AUDCAD-exclusive 'Savings Fruit' with a +30% annual interest rate

Long-term box-range market grid-averaging Expert Advisor

AUDCAD-only “Savings Fruit”

Forward period of 8 months yields +220,000 JPY in profit, maximum drawdown 180,000 JPY

By using ultra-small lots to accumulate profits in up to 90 positions in small increments!

◆ Trading Logic

It can be adjusted via parameters, but it is optimized for AUDCAD,

based on a specific price, selling above it and buying below it, averaging in every 5 pips.

TP is 45, SL is 1200.

1200 is a figure derived from historical charts, and basically it is designed not to cut losses.

◆ How large could the maximum unrealized loss be with averaging?

I think the most concerning thing about grid-averaging EAs is how much unrealized loss they could incur?

I think so

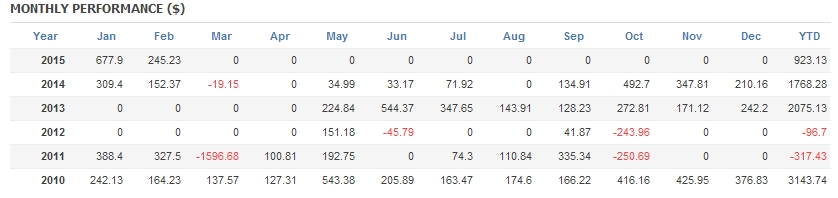

Backtests since 2010 show

2010-2015 maximum DD $6,986.

2015-2017 maximum DD $1,679.

For reference, the monthly profit/loss is here

【2010-2015

From late 2011 to 2012 it was negative, and since monthly gained pips were often 0,

this indicates there were periods when averaging positions were held without being closed.

【2015-2016】

2015-2016 the settings matched the market well, producing profit every month.

Viewed on a weekly chart over several years, caution is needed when breaking out of the recent box range, but

it is a versatile EA because you can adjust via parameters.

◆ The key of grid-averaging EAs lies in a long-term perspective!

Looking at a chart over several years on a weekly basis, you can see that it stays within a certain price range.

From late 2012 to 2013 it broke below the previous range,

and profits were not realized until the price returned within that range.

Since 2014, a large range of about 1000 pips has formed.

Savings Fruit is an EA that, based on the central price of that 1000-pip range, performs sell grid and buy grid

around it.

Therefore, if you run a 10-year backtest, the range in recent years is far from that, so

you won't get the exact intended performance.

From a long-term perspective, if you can operate within a large range market (500 pips to 1000 pips),

it could be a useful tool.

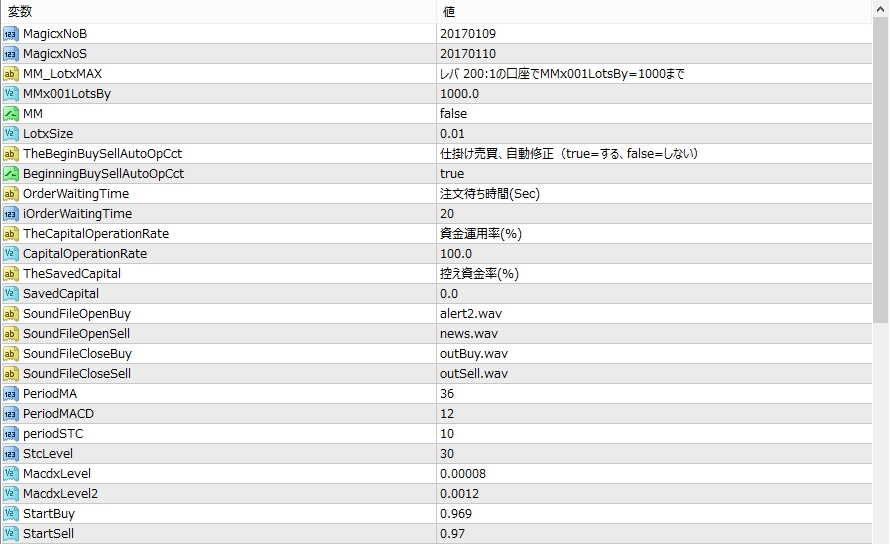

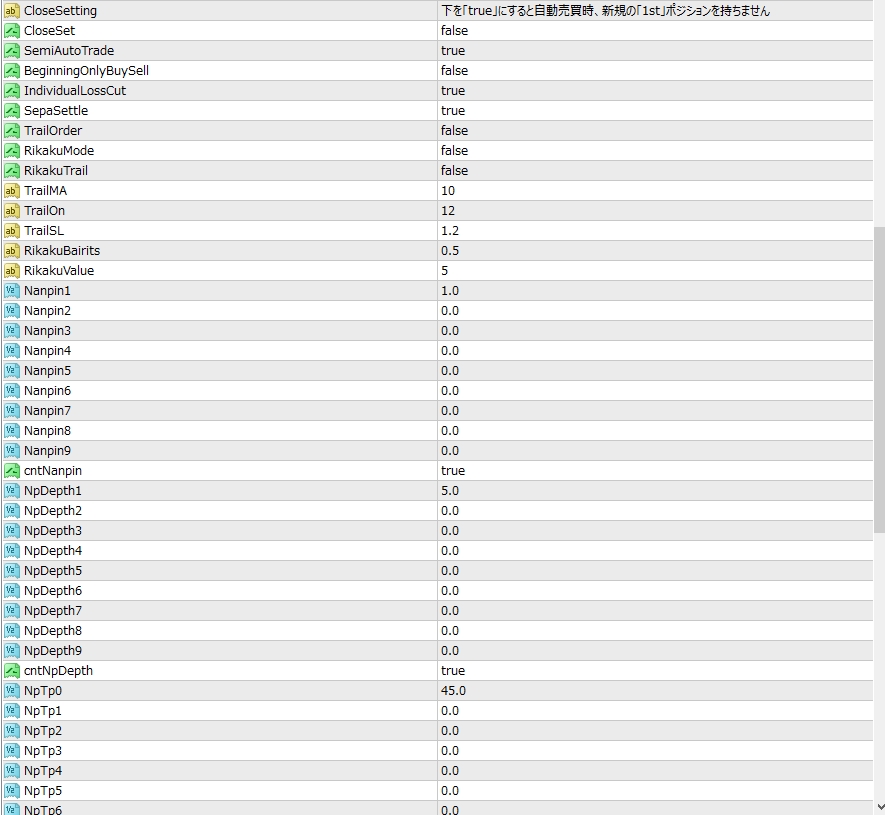

◆ Actually, fine customization is possible

(Part omitted)

(Some of the parameters)

◆ MM function available

◆ Trailing function available

◆ TP, SL adjustable

◆ Entry time restriction available

◆ Base price adjustable

◆ Holding period expiry setting

Because it is optimized for the AUDCAD market in recent years,

you can use it with default settings.

However, it is not connected with terms like high win rate or risk-reward ratio,

it is more about a “tool” where you set the strategy in advance and use

as an EA,

intermediate users and above can enjoy configuring it in their own way.You can do so.

“Savings Fruit”

20,000 yen

The era of monotonous EAs is over! From now on, this is the one!