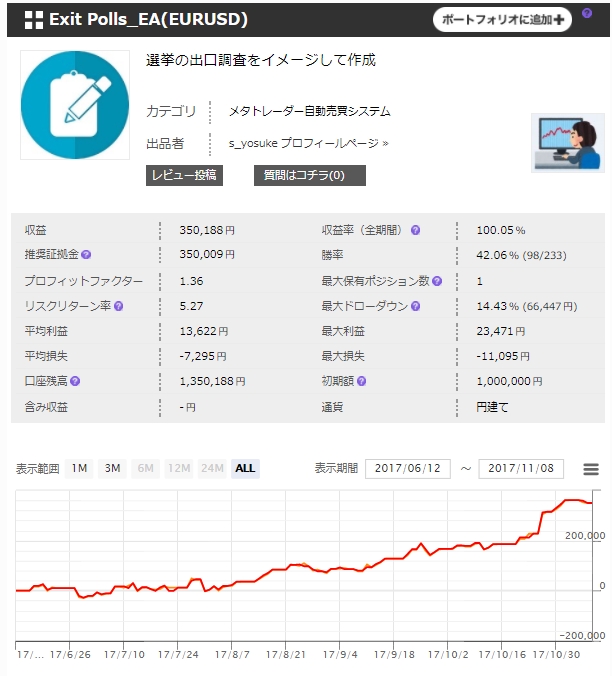

No. 1 in the 3-month rate of return ranking! "Exit Polls_EA"

No.1 in the 3-month return ranking!

Risk-reward ratio of 5 or higher

Exit Polls_EA that closes within one day

【Overview of Exit Polls_EA】

1) Currency pair: EURUSD ※ Not available for use with other currency pairs.

2) Timeframe: Daily chart only ※ Not available for use with other timeframes.

3) Maximum number of open positions: 1

4) Hedging: None

5) Spread filter: Entry is possible if the default is 0.6 pips or less (can be changed between 0.1–2.0 pips)

6) Trading hours: 21:25–21:35 JST; otherwise (10 minutes per day trading is prohibited)

7) Lot size: Variable (the entry lot size continually changes to allow up to 15x leverage relative to account balance; adjustable from 1x to 10x)

◆Actual entries?

Every few days, at regular intervals, it performs counter-trend entries. Red indicates SELL, blue indicates BUY.

Because it is on a daily chart, it may appear that multiple positions are opened on the same day,

but

since the maximum open position is 1,

◆ Wide range of settlement methods

【Settlement Methods】

1) If the position is held for more than 24 hours, it will be forcibly closed.

2) If the account balance drawdown exceeds 22%, it will be forcibly closed.

3) Stop loss is determined by a proprietary function (variable type).

4) Take profit is determined by a proprietary function (variable type).

In addition to logic-based settlements, there are time-limited settlements and forced settlements based on drawdown ratios.

Because there is no fixed TP/SL, predicting average monthly profit is difficult, but based on forward performance it has been progressing very smoothly.

Let’s look at the average gained pips and the average loss pips

◆ Average TP/SL based on the most recent 3 months' data

Average gained pips 29.3 pips Maximum gained pips 52.4 pips

Average loss pips -15.8 pips Maximum loss pips -20.1 pips

This results in a TP:SL close to 2:1, which is an ideal design.

The win rate is 45%, relatively low, but the risk-reward ratio is good, so there is no problem.

As noted in the description, even with a win rate of 30%, profits can still persist.

Also, in the event of sudden market movements, it will be forcibly closed with 22% of the account funds, so

there is no risk of account ruin.

The publicly available backtest data has modeling quality listed as N/A, so

it should be used as a reference.

Backtest data at roughly five-year intervals and results based on simple interest would be ideal, but…

Since forward performance is good, perhaps wait a little longer and consider purchasing!

Created to resemble exit polls