I want to trade using a 200-period moving average on BTCFX

Hello everyone, 200 days! The steady, steady-trading guy@xi10jun1here.

I wonder if the Bitcoin split scare has passed smoothly. It seems BTG forked without notable turmoil.

That said, the forked coin is basically unusable, right…

*As in the previous post, there is an important notice for paid readers, so please read all the way down.

*This column is designed so half of it is free to read, a beacon of conscience. Of course, if you read up to the paid portion (weekly updates for 400 yen per month, about 80–100 yen per column), I would be very encouraged!

This week’s results (2017-10-20 to 2017-10-26)

First, as usual, the results. I’ll present the changes first.

- Last week (until 2017-10-20) assets: 52,253 yen

- This week (until 2017-10-26) assets: 52,678 yen

- Change: +425 yen

We ended this week still in the positive! Because it was around the fork, I stayed mostly flat and watched.

There wasn’t as much movement as during the previous fork, so should we continue trading?

Now, for this week’s column, I’d like to discuss how I’ve been using the 200-period moving average that I’ve been employing recently.

How should we use the 200-period moving average?

The 200-period moving average is, as the name suggests, a long-term moving average, so it’s for those looking at long-term investing.

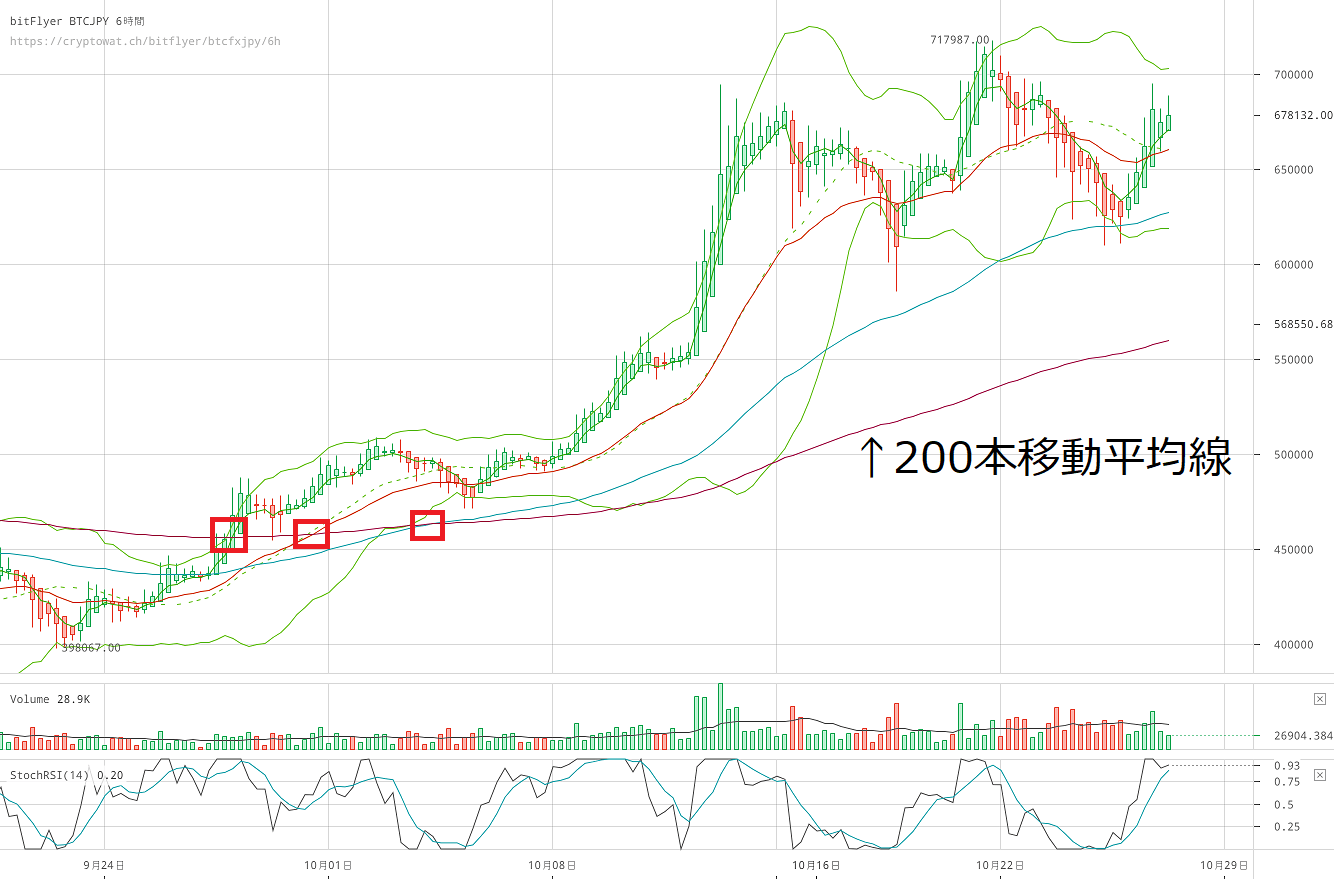

Let’s try looking at a 6-hour chart.

The red box on the left shows the gold crosses of the 5, 25, 75, and 200-period moving averages.

If you had held long positions around this area, you would have made quite a profit, I imagine.

But as a buying signal, for long-term it may be fine to rely on the gold cross alone; what about for short-term?

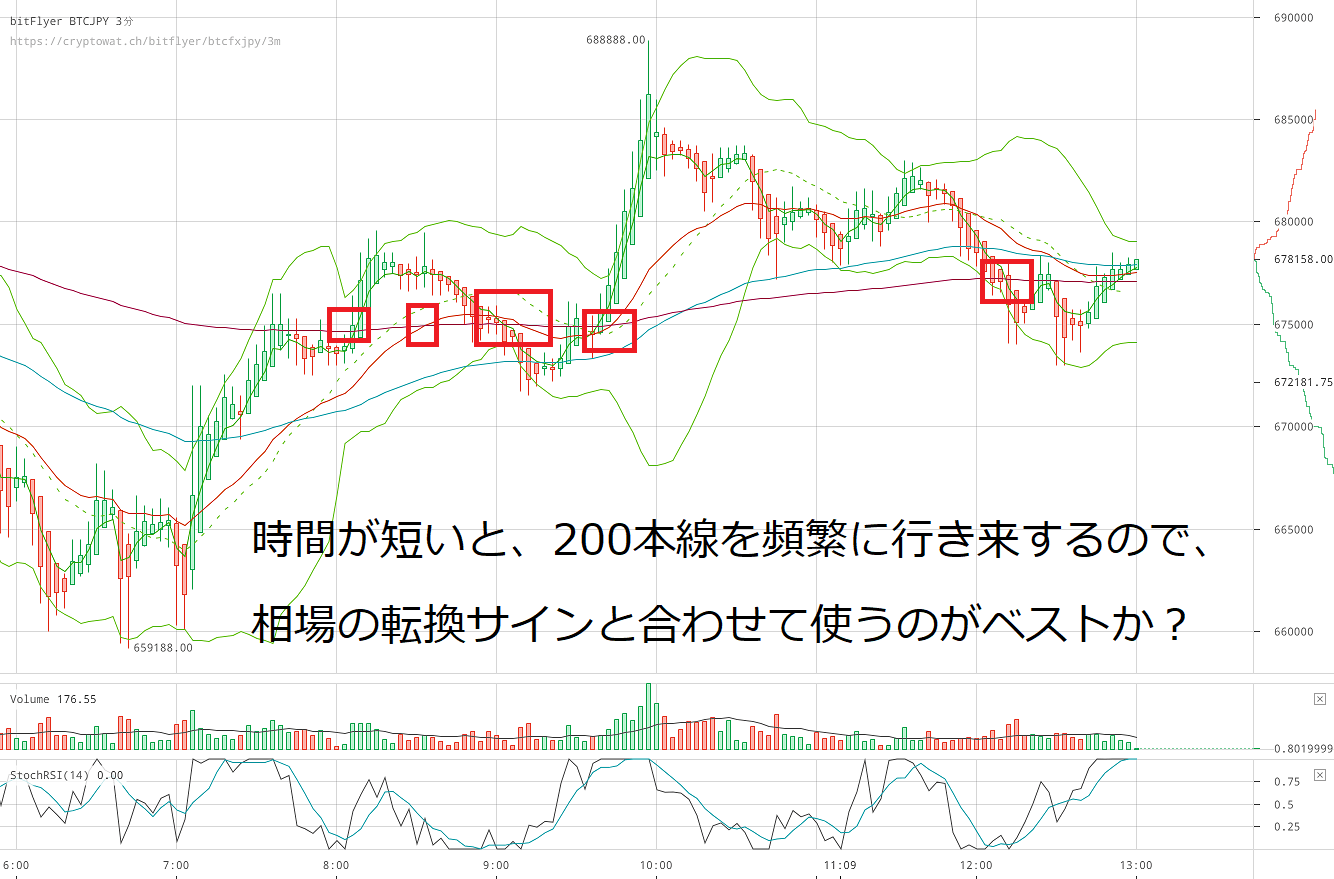

I tried displaying a 3-minute chart.

On the 3-minute chart, crosses occur frequently. If you hold too long, you might hit your stop loss…

If there’s a usable scenario, it’s probably: buy after the first golden cross that occurs after a prolonged downtrend and a rebound starts to rise, which would have a higher win rate.

Thus, we need to consider how often such scenes occur, which time frame to watch timing on, and how long to hold positions—the details of strategies and rules.

Free summary: master long-term moving averages

Moving averages aren’t something to be underestimated; when you review later, you’ll find many moments like “Ah, if I had bought here (or sold here).”

To maximize those moments, we should master long-term moving averages as well.

Also, it would be great if we could use moving average divergence, too…

So, this paid column will discuss future outlooks.

About paid column access

Recently, fx-on sent a notice about potential leakage of personal information due to unauthorized access. Consequently, credit card payments may be temporarily unavailable, which could affect access to the paid portion of the column.

Therefore, paying subscribers using credit cards would be grateful if you could purchase via convenience store payment or bank transfer.

Thank you for your understanding.

End-section 1: Latest tax information!

The National Tax Agency’s site has updated its legal view on Bitcoin.

Here it is →No.1524 Taxation when there is profit from using Bitcoin | Income Tax | National Tax Agency

According to this, profits obtained from using Bitcoin are considered “miscellaneous income.”

So, profits from my kind of futures trading would be generally classified as miscellaneous income. As I’ve mentioned in the end section before, as per our blog’s article (→Filing taxes for Bitcoin margin trading (BTCFX): global taxation? separate taxation? | Yutori-sedai no investors jun), as expected, loss offsetting seems not possible. I wish this could be handled a bit differently….

Also, according to comment from BitFlyer’s CEO Hiroyuki Kano on NewsPicks (No.1524 Taxation when there is profit from using Bitcoin - NewsPicks), if you bought Bitcoin for 100,000 yen and used it to buy something when it was worth 500,000 yen, the 400,000 yen difference would be recognized as profit.

When you use Bitcoin to purchase goods or services, if the price of Bitcoin at the time of payment is higher than at the time of purchase, that amount is recognized as profit. So this also applies to purchasing with Bitcoin on FANCY, so beware.

*Please note that laws and tax interpretations may change, altering how you file taxes or pay taxes. Before filing, be sure to check with your local tax office or a tax professional.

End-section 2: Try shopping with Bitcoin!

Actually, on the overseas e-commerce site “FANCY,” you can purchase items with Bitcoin! There are some shipping costs, but it offers stylish items that you won’t see in Japan!

I’ve summarized how to use FANCY on this blog, so please refer to this.

- →How to create an account, register, and set up on FANCY and the flow of product purchases | Yutori-sedai no investors jun

- →How to buy (pay with) FANCY items with Bitcoin | Yutori-sedai no investors jun

※Free ends here. The remainder is detailed analysis and future outlook, so it is paid. For those wanting to read more, of course, donating via subscription is greatly appreciated! Please continue to support us!