A high-win-rate EA that combines the scalping logic of three EAs 「TPMIX-USDJPY」

14-year backtest available!

A high-win-rate EA that combines three scalping logics.

'TPMIX-USDJPY'

'sinka' series by Mr. Zenn — the latest work!

Although sales have just started, forward testing can be predicted from backtests, so we’re introducing it in advance

We will introduce it!

■ Adopts the logics of three EAs

”TPMIX is an EA that consolidates 「TP60Minutes」「TP120Minutes」「TP240Minutes」into one.

This is an EA that eliminates the inefficiency of potentially holding the same position when run separately.”

As described, it adopts the three EAs' logics and is consolidated into one EA to avoid entering at the same time.

This is the integrated EA.

Although it's called a scalping EA, it basically makes high-probability entries with one position, so the entry frequency is originally

not that high.

By increasing the number of entry logics, the annual average number of trades is 170, and the entry frequency is about 3–4 times per week.

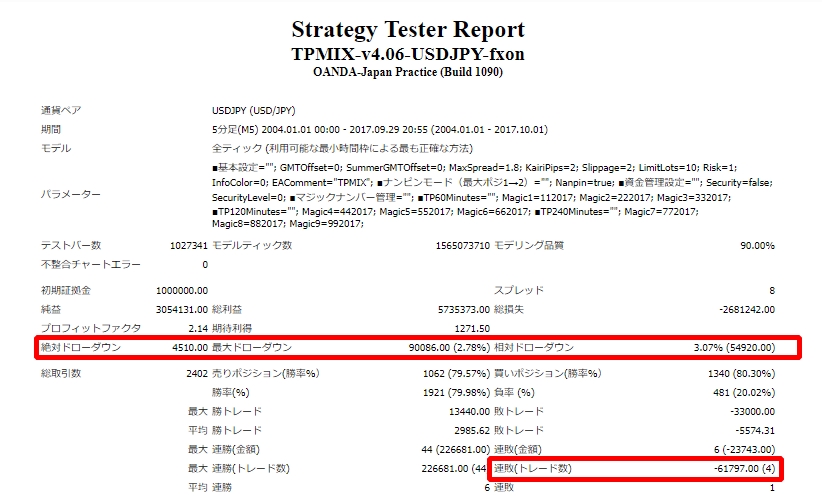

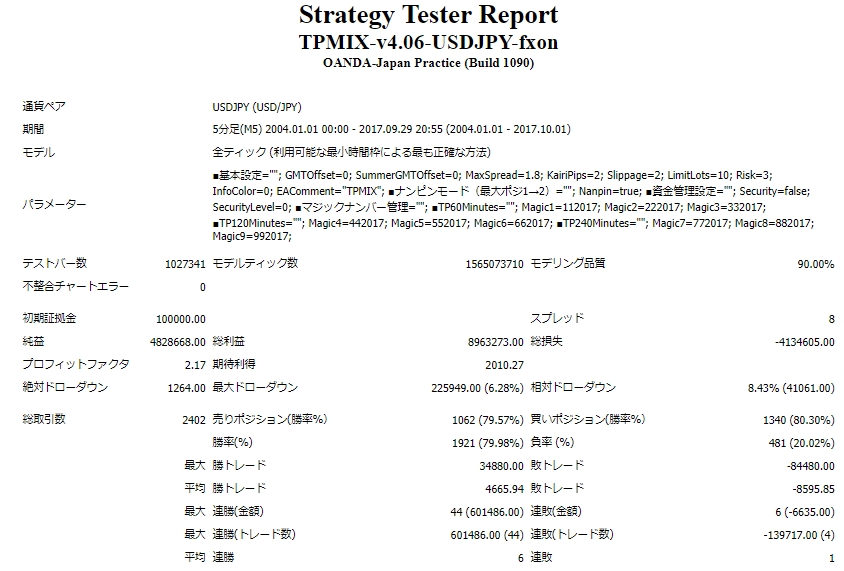

■ Basic contents from backtests

【Basic Design】

TP:9

SL:最大90

Maximum number of positions: 2 (when averaging down is allowed)

【Backtest Data】

Annual average number of trades 170

Annual average profit: +

14-year maximum drawdown:Risk 1% 2.78%

Maximum consecutive losses: 4

Win rate 79.9%

This is what it shows.

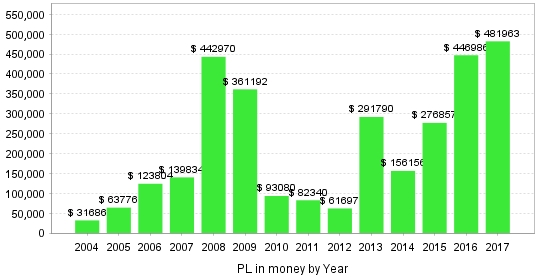

For reference, the yearly profit/loss progression is shown here

These earnings amounts are the result of operating with 1% risk using compound interest, so

the profit amount indicates how much it increased year over year, but it is not possible to strictly determine the earned pips.

What to note is the win rate; on average 79%, but many years exceed 80%,

and the high win rate shows there is meaning in operating it with compounding.

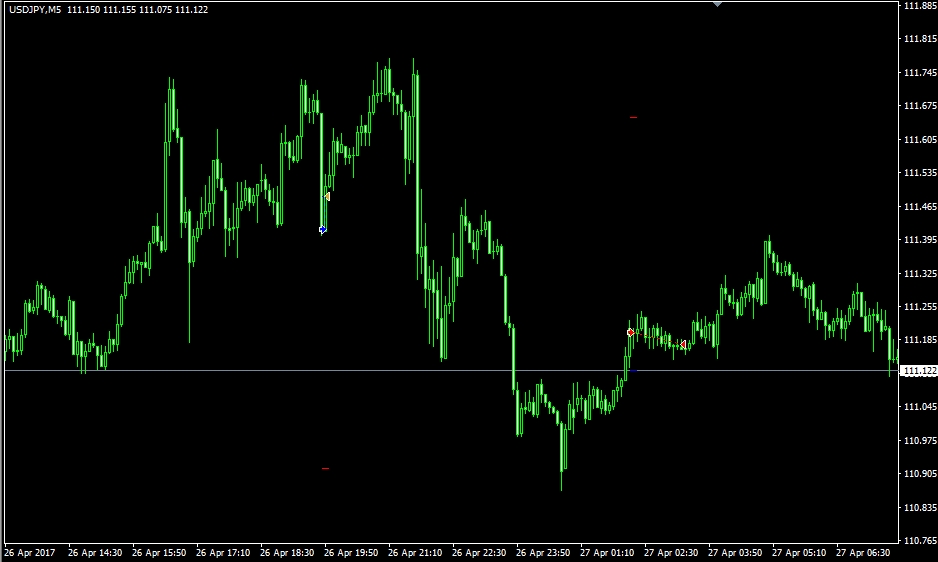

■ Entry Example

There are three entry logics, as stated, but

this is a retracement sell on a price drop. There is up to one averaging-down, and it appears successful

as you can see.

Even though it's scalping, because it targets high-probability entries, the trading frequency isn't high.

■ Concept: allocate lot sizes from Risk%

Mr. Zenn's lot management starts with determining the loss per position.

Default is Risk 1%, but in 14 years of backtests, the maximum number of consecutive losses is 4,

and with an average win rate of 79%, operating at 1% risk is now considered a wasteful level.

Even with 3% risk, the maximum drawdown is about 12% (more precisely, it would be even lower if recalculated from the reduced account funds); with one EA running, 5–8% risk is not a problem.

Regardless of account balance, risk remains constant, so you can run it with confidence.

■ From 100,000 yen with 3% risk, after 14 years it becomes 4,800,000 yen

14-year backtest data at 3% risk is also published.

But the maximum drawdown is still in the 6% range, so taking a bit more risk seems okay.

■ Campaign running for a discount over 3 months!

There is a campaign where 30% of the sale price is returned when using a certain system!

For details, please visit the sales page ♪