What winning EA traders are doing! Along with concrete examples of changes to parameter settings for 'Ride the Momentum'.

We often ask investors who purchase EA in large quantities and who are known to be winning with EA trading about their methods.

When I actually spoke with them, there were people who claimed to have sustained an annual return of XX% for three years. I think there are even more amazing people out there, though.

Everyone changes a lot of those parameters, such as imposing time limits on the acquired EAs, weekday restrictions, weekend rollover restrictions, changes to stop-loss settings and take-profit values, adjusting the trailing width, and modifying the value for how many pips away from the planned entry rate you would accept when slippage occurs.

Originally, even if a high-quality EA's performance declines when market movements change, it is possible to improve performance by tweaking the parameters.

Therefore, this time, we spoke with an investor who does substantial EA trading, ashibin, to learn the parameters you currently have set, and we would like to share them.

The target EA is,Riding the Momentum.

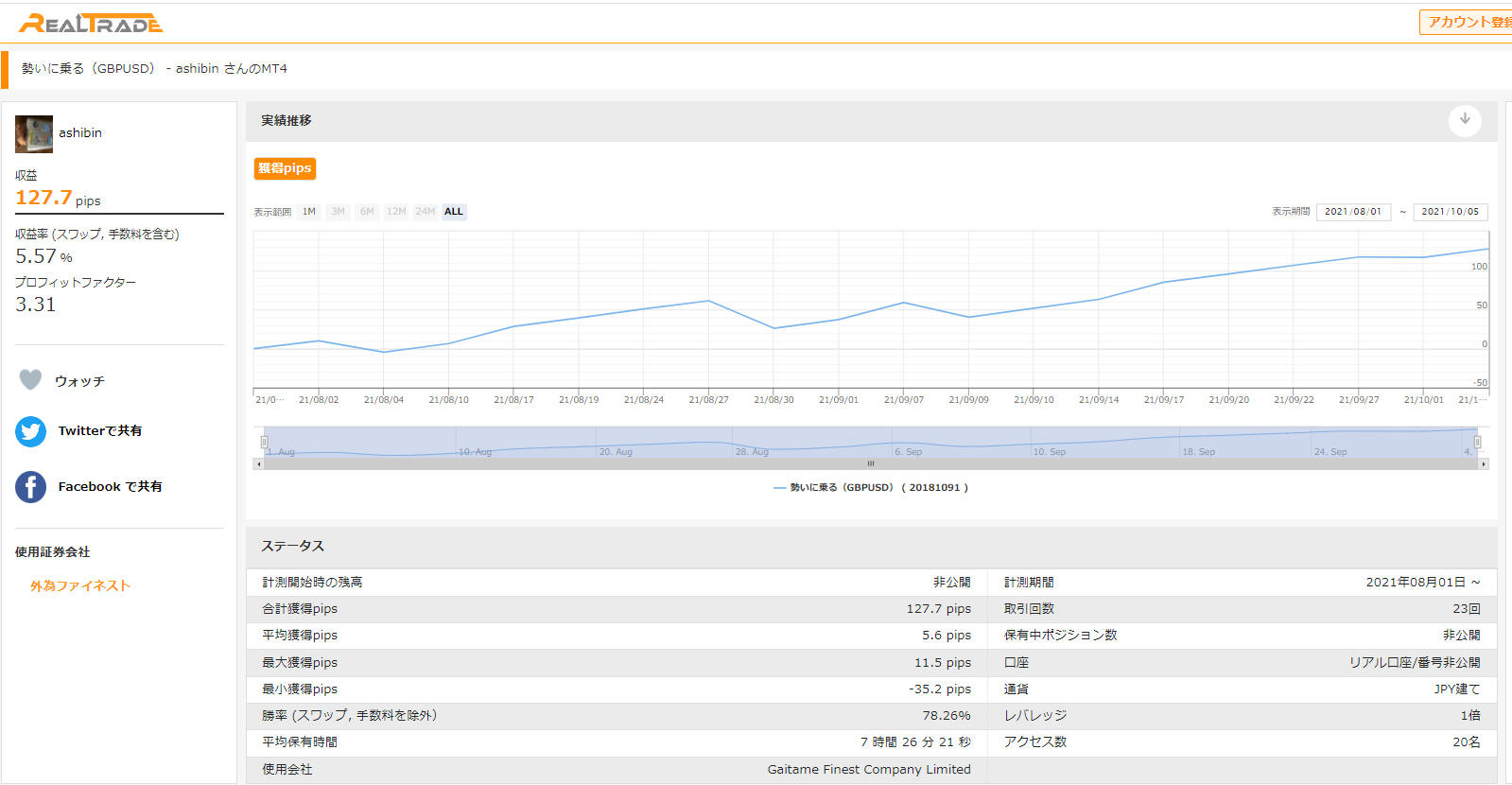

With 551 copies sold, a substantial number of customers are still using it with various tweaks, and ashibin's current GBPUSD parameter settings trade results are as follows.

Riding the MomentumIn the official forward test, three pairs were run: USDJPY, GBPUSD, and EURUSD, but ashibin reportedly only runs GBPUSD.

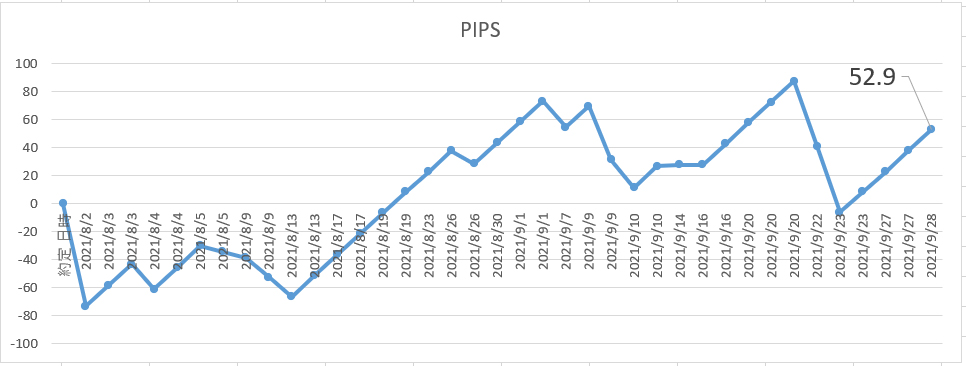

As a result, he has changed parameters every few months, but the official GBPUSD operation using the initial settings yielded a result of 52.9 pips during August–September 2021 as shown below.

ashibin's parameter setting results showed a remarkable growth of 127.7 pips.

ashibin has nearly 30 years of trading experience, with broad experience, knowledge, and skills, and has achieved substantial results in discretionary trading. When he feels that these capabilities are fully utilized and the market has changed, he repeats backtests and changes the parameter settings, andRiding the Momentumappears to have further improved in performance.

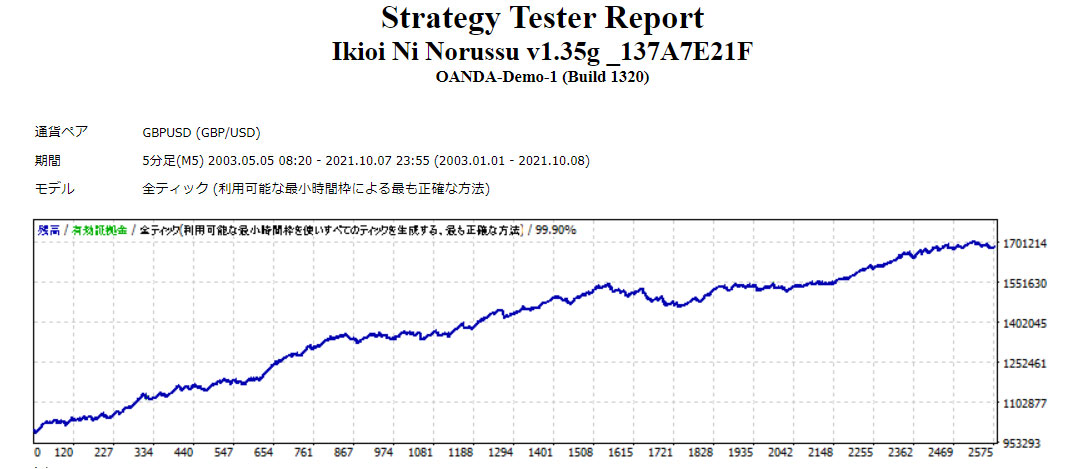

Moreover, when we ran long-term backtests from 2003 in TDS, it wasn’t just a short two-month trial at all.

Riding the Momentummay owe some of its strength to the logic, but I think ashibin's ability to adjust the settings should not be praised less.

Now, the crucial, specific parameter changes are as follows.

input_SL = 90 : Maximum stop-loss width (pips) unit →35.0

input_TP_GBPUSD = 15 : GBPUSD take-profit width (pips) unit →11.0

TL_StartPips = 4 : Trailing Stop start pips. Unrealized profit. Trailing stop starts when the specified pips of unrealized profit occur. →17.0

gNoTradeFrom = 21 : On Friday, no entries after this time. (Server time) →11

gNoTradeUntil = 24 : No entries after this time on Friday. (Server time) * Weekend related (Note 33) →17

gYearEndFrom = 25 : From what day in December to stop trading. With default 25, no trading after December 25. (If you do not want to stop, enter an integer 32 or greater.) →31

d1NoTradeFrom = 25:00 : Every day, no entries after this time. (Server time) →18:00

d1NoTradeUntil = 25:59 : Every day, no entries until this time. (Server time) →19:59

d2NoTradeFrom = 25:00 : Every day, no entries after this time. (Server time) →01:00

d2NoTradeUntil = 25:59 : Every day, no entries until this time. (Server time) →6:59

gEvacuateStartPipsJE = -25 : Start position for evacuation (pips) for USDJPY and EURUSD. If the price deviates by the specified pips from entry, the evacuation logic is triggered. →26.0

gEvacuateTimeAfterG = 15 : Time elapsed before evacuation starts for GBPUSD (server time). The evacuation logic is triggered after the specified server time. →35

Comments = "Ikioi v1.35g " : Name of the EA →Ikioi v1.35g-GDPUSD-S35

To reiterate, settings can be changed every few months, so please understand that the above represents the current settings.

We will also place the preset file containing these parameters in front of the button, so please feel free to use it.

written by Hayakawa