Six-logic-equipped 1-position low-drawdown EA "One Grain Ten Thousandfold"

Six-logic equipped! GBPUSD-only EA with 1 position

'One Grain, Ten Thousandfold'

Currency pair: [GBP/USD]

Trading style: [Day trading]

Maximum number of positions: 1

Operation type: 1-lot operation

Maximum lot size: -

Used time frame: M5

Maximum stop loss: 75 pips; Others: automatically determined by logic; Minimum 30 pips

Take profit: 125 pips; Others: automatically determined by logic; Minimum 20 pips

— 'One Grain, Ten Thousandfold' means that one grain of rice can grow into a stalk that yields ten thousandfold. —

(From Wikipedia)

Currently rising in popularity as 'One Grain, Ten Thousandfold'; as the name suggests, can it start with a small amount and yield big results?

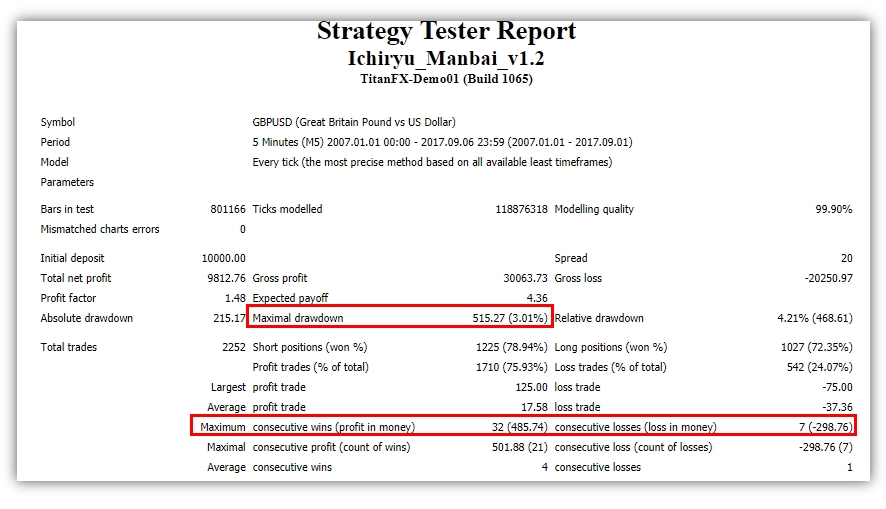

■Backtest Analysis

First, let's take a look at the official backtest.

【Risk】

With a fixed 0.1-lot size over a 10-year backtest, the maximum drawdown (unrealized loss) is $515 (500 pips)

Maximum number of consecutive losses is 7 (loss amount $298)

This indicates, with 1-lot operation and a maximum stop-out at 75 pips, the maximum drawdown is

a very small percentage.

【Number of trades】About 200 per year, about 16 per month.

【Win rate】About 76% over 10 years

Average gain: +17 pips; average loss: -37 pips.

If the win rate does not fall below 65%, profits remain.

【Monthly profit/loss in backtest】

There are no annual losses, and you earn 500 pips to 1400 pips per year.

It is rare for a 10-year backtest to show this level of consistency!

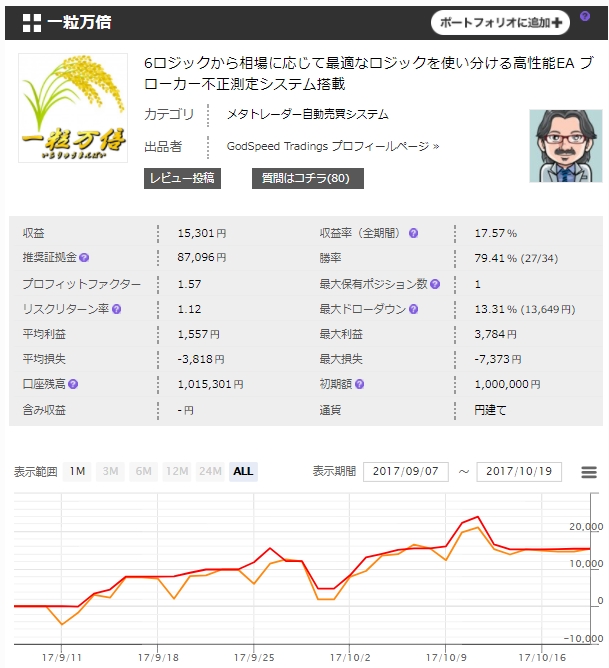

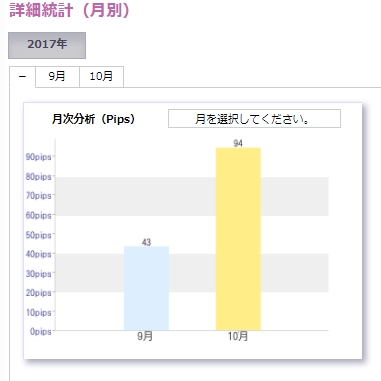

■Forward Analysis

In 2 months, 147 pips; it seems you will quickly reach over 500 pips per year.

■What are the six logics’ trades?

One Grain, Ten Thousandfold uses 1-position trading, but it is equipped with six logics, so the number of entries

is not too few.

(Entry example 1)

Looking at each trade, it performs short-term contrarian and mid-term trend-following entries, adapting to the market conditions.

Entry logic changes according to market conditions.

As the win rate is 76%, there are 9 trades with 7 wins!

(Entry example 2)

There is a 75-pip maximum stop loss, but it rarely hits the maximum drawdown.

It seems to have a higher win rate than certain discretionary trading.

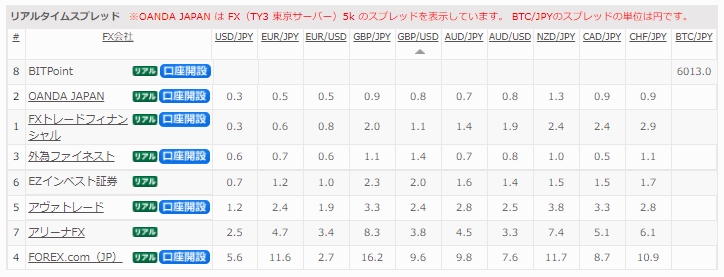

■GBPUSD spreads comparison!

GBPUSD is somewhat of a minor pair compared with USDJPY or EURUSD, but how do the spreads among brokers look?

Let's compare using fx-on spread comparisons.

【Normal spreads】

Spreads are quite tight for Oanda, FX Trade Financial, and Gaitame Finest, so using these brokers alone could yield profits beyond the backtest.

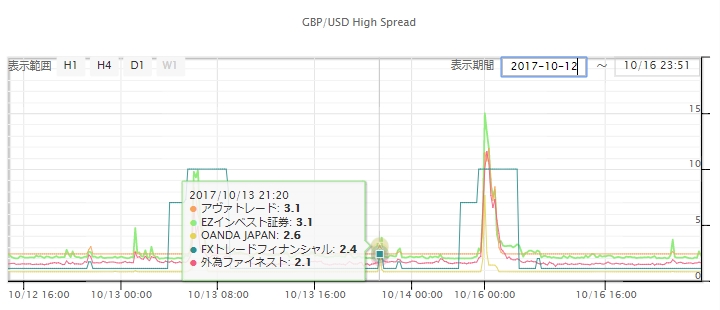

【1-week spread fluctuation】

At rollover and during data releases, all brokers’ spreads widen to 2 pips or more.

Backtest spreads are 2 pips, so during events, results may differ from the backtest or entries may not occur.

■Annual revenue projection?

If the 10-year maximum drawdown is 500 pips,

for an account of 1,000,000 yen, using 0.5 lots keeps the maximum drawdown at 25%–30%.

In that case, profits based on the backtest would be at least $2,500 to $7,000.

Safe operation yields an annual return of 25–70%, which is attractive, and with GBPUSD operationdiversification by currency pairis also possible.

Also, those with smaller funds can start with about 150,000 yen and operate from 0.1 lots.

■Other features and operating cautions

If you read the entire sales page for 'One Grain, Ten Thousandfold', there is hardly any need for further introduction

as it is explained in detail, so please read carefully.

・Money Management (MM) feature available

・Broker fraud monitoring function built-in

・GBPUSD spread below 2.5 pips recommended

・Stop level less than 2 recommended

【Extras】

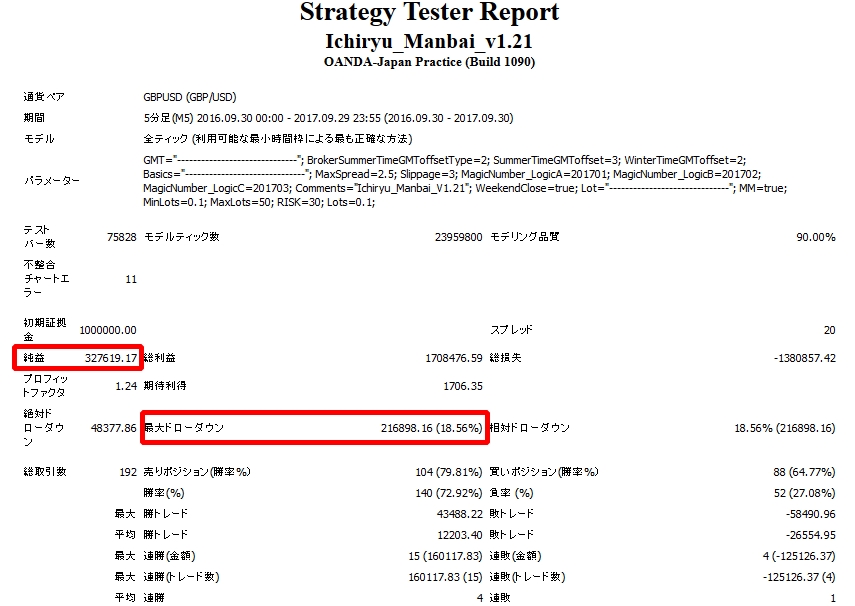

One-year backtest from 2016/9/30 to 2017/9/30

Comparing fixed 0.1 lot and compounding (Risk 30)!

※Click to open the image in a new window

(Default settings, fixed 0.1 lot)

Annual earnings of 50,000 yen (500 pips)

Maximum drawdown 30,000 yen

(MM=true, Risk=30)

Annual earnings 320,000 yen; maximum drawdown 210,000 yen

※MM feature is a function that makes risk management easy for those who find money management burdensome!

Up to around Risk 30, you can operate safely and efficiently!