Pound crash! The FX company that stood out in a crisis...

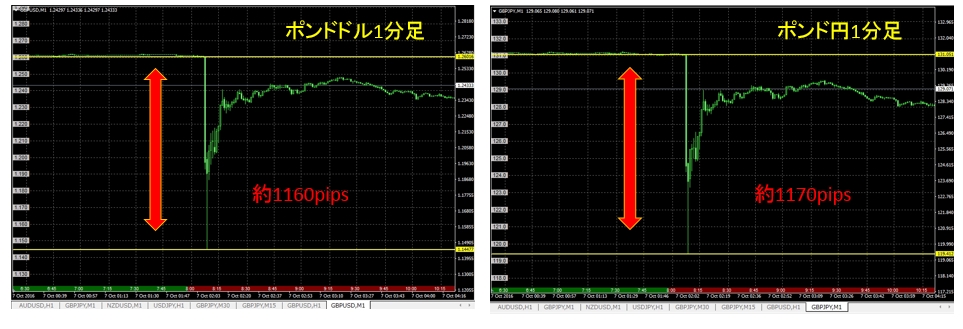

On October 7, 2016, during the 8 o'clock hour in the morning, the pound (GBPUSD, GBPJPY)

plunged by more than 1000 pips in an instant.

GBPJPY: 131.1 yen → 119.4 yen

GBPUSD: 1.2612 → 1.145

Two minutes after the plunge, it formed a large lower wick,

and ten minutes later it returned to about the pre-crash level, around -200 pips.

There were rumors of a misorder, but instant, including stop-loss orders etc.,

the price collapsed. This is the scary part of forex—such things can happen...

Those who sold were in heaven, and those who held long positions must be wondering what happened...

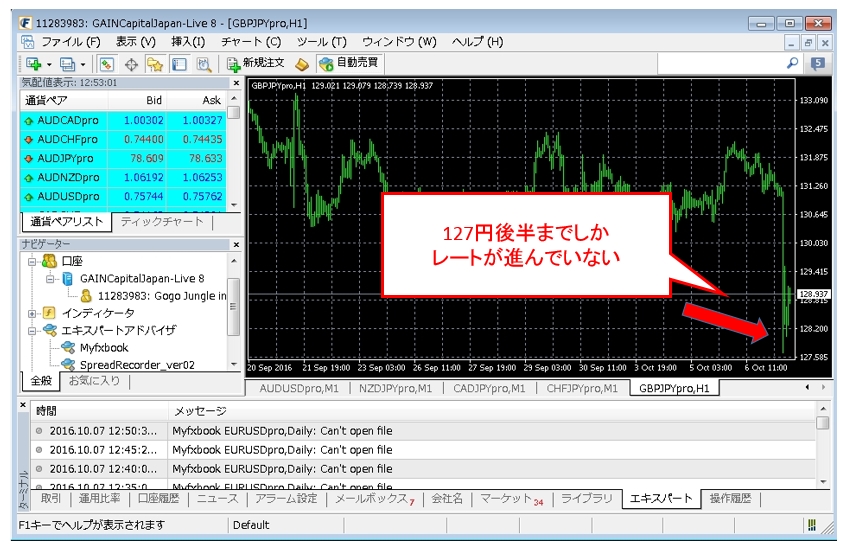

■ At the time of the crash, different rates were quoted by different brokers

I was watching fx-on’s EAs (Forward) to see what would happen,

and it turned out that the rate during the crash differed by broker!

Here is the shocking image!

(*Both are real accounts)

There was about an 8-yen difference at the moment of the crash.

One side dropped to the high 127s, the other to 119 yen.

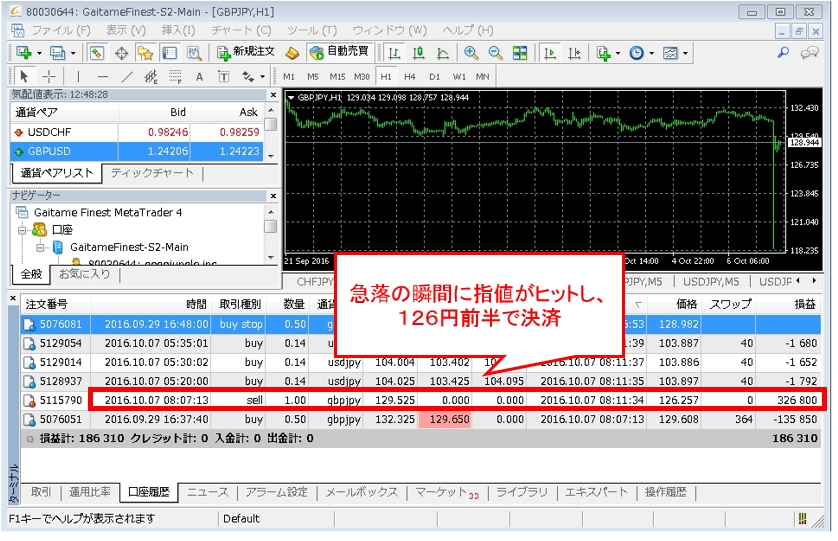

In the account that fell to 119 yen,even during the sharp drop, orders placed with a limit order were filled properly and executed in about three minutes.

Rumors say that some brokers did not accept orders for about 30 minutes after this rate spike.

With different rates and different fill power, during such emergencies the profits (and losses) can differ greatly.

■ The accounts with superb fill power and direct interbank rates are

The reason there was a price difference during the crash is whether or not the platform was directly linked to interbank (NDD method).

NDD method (Interbank Direct Connection) means

NDD stands for No Dealing Desk, and without a dealer (FX company) intermediary, orders are placed at the rates quoted by multiple covering financial institutions*.

Other than interbank-direct type, there areDD (Dealing Desk) method orOTC (Over The Counter).

In relative financial transactions, the counterparty may hedge to mitigate risk by placing the same order with another institution.

By performing a cover trade, financial traders can hedge risks, so

many domestic securities firms adopt this.

If you conduct cover trades, during drastic market moves, orders may not be fully covered,

and there can be divergence from the interbank quoted rate.

Well, not covering = being a pure-taking activity, perhaps...

From this incident, you can understand how important NDD-type accounts are!

Gaitame Finex’s promises are no lies!

Gaitame Finex’s MT4 uses the “CURRENEX Bridge.”

With an entirely hands-free order-to-execution process (STP, Straight Through Processing),

it enables ultra-fast MT4 (MetaTrader 4).

Gaitame Finex, with superb fill power and recommended for EA use,

if you want an account with EA, there is a campaign with fx-on♪

If you want to open an account with EA, click the banner below!