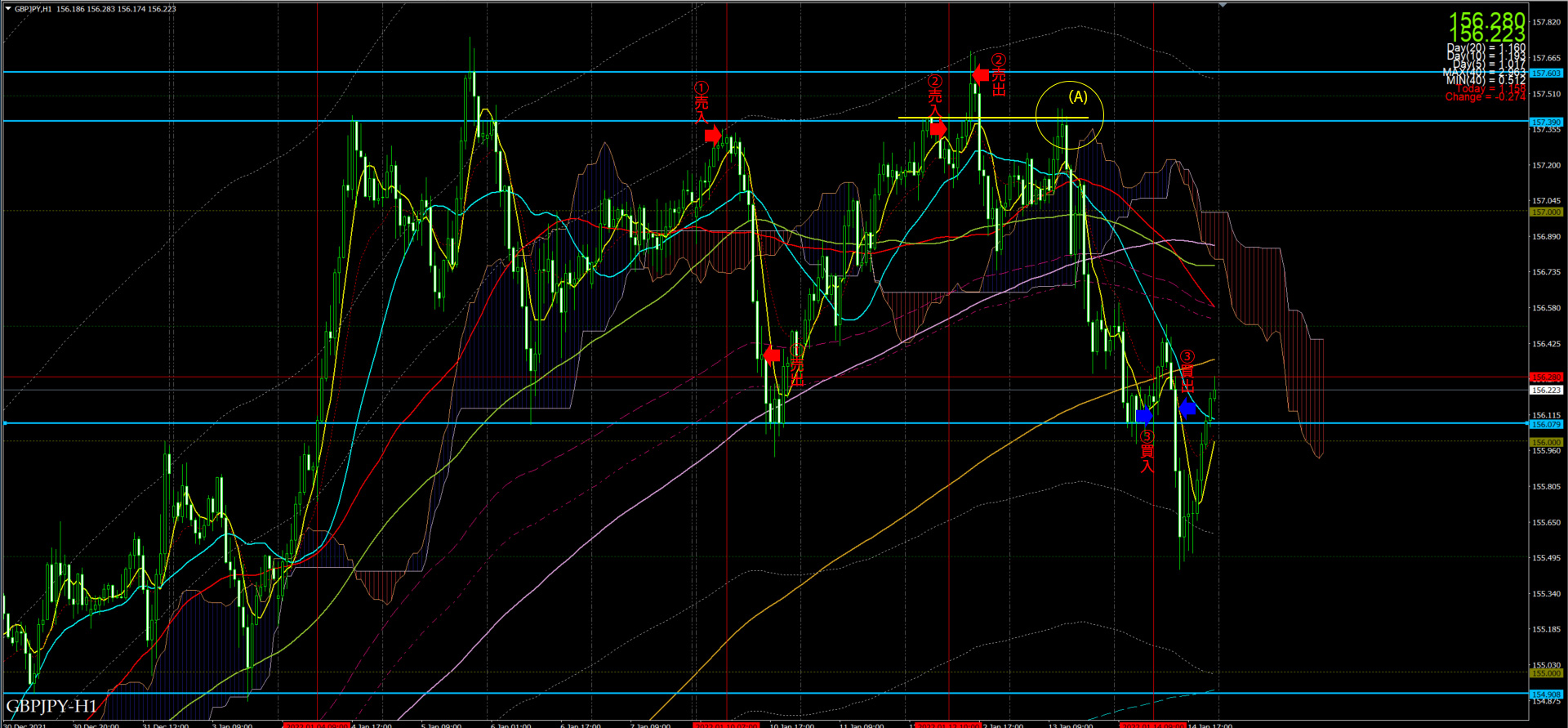

1-hour chart

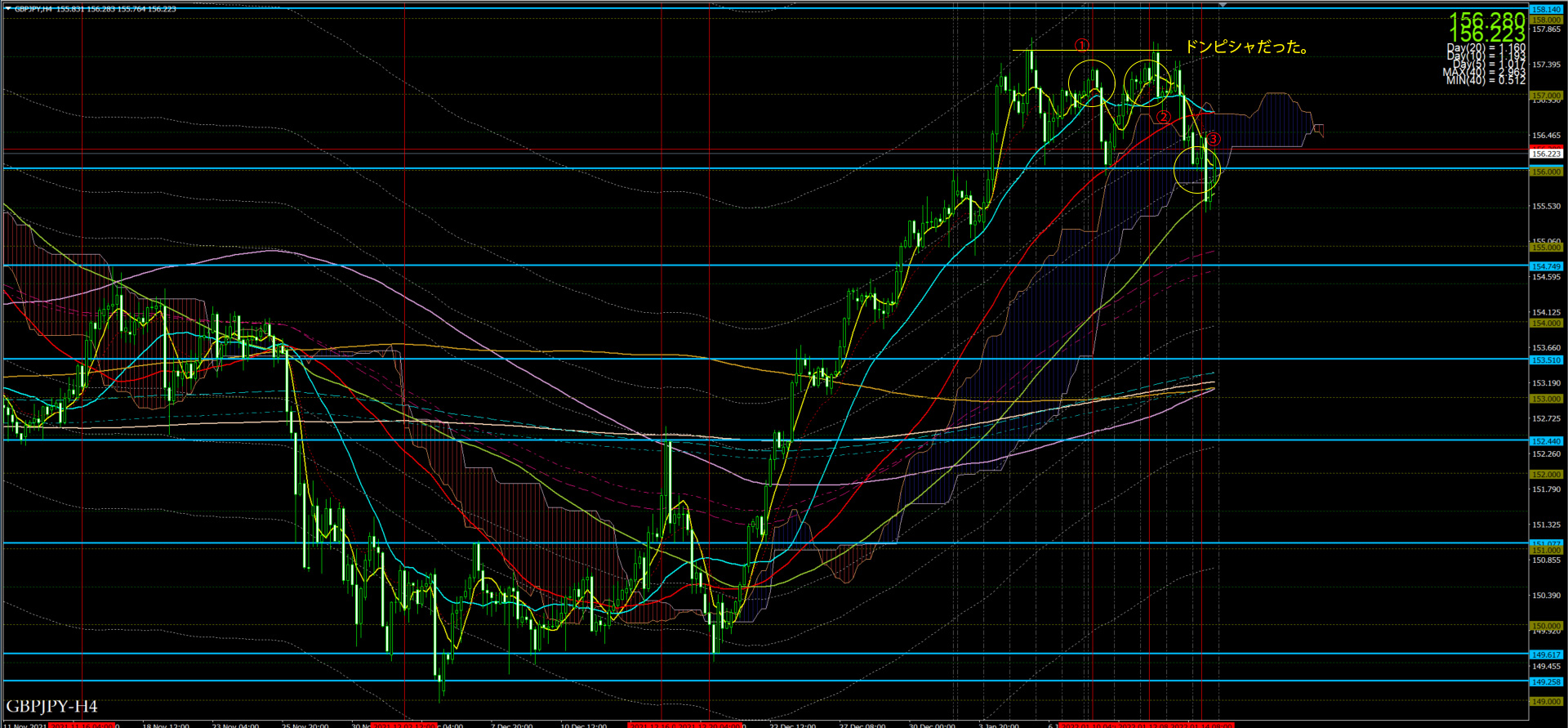

4-hour chart

【 Market Result #1 】

Entry (sell) 1/10 10:01 GBP/JPN 157.295

Exit 1/10 23:00 GBP/JPN 156.417

Profit/Loss +87.8 pips

Judged as exactly hit. Prices drifted downward. Take profit near the recent low.

【 Market Result #2 】

Entry (sell) 1/12 17:05 GBP/JPN 157.342

Exit 1/12 22:35 GBP/JPN 157.691

Profit/Loss -34.9 pips

Entered by placing a limit order at the upper price line that was hit exactly; it dipped slightly but ultimately broke through. Forced stop resulted in a loss.

【 Market Result #3 】

Entry (buy) 1/14 16:39 GBP/JPN 156.112

Exit 1/14 21:11 GBP/JPN 156.153

Profit/Loss +4.1 pips

Judged that the most recent low was hit exactly. Entered long when it retraced. It rose but ultimately fell back, finally taking profit near cost price with a small gain.

【 Overall Assessment 】

This week: 2 wins, 1 loss. +57 pips.

Slight gains occurred amid a ranging market.

(A) was exactly hit. The 4-hour chart also marks a precise point; this is a point not to be skipped.

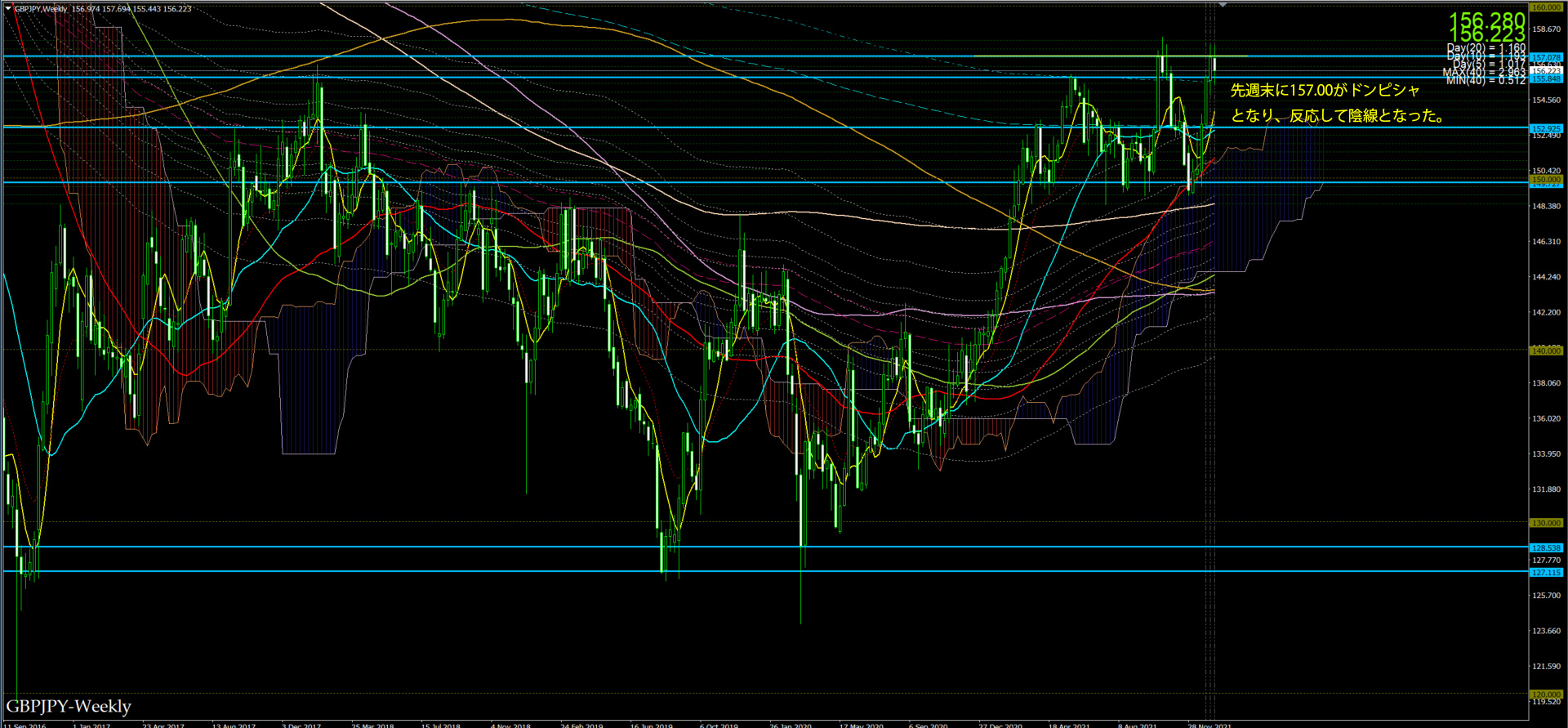

Looking at the weekly chart

At the end of last week, 157.00 was a precise level, reacting with a bearish candle.

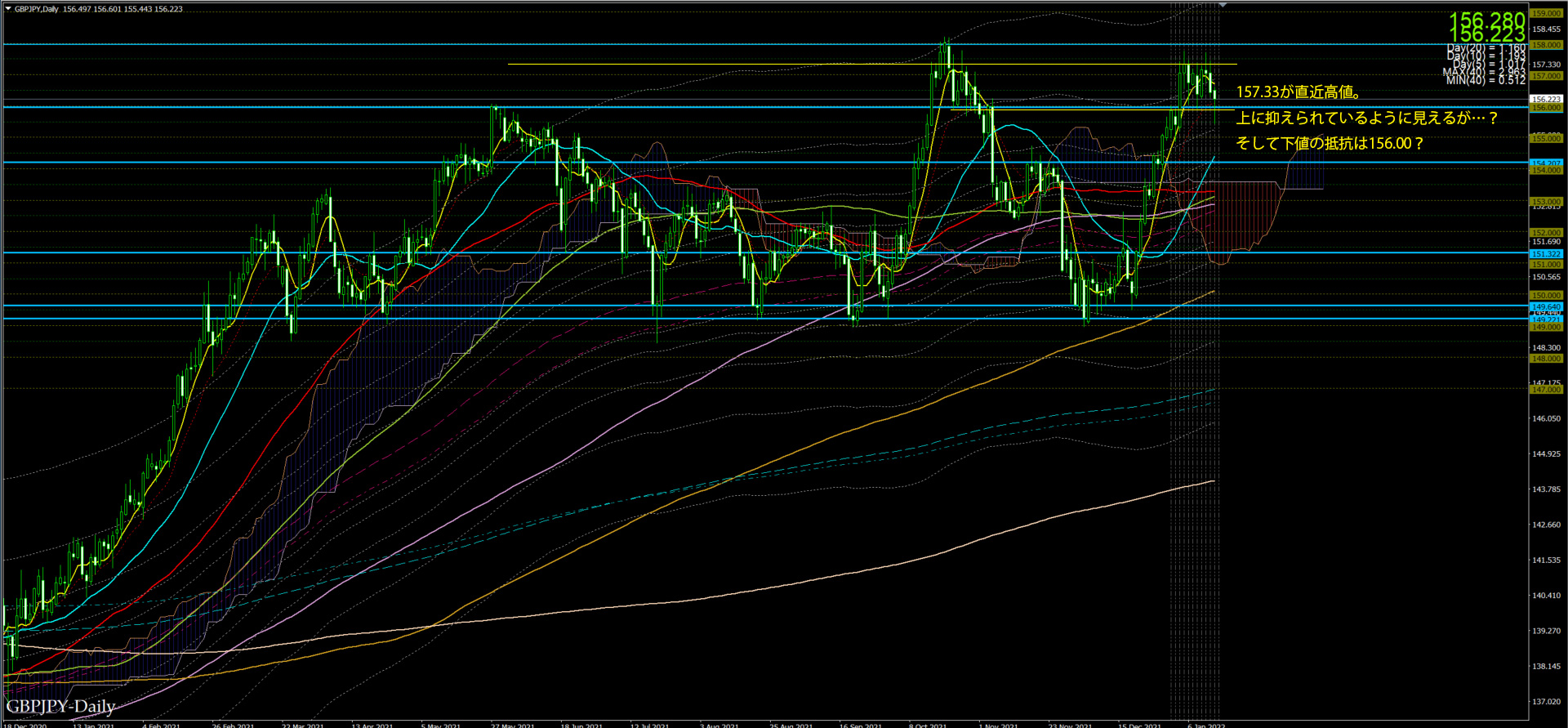

157.33 is the recent high.

It seems capped upward, but...?

And support at the low around 156.00?

------------------------------------------------------------

Iaito-sensei’s “Close-Price Trading Method” is the basis for trading here.

※ The “Exactly Hit Pattern” is when the candle’s close is near the latest close (often forming shapes like double bottoms or triple tops), treated as a resistance line for entry.

※ The “Wick-Release Pattern” is when the closes of MA100, MA200, MA300 align near the same level, indicating a potential reversal and prompting an entry.

Also, for Iaito-sensei’s close-price trading method, you may refer to the following as well,

------------------------------------------------------------

EA that enters at the close price: “OwarineDeEntry”

× ![]()