【This week's trade review】Pound/Yen January 3, 2022 - January 7, 2022 Result

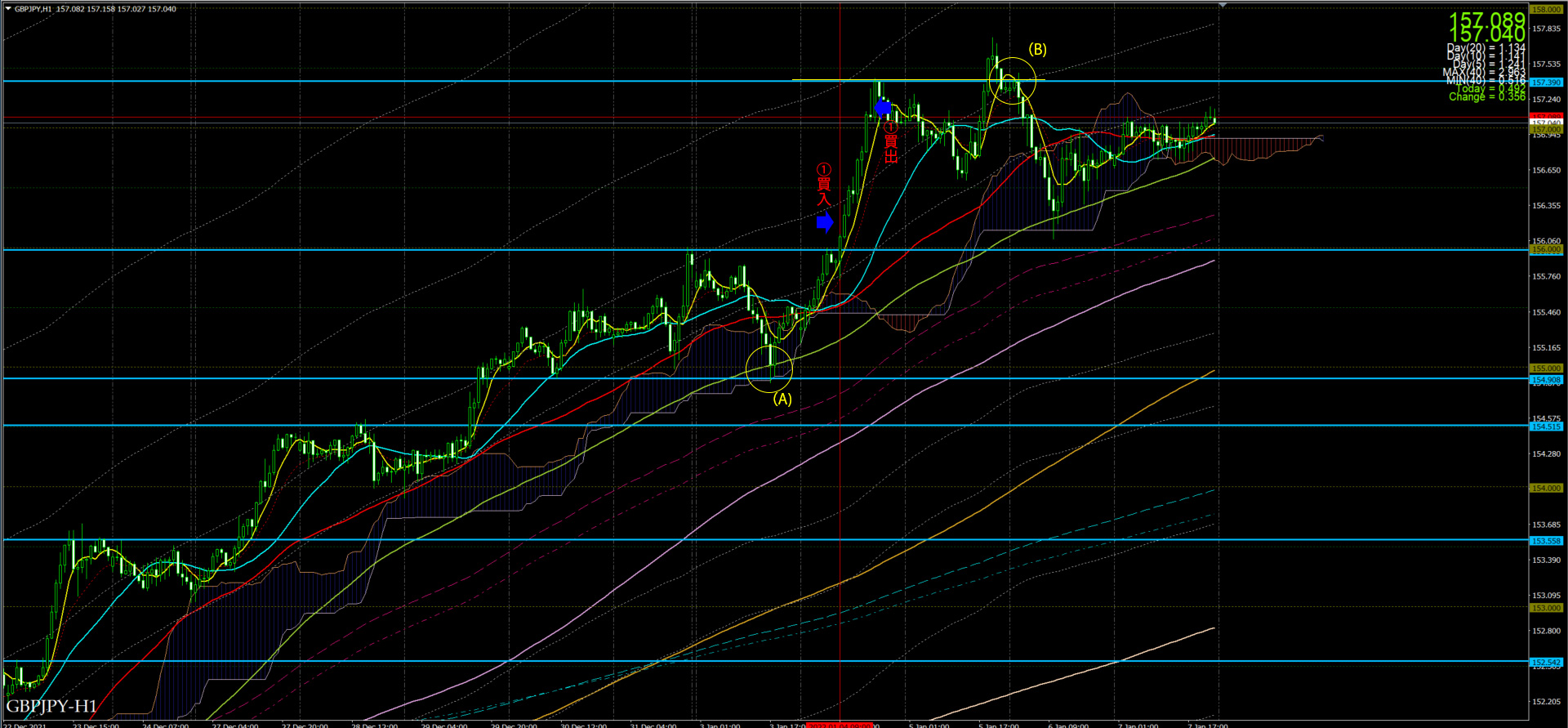

1-hour chart

4-hour chart

【Market Result ①】

Entry (Sell) 1/4 10:01 GBP/JPY 156.194

Exit 1/4 23:08 GBP/JPY 157.151

Profit/Loss +95.7 pips

Since it broke above the recent high, I bought thinking it would rise, and it continued up, taking profit just short of 100 pips

【Overall Comment】

1 win, +95.7 pips. Not bad.

(A) was a doji-whisker pattern around MA100. It also hit exactly at 156.00 “00”. I thought the market would be thin after the New Year, so I wasn’t biased.

(B) was a perfect hit.

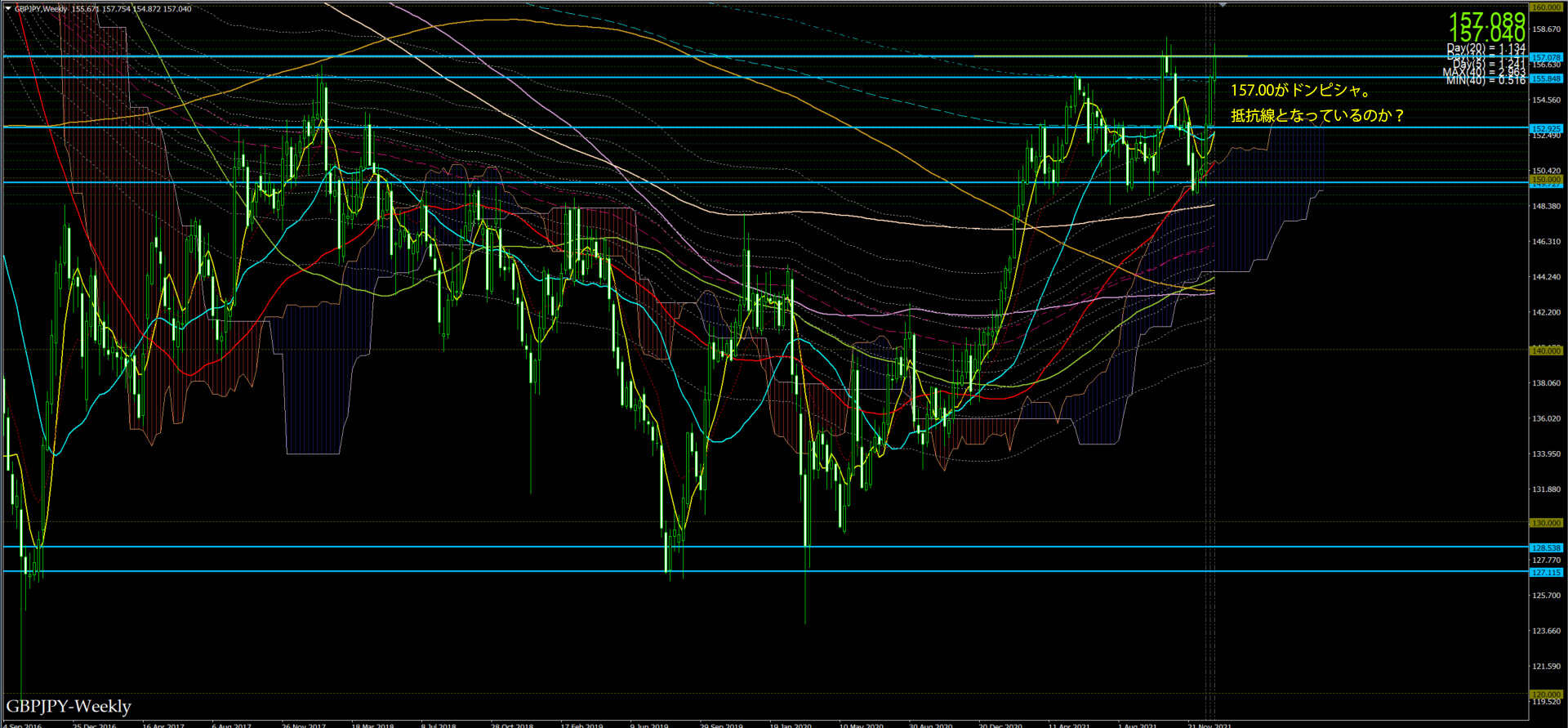

Looking at the weekly chart, a hit occurred around 157.00. Is 157.000 acting as a resistance?

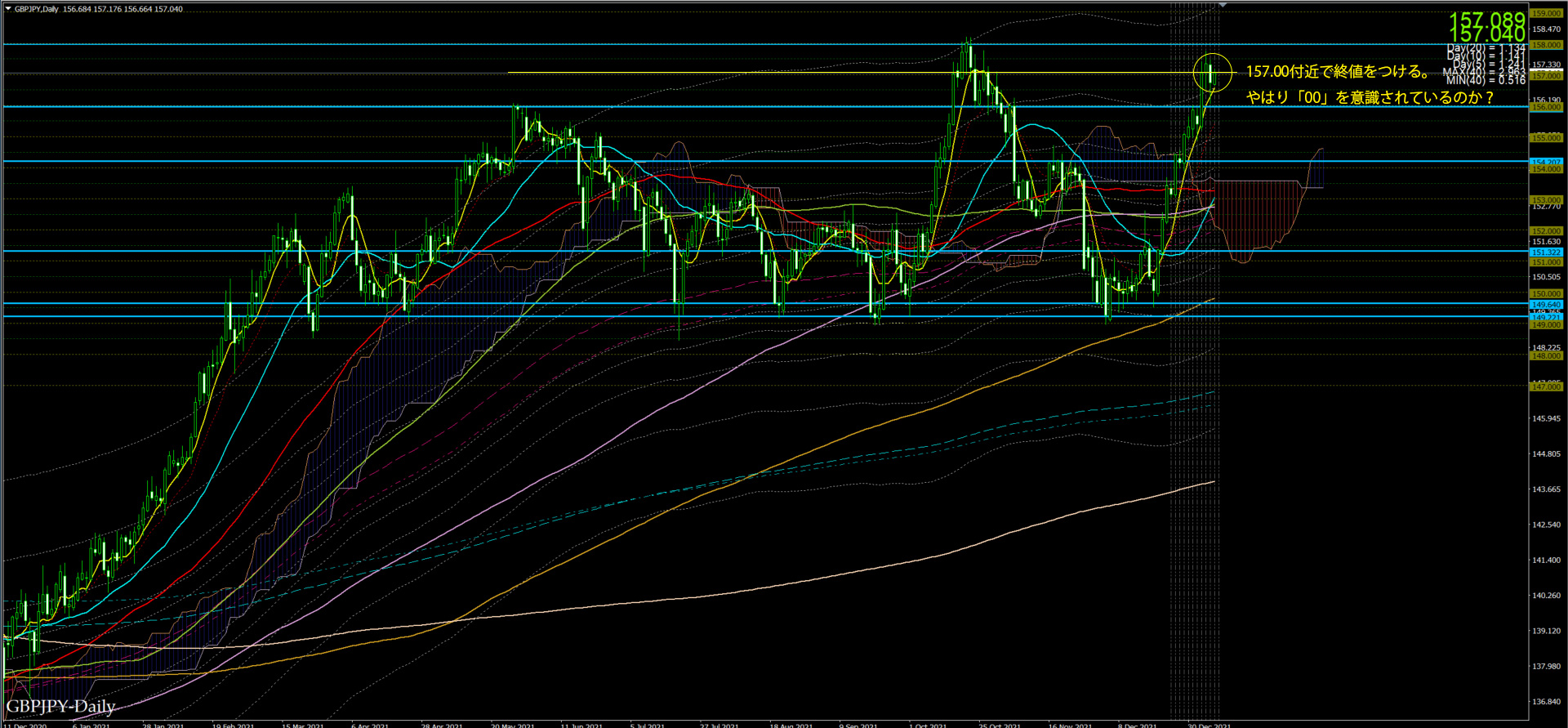

Looking at the daily chart, the weekend close ends around 157.00. Is the “00” acting as a resistance line?

------------------------------------------------------------

I am trading based on Iidatchi-sensei's “Close Price Trading Method.”

※ A perfect-hit pattern refers to when the candlestick close is at nearly the same price as the most recent close (often forming shapes like a double bottom or triple top). This is treated as a resistance line for entry.

※ The whisker-pull pattern refers to entries when the close aligns with MA100, MA200, or MA300, with the expectation of a reversal.

Also, for Iidatchi-sensei's close-price trading method, you may refer to the following as well,

------------------------------------------------------------

EA that enters by setting a limit at the closing price “OwarineDeEntry”

× ![]()