The dollar/yen closed in the 114 yen range, preparations are in place, but the attempt at higher levels begins after President Trump's first Asia visit

In the Friday’s release of the U.S. employment statistics, which came in below market expectations, the market initially responded with a dollar sell-off, but once it regained its footing, the dollar was gradually bought back and the euro-dollar formed a tailing upper shadow, reaching the day’s

lows and the USD/JPY also moved above the level seen at the time of the employment data release.

From this movement, it appears that in the forex market, the employment data this time did not produce a trend-changing, large impact, but the euro-dollar has already entered a near-term correction from its near-term highs, and next week, with attention to the post-event high, selling on rallies is likely to be favored.

The USD/JPY ended the week around 114 yen, and it is now about to challenge a resistance area in the latter half of this year.

However, with President Trump visiting Japan for the first time, the day will be extremely tense for the USD/JPY while he stays in the country.

Essentially, during President Trump’s stay, we expect it to be difficult for the pair to push higher, and given the worsening U.S.-North Korea issue, there is also a day when Trump might get closer to North Korea, raising concerns of another North Korean missile launch, which could flip the current market to risk-off.

Although the U.S.-Japan summit this time centers on North Korea issues and touches on trade, there is little time to discuss currency matters, but with President Trump’s first visit to Japan, unless there is a concern about a stronger dollar providing a drag, the USD/JPY could break above the near-term resistance around the mid-114s on a close basis and then aim for its highest levels of the year.

Therefore, at least while President Trump is staying, those who want to push the USD/JPY higher may find it difficult, and they may observe the situation until after Trump leaves the country before taking action.

The USD/JPY ended the week in the 114 range, and while it would be nice to reach the higher resistance in the second half of the year, Trump’s visit makes that a tense day.

Nevertheless, during Trump’s stay, it is likely difficult to push the upper levels, and unless the dollar strengthens in a way that bites, the USD/JPY may attempt to reach higher levels.

The day will be extremely tense for the dollar-yen pair as long as President Trump remains in Japan.

In general, during his stay, we expect the dollar to struggle to move higher, and given the worsening U.S.-North Korea situation, there is a risk that another missile test could occur, turning the current market to risk-off.

During the stay, the day is one of risk-off concerns as North Korea issues may escalate.

During the talk of North Korea issues at the U.S.-Japan summit, the possibility of North Korea further escalating remains, which could lead to a risk-off situation.

The risk of another North Korean missile launch could materialize.

This time, the U.S.-Japan summit focuses on North Korea issues, though trade issues are also mentioned, but currency issues are unlikely to be discussed; however, with Trump’s visit to Japan, unless there is a concern of a rising dollar, the USD/JPY may not see a rise in the near term.

The time to discuss U.S.-Japan currency matters is unlikely, but given Trump’s first visit to Japan, barring any fear of a stronger dollar biting in, the USD/JPY could clear the 114 mid-resistance on a close basis and move toward this year’s high.

If the dollar risks are not biting, the USD/JPY may push toward this year’s high.

The near-term resistance for USD/JPY is in the 114 mid-range; unless it breaks below 113 yen, it may be appropriate to maintain a view of buying opportunities on dips.

From the recent price action, after a brief dip the USD/JPY has shown a wick and rebound; next week, unless the near-term support is broken, dips could provide buying opportunities.

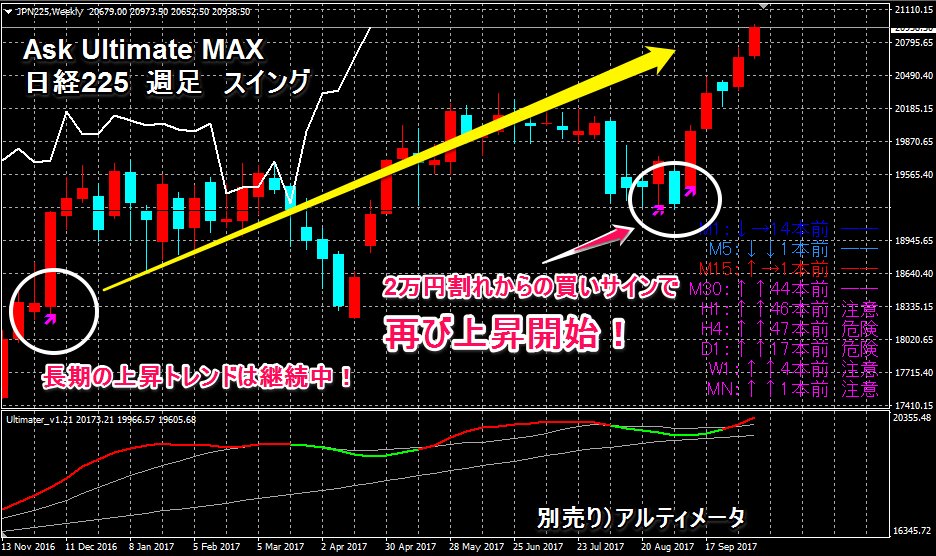

Ask Ultimate MAX

● USD/JPY: Be ready for a reversal higher! Rebound from the 107 yen range hit

● The “Market Compass” contains many other important articles

Ask Ultimate MAX

In the Nikkei 225, there were moments when it dipped below 20,000 due to North Korea issues, but MAX shows a buying signal!

Ask Ultimate Shadow Trader

We are offering a bundled version of the Ask series MAX and Shadow Trader as a year-end campaign!

It includes bonuses; for details, please see below

Ultimate Triple Trade: a full-saint trade to master the ultimate trading!