EA using fractals『Gewin9』

Do fractals have universality? PF6.3

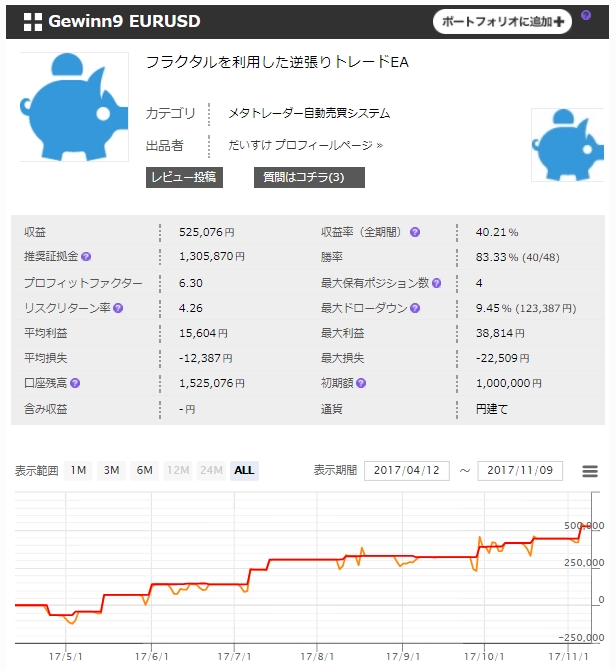

'Gewinn9 EURUSD'

Forward period: six months, fixed 0.5 lot operation

Realized P/L +520,000 yen, maximum drawdown during the period is 120,000 yen

PF6.3 has a robust performance with an 83% win rate and small losses and large gains!

'Gewinn9 EURUSD' Overview

Currency pair: EUR/USD

Maximum number of positions: 4

Used timeframe: H1

Maximum stop loss: 150 pips

Take profit: 400 pips

【EA Concept】

"Using fractals to observe trends,

This is an EURUSD specialist EA that implements a trend-following strategy on the weekly trend and a contrarian strategy on the hourly chart.

It makes an open decision when a new hourly bar is formed.

When a 4-hour fractal is detected, it determines whether to close positions.

We quickly move to break-even. When possible, we take large profits.

It's a simple EA that only looks at fractals.

"I think it could be strong over the long term because of that."

◆What exactly is a fractal?

The fractal structure refers to the principle that parts are self-similar to the whole, but

This can also be applied to charts.

In FX trading technical analysis, a fractal refers to a reversal point within the large price movements of the overall market.

where reversals occur.

The fractal indicator was developed by Bill Williams.

Its definition is: a bullish fractal consists of five bars, and the highs of the two bars immediately following the bar with the highest high are consecutively lower. Conversely, a bearish fractal is when the two lows immediately following the bar with the lowest low are consecutively lower.

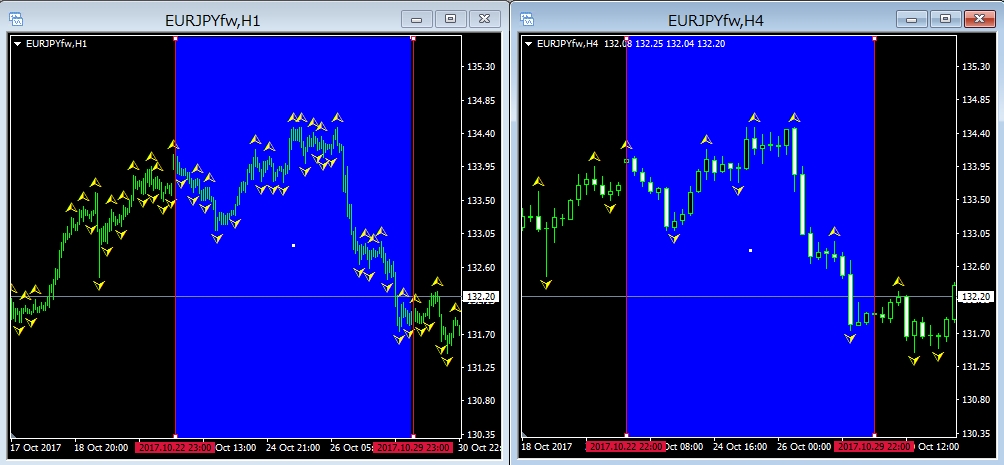

I displayed the fractal indicator on the 4-hour and 1-hour timeframes.

On short timeframes, fractal signals appear frequently, but when filtered with longer timeframes,

entry points become narrower.

Gewinn9 is an EA that utilizes fractals.

It employs a trend-following approach against the weekly trend and a contrarian approach on the hourly chart.

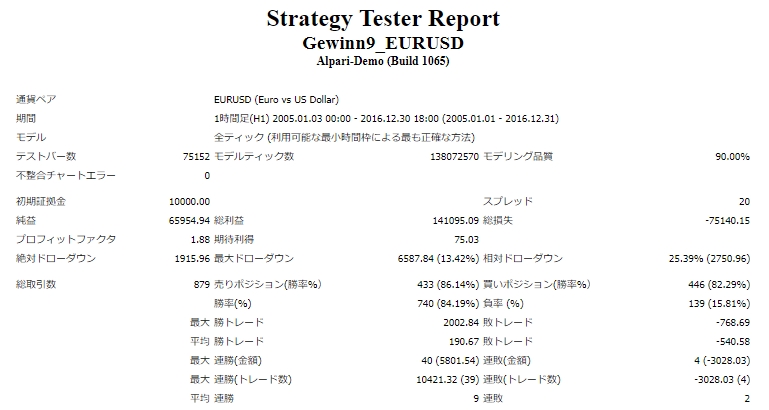

◆Backtest Verification

Backtests use a $10,000 account with a fixed 0.5-lot size across 4 positions, making it quite aggressive.

Maximum drawdown is $6,587, which means about $1,317 max drawdown per 0.1 lot.

If you want to operate safely, about 0.3 lots per $10,000 of account funds would be advisable.

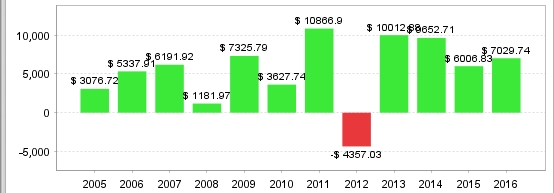

【Annual Profit/Loss】

In an 11-year backtest, 2012 shows a loss of $4,357, a considerable struggle, but

other years show substantial profits.

If you don't encounter a risky year, it could be quite profitable.

Pips earned basis is shown here. It varies somewhat with the spread.

(Backtest measurements by OANDA Japan)

Maximum stop loss per position is 150 pips, so

4 positions × 150 pips = 600 pips maximum loss, so adjust the lot size accordingly.

Annualized 1000 pips is within reach!

The number of trades is low, but it has a good risk-reward ratio, and with risk around 30%, an annual return of 50% or more is expected. There is about one loss year in ten, but otherwise it grows assets steadily.