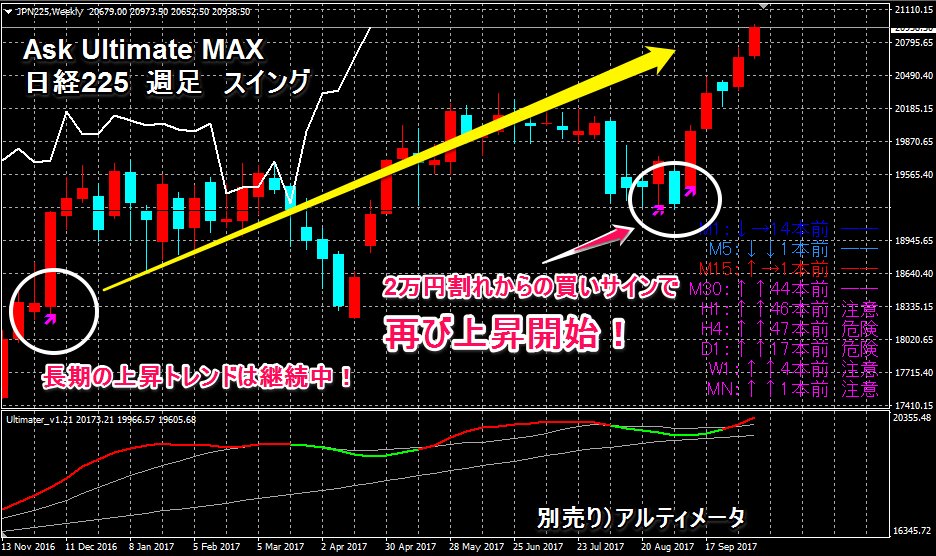

Can the Nikkei Stock Average, which hit a 20-year high, seize the moment to rise further? Attention turns to President Trump's first visit to Japan!

The North Korea issue: no sign of a breakthrough toward a resolution

U.S. President Donald Trump has stated he will visit Japan for the first time in November.

He is set to visit Japan, followed by visits to Vietnam for the APEC summit

and to both China and South Korea, with the Korea issue expected to be the main focus in each country,

while domestically, just after the elections, the Nikkei Stock Average, which recently reached a 20-year high,

may slow down in the near term after the election, but attention is on the foreign exchange market

as President Trump’s first visit to Japan could cause some movement in the dollar-yen pair.

★ In the near term, signs of overbuying are lighting up; is a closeout point near?

It detects the early signs of a major market turning and tells you the perfect timing to close positions!

Ask_Ultimate_MAX by “Kawaseri Gui”

★ A strong rebound after breaking the year’s low!

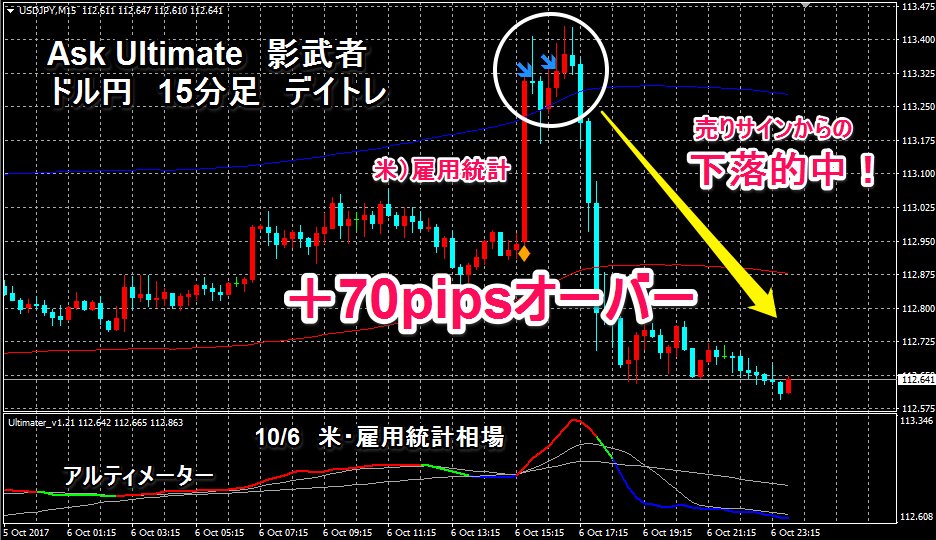

In September, the dollar-yen dropped to the 107 range on the North Korea issue, then surged 6 yen to the 113 range

In the near term, 114 yen is in focus and currently a pullback from the highs.

Domestic factors: if the House of Representatives election passes smoothly, the August resistance has become

a support point and the year-end market could become dollar-yen limited,

but there may be a Trump visit to Japan affecting the market.

With the Nikkei average hitting a 20-year high, if the dollar-yen rises at this timing

there is a strong chance it could attempt a new high at least for this year.

Of course there are North Korea concerns, but if missiles are fired again and other countries are not affected,

the dollar-yen pullback could become a buying opportunity.

From short-term trading to swing trading is OK! Could there be significant movement at year-end as well!

★ Break the year’s high and aim for a new high!

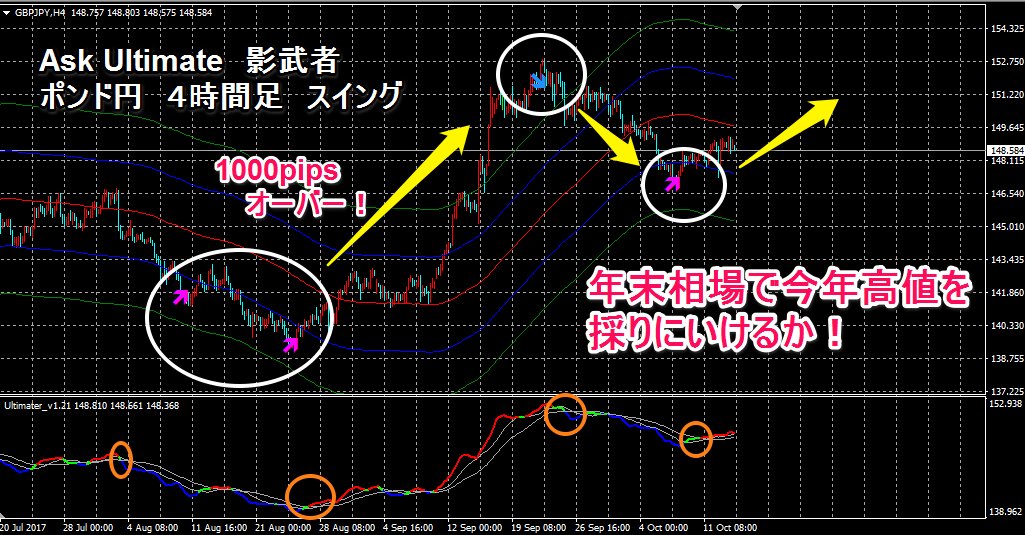

★10/13 Blog post: Will the pound-yen upside attempt resume?

★Sensing the ultimate strong/weak market and telling you the perfect timing to close!

Ask_Ultimate Shadow by “Kawaseri Gui”

★ For short-term trading, the range of 112–113 is anticipated; is it a pullback selling or a dip-buying strategy?

We are selling a year-end campaign for the MAX and Shadow set of the Ask series introduced this time!

There are bonuses as well; for details, see below

Ultimate Full-Insight Trade to master the ultimate trade!