Doing well! "Hrunting GBPJPY" Build your portfolio with a value-packed set

Hrunting GBPJPY is trending upward and performing well♪

It has low drawdown and is expected to generate stable profits, but,

There is an even better value bundle sale available.

Among KML's EAs currently live in forward operation, it has the second-highest realized profit.

When combined with Flame Angel, what kind of portfolio will it form?

I would like to introduce it in detail.

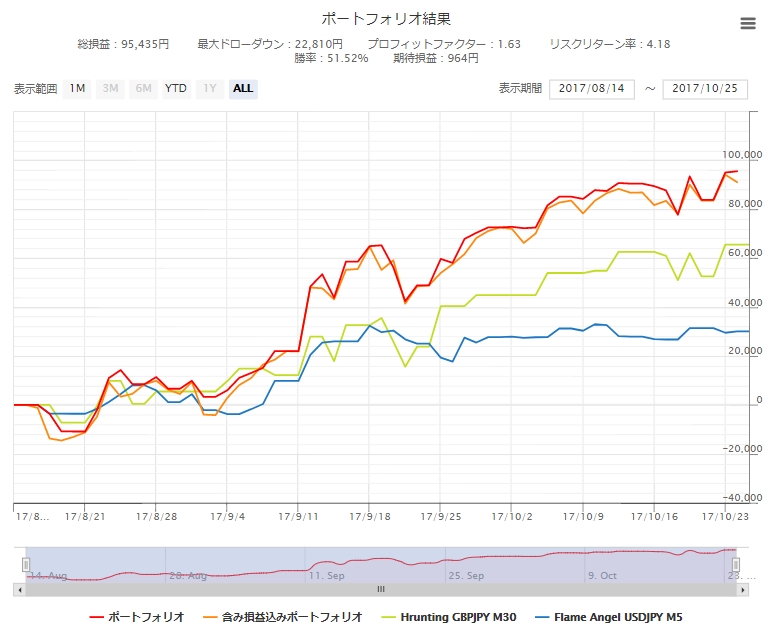

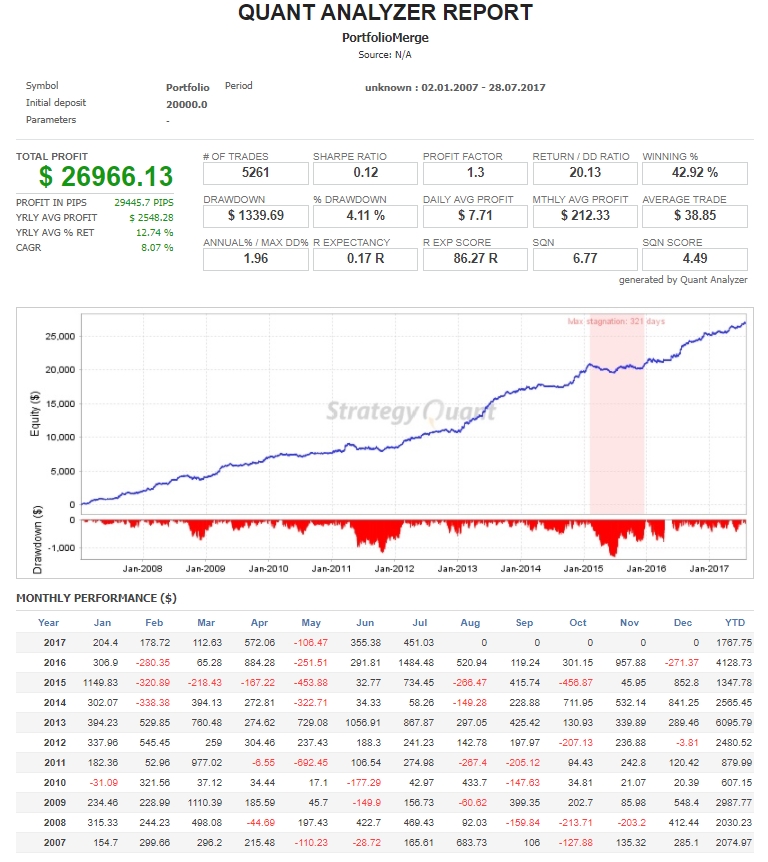

First, let's look at the forward two-month performance using the fx-on portfolio feature!

Red line: Portfolio

Green line: Hrunting GBPJPY M30

Blue line: Flame Angel USDJPY M5

In terms of the profit and loss curve, both EAs are similar, but currently HruntingGBPJPY is leading.

Both fixed at 0.1 lots, with a maximum drawdown of 22,810 yen and net profit of 95,435 yen

and a risk-reward ratio of over 4, performing very well!

■Features of each EA

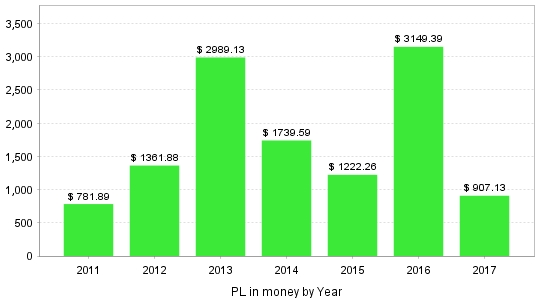

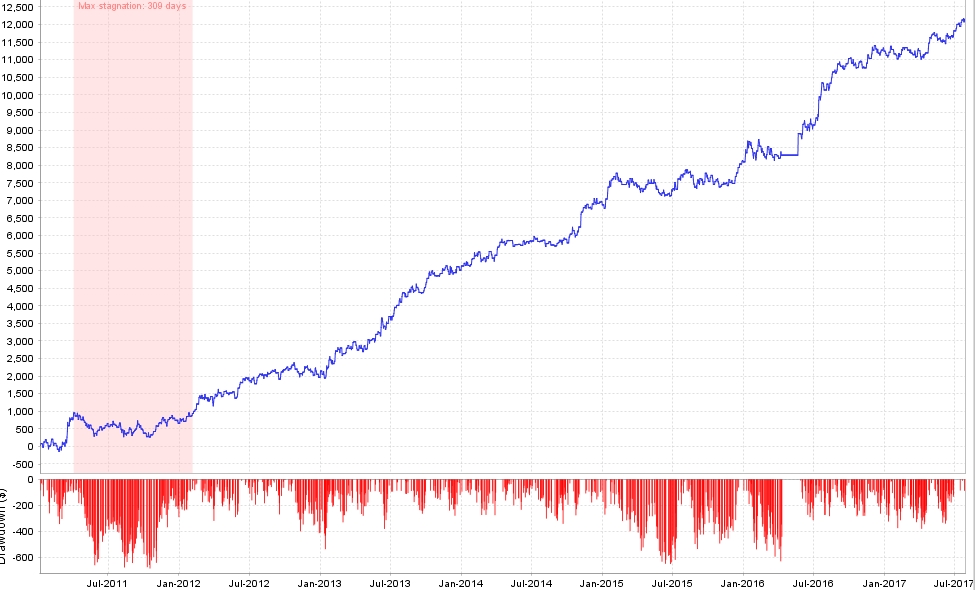

【Hrunting GBPJPY M30】Backtest data

Average annual number of trades: 156

Average annual profit (USD): 1845 USD

Maximum drawdown during the period: 775 USD

PF: 1.32

Performance in 2011 wasn't good, but there were no years with negative results overall.

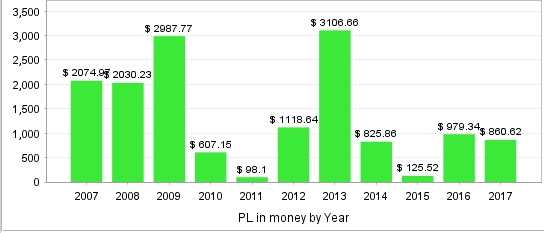

【Flame Angel USDJPY M5】Backtest data

Average annual number of trades: 383

Average annual profit (USD): 1399 USD

Maximum drawdown during the period: 835 USD

PF: 1.29

This has longer-term backtest data than Hrunting GBPJPY.

Performance in the latter half of 2011 and in 2015 was a bit weak.

When comparing both EAs, you can see that the maximum drawdown and the average annual profit are similar.

The Profit Factor is higher for Hrunting GBPJPY, but its trade count is lower.

That gap is covered by Flame Angel, and because it uses a 5-minute timeframe, it has a higher trade frequency.

Both have a relatively small maximum drawdown relative to expected profits, making risk control easier, and

even if you run both simultaneously, profits can double, but losses will not double.

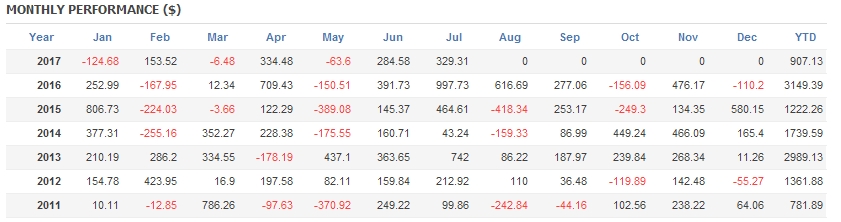

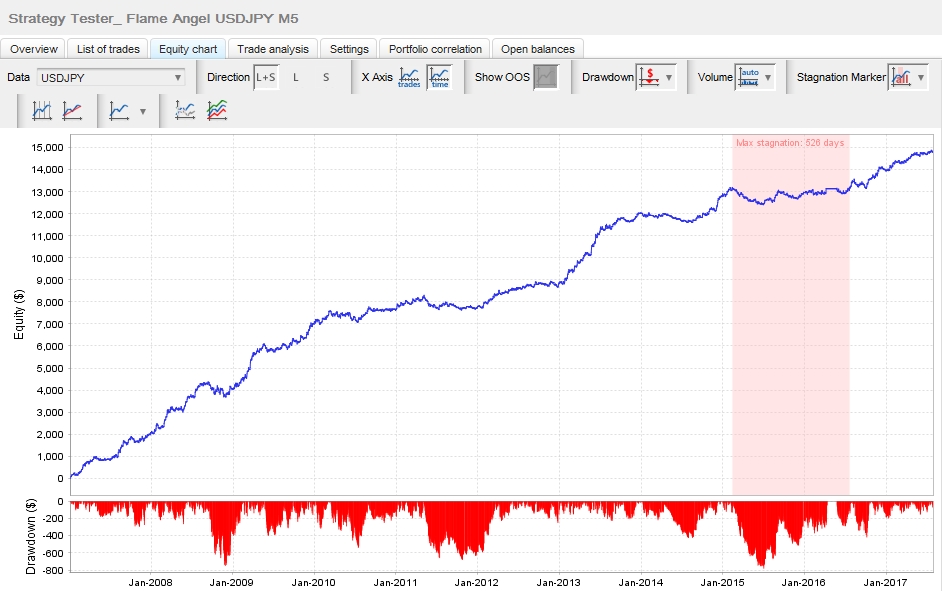

■What happens when running both simultaneously…?

Strictly speaking, the period when both EAs were running simultaneously starts from 2011 onward, so,

if you take the average from 2011-2016,

Maximum drawdown 1339 USD

Annual average profit 2919 USD

Maximum positions held: 2+2

This would be the result.

With 25x leverage, required margin is about 230,000 yen

Drawdown x 3 equals about 450,000 yen

And, with around 700,000 yen,Maximum drawdown would be 30%

Annual expected profit is 330,000 yen, andannual return of +47%.

This seems like a pretty good portfolio, doesn't it!

By the way, if you operate only Hrunting GBPJPY and double the lot size,

Maximum drawdown 1550 USD

Projected annual profit: 3690 USD

Therefore, this yields more net profit.

However, the required margin for 0.1 lots of GBPJPY is around 70,000 yen,

so the margin is higher with this approach.

(As of October 2017, required margin

For GBPJPY 10,000 units: around 74,000 yen

For USDJPY 10,000 units: around 45,000 yen

This is the case)

This is a recommended portfolio for those seeking currency pair diversification and higher trading frequency!

Here are the EAs

If you're after profits, this is the way!

『Hrunting GBPJPY M30』

¥19,800

A GBPJPY swing-type EA with average win/loss ratio 1:1 and a win rate over 50%

High trading frequency with low drawdown!

『Flame Angel USDJPY M5』

¥19,800

A USD/JPY dedicated EA with small losses and large gains

With a portfolio, roughly 700,000 yen in capital could yield over 40% annual return.

The bundle/set is almost sold out!

¥29,600

This is a great value bundle