Annual gain of around 1000 pips! An EA with 6 logics per position: 'Take Kuma USDJPY'

Annual gain around 1000 pips!

EA with 6 logic-based strategies in 1 position

The initial margin is 10,000,000 yen, but the maximum drawdown is 360,000 yen, and

because the maximum number of open positions is 1, it is possible to operate with a recommended margin of 1,000,000 yen for 1.0 lot (100,000 units)

, you can operate.

Backtest data:

Period: 2007.01.01-2016.12.31

・10-year net profit: +11,700,000 yen!

・Maximum drawdown: 360,000 yen

・Average winning pips: 14 pips

・Average losing pips: -52 pips

・Win rate: 88%

・Total trades: 1722 (annual average 172 trades)

With simple-interest operation, the gains in pips and the low drawdown are outstanding.

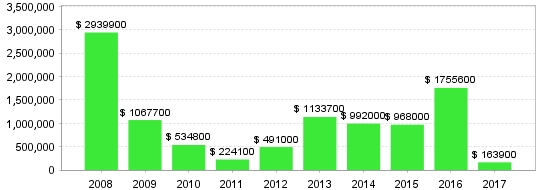

【Monthly P/L】

There are months when a fixed 1.0 lot loses more than 100,000 yen, but over the year there are no years with a negative carryover.

There are no years carried forward.

【Annual Profit/Loss】

2011 was a bit weak, but in recent years it has consistently earned around 1000 pips per year.

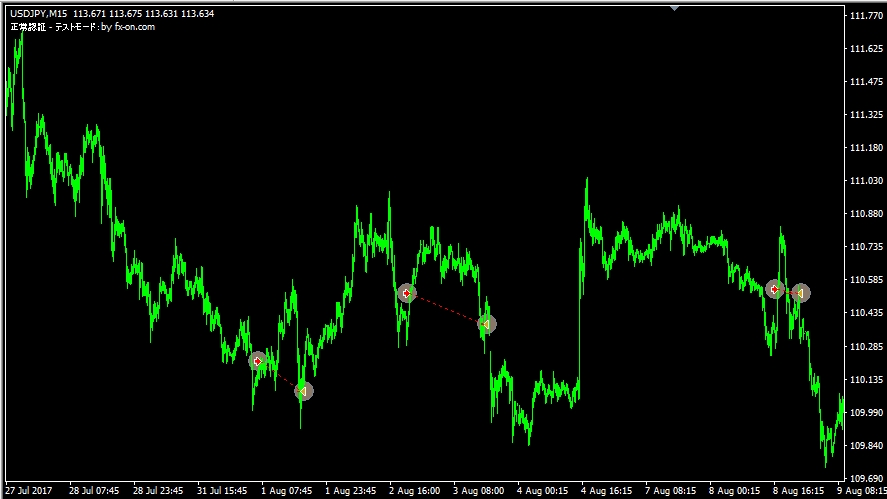

【Entry Example】

We use day trading and scalping according to the situation

Since the maximum number of open positions is 1, entries from multiple logics do not coincide.

【Recommended EA for High Win Rate, Compounding Also an Option】

For a 1,000,000 yen account, default compounding keeps the margin around 300,000 yen

.

It grows at roughly 0.5 lot per 1,000,000 yen, so risk stays constant.

In backtests also published on the sales page,

profit of over 798 million yen over 10 years!

(More than 2,650x the initial required margin)

Because compounding increases with time, it would be interesting to see how much more it grows with a bit more

realistic 2-3 years of operation would show how much more it grows.

Spread 1 pip, 2015-01-01 to 2017-01-01

Two-year backtest (compounding is the default setting)

Relative drawdown 14.8%,

Net profit +2,260,000 yen (+226%)

Three-year backtest

2014-01-01-2017-01-01

Relative drawdown 14.87%

Net profit +4,860,000 yen

After about 3 years, profits exceed those of fixed 1.0 lot.

Relative drawdown remains constant relative to capital, which is reassuring.

Of course, the gains are excellent even with simple-interest operation,

so please monitor for any backtest-forward divergence and consider using it!

From the sales page, it seems to be the work of a seasoned systems engineer,

so you can tell that meticulous testing has been repeated.

Please read the product description carefully!

"Take Kuma USDJPY"

9,800 JPY