Examine the One-Win EURUSD and the Original One-Win portfolio

fx-on's top-selling 'Ippon-kachi' is a USDJPY-only EA, but,

Do you know that there is an EURUSD version of Ippon-kachi?

Since it's marketed as the Ippon-kachi series, is a portfolio possible?

I would like to analyze it using backtest data!

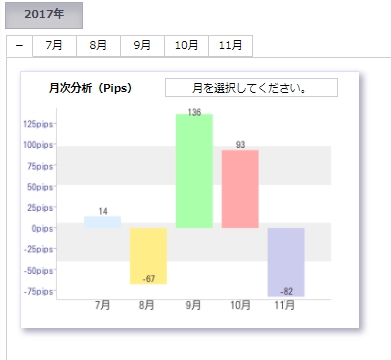

[Ippon-kachi 2017 Forward Statistics Information]

[Ippon-kachi_EURUSD Forward Statistics Information]

November was weak for both Ippon-kachi series, wasn't it?

Will the Ippon-kachi series become a portfolio?

I would like to infer from backtests.

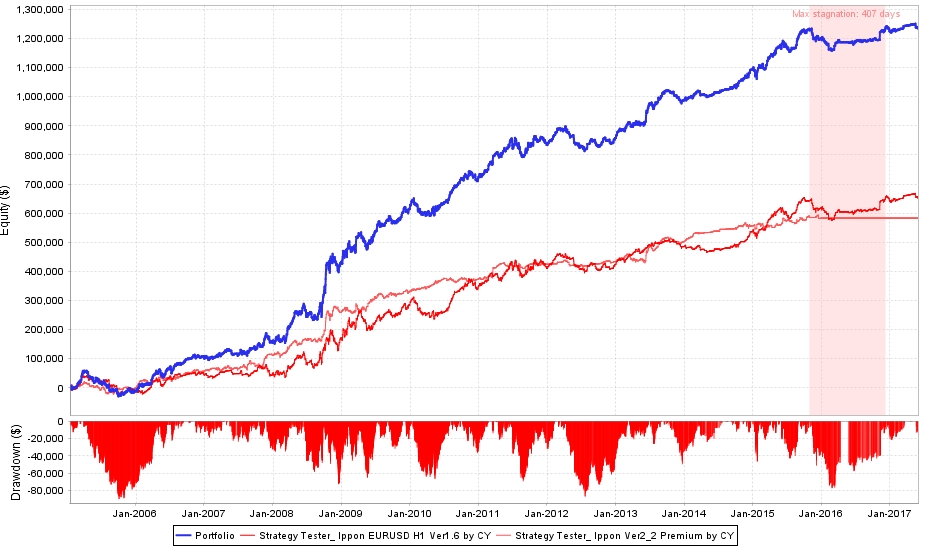

[Portfolio-izing the backtests of Ippon-kachi and Ippon-kachi EURUSD!]

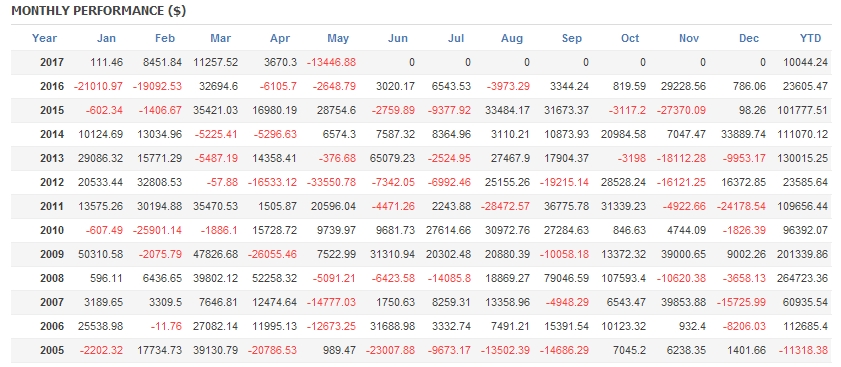

Note: From 2016 onward, 'Ippon-kachi' has been forward-running, so there is no backtest data.

Note: The backtest lot size is 0.1 lot.

In terms of the profit-and-loss curve, the EURUSD version zig-zags more, while the original Ippon-kachi shows a smaller drawdown and a smoother upward curve. Regarding profitability, in 2015, when both EAs had backtests, the EURUSD version produced the larger result.

Maximum drawdown for each EA at 0.1 lot-80,000 yenis the case.

Looking at the monthly portfolio P&L, 2005 is negative.

Please use this as a reference to adjust the lot size depending on your account funds and acceptable drawdown percentage.

[Consider a portfolio with other series]

The Ippon-kachi (USDJPY) and Ippon-kachi EURUSD are not exactly negatively correlated, and their profit growth rates were similar and they did not drag each other down, however,

I wonder if there is another good combination?

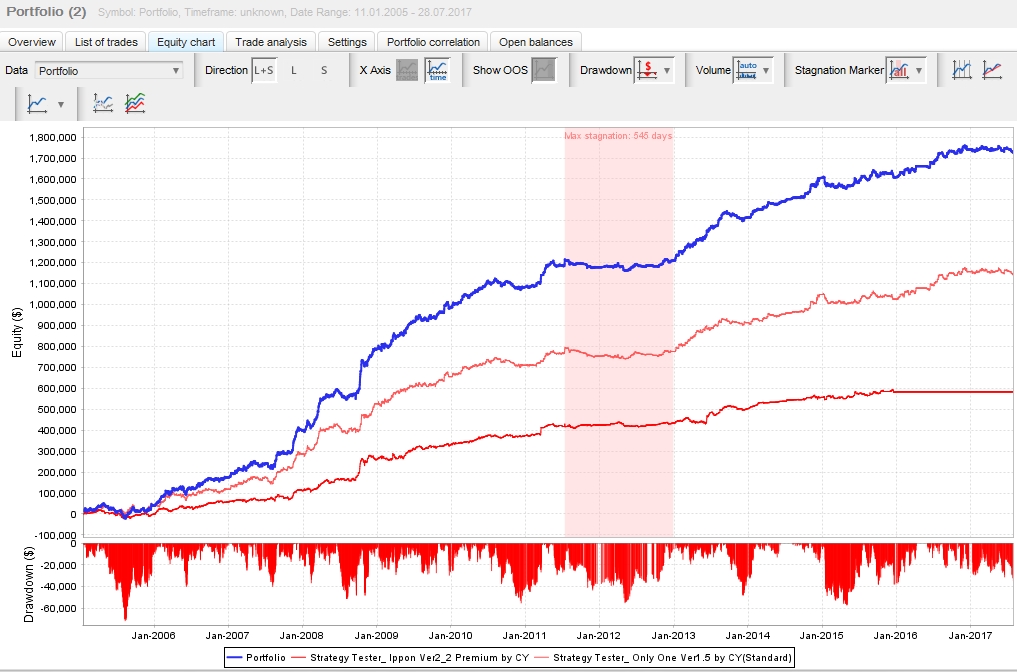

So I compared with the new 'Only One'!

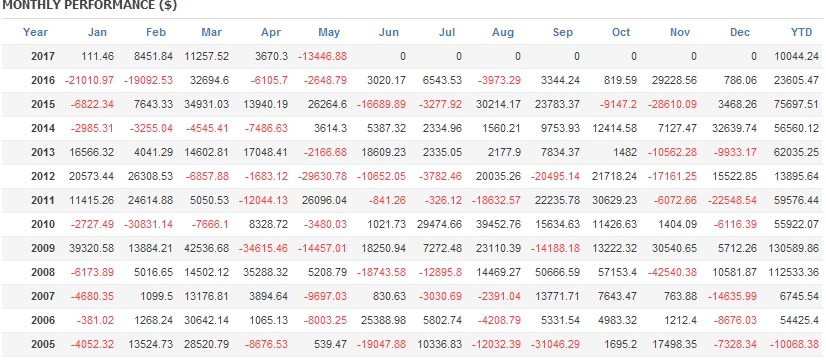

[Combination of Only One (USDJPY) and Ippon-kachi EURUSD]

The profit-and-loss curves are fairly similar.

This also has a negative in 2005, but in other years, the overall annual profit is larger than the "Ippon-kachi & Ippon-kachi EURUSD" combination,and the annual profit is generally larger.That said, the maximum drawdown for each EA at 0.1 lot is just under 10,000 yen. It's a high-risk, high-return type.

(2016 is the profit/loss for Only One only)

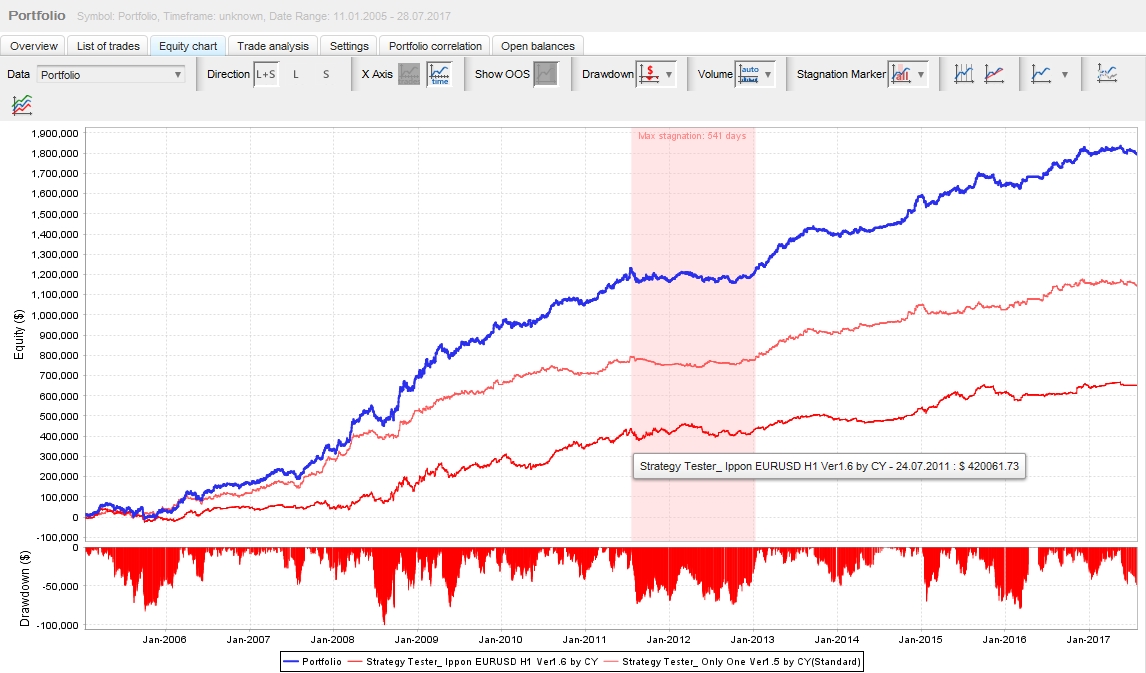

[Combination of Ippon-kachi and Only One (USDJPY)]

The 2005 loss has disappeared!

However, I was concerned that 2015's profit was low.

Also, the maximum drawdown is relatively small at -60,000 yen for 0.1-lot per EA, making it a combination that can support larger lot sizes.

Also, since there is no backtest data for "Ippon-kachi" after 2016, this shows Only One's P/L only.

If you prioritize profitability, the combination "Ippon-kachi EURUSD + Only One"

If you want to eliminate annual losses, the "Only One + Ippon-kachi" combination,

If you want a balanced type, "Ippon-kachi + Ippon-kachi EURUSD" seems good!

That is the result.

If you are considering portfolios besides Ippon-kachi,

please also keep an eye on these two♪