Free! Indicator Tools (August–October 2017)

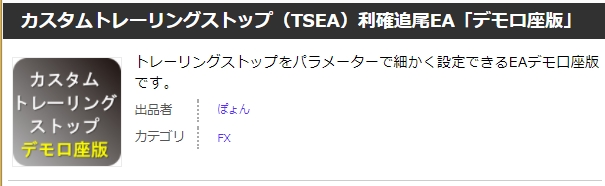

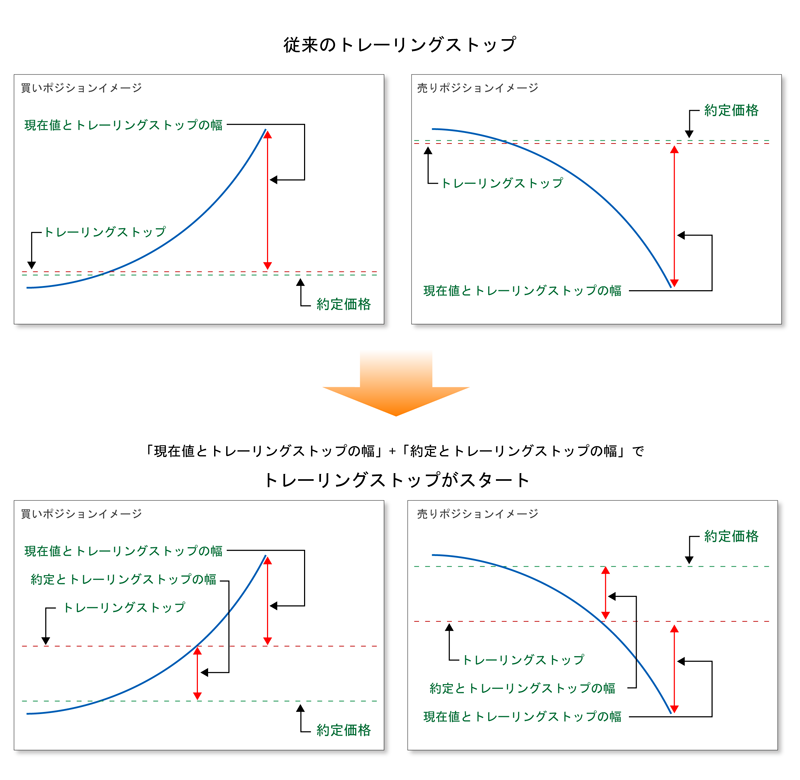

Differences from traditional trailing stops

Fine-tune the trailing stop start position (PIPS settings)

Traditional trailing stops could not be configured.

“Current value and trailing stop width” “Execution and trailing stop width”

can now be set via parameters.

Stop-loss (stop order) feature equipped (PIPS settings)

Setting stop-loss via parameters is also possible.

The unit can be set in PIPS.

After execution, it can also be changed manually.

Take-profit (take profit) feature equipped (PIPS settings)

Setting take-profit via parameters is also possible.

The unit can be set in PIPS.

After execution, it can also be changed manually.

Alert Assist feature

Minimum trading levels for take-profit and stop-loss vary by FX broker. If you set parameters below your broker’s minimum level, an alert will inform you of the minimum trading level.

If an alert occurs, please adjust the parameters to appropriate values before use.

Operating Environment

This software operates on a demo account.

This software runs as an Expert Advisor (EA) on the MT4 platform.

This software runs on FX brokers where MT4 is available.

This software can be used with multiple currency pairs.

Notes

This software does notimplement an order execution feature, so please execute orders manually.

If the PC or MT4 restarts while this software is running and there are trades not yet settled, take-profit and stop-loss orders will be in an ordered state.

This software operates normally when MT4 is running. If MT4 is restarted, please configure again.

Finally

Thank you for reading to the end and for your interest.

This software runs on a demo account. If you wish to run on a live account, please use the paid version.

If you encounter issues, we plan to upgrade the version at no charge.

If you have any questions, please feel free to contact us.

Email Sending Tool☆ Free distribution (limited copies)

※Main features

This is a tool that automatically sends profit and loss statistics when a position is settled.

※Supported currency pairs (28 pairs):

EURGBP, EURAUD, EURNZD, EURUSD, EURCAD, EURCHF, EURJPY,

GBPAUD, GBPNZD, GBPUSD, GBPCAD, GBPCHF, GBPJPY,

AUDNZD, AUDUSD, AUDCAD, AUDCHF, AUDJPY,

NZDUSD, NZDCAD, NZDCHF, NZDJPY,

USDCAD, USDCHF, USDJPY,

CADCHF, CADJPY,

CHFJPY

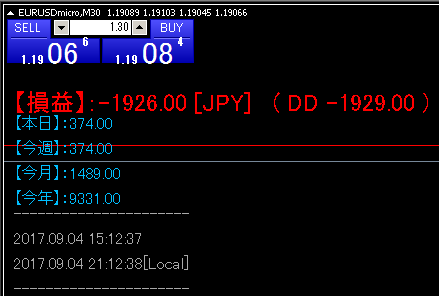

This is the chart screen.

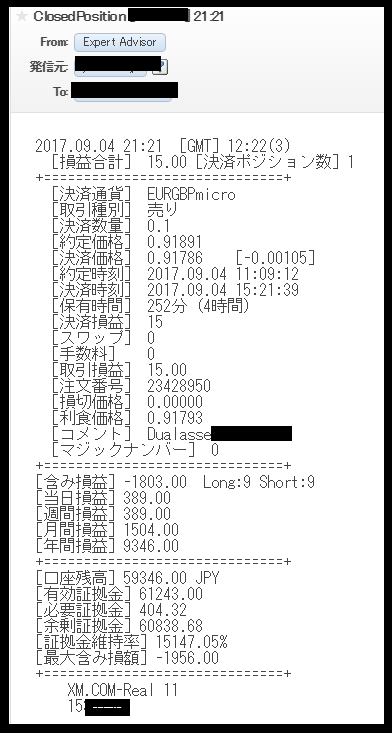

This is an example of the profit and loss statistics email.

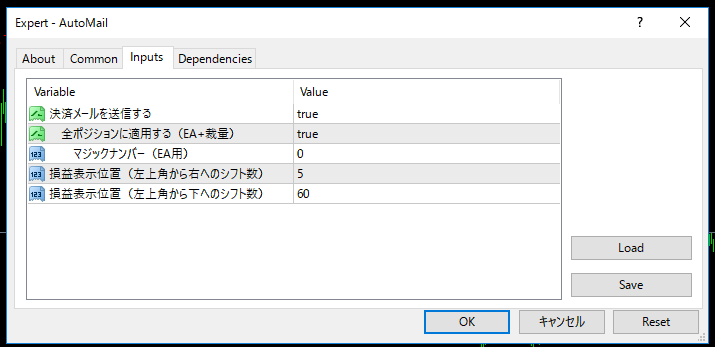

This is the parameter input screen.

AutoMail latest information (to the blog)

※There are no usage restrictions.

※No support is provided for free distribution.

※Free distribution may end without notice.

Profit and loss statistics sending tool - Free distribution in progress (limited copies)

Nice to meet you. We are DFX Popeye & Spinach.

We run a blog called DefinitionFX where we challenge the market with advantage and probability.

Blog URLhttp://definitionfx.blog.fc2.com/

fx-on Columnhttps://fx-on.com/navi/serial/?id=245

We enjoy the blog with the motto of making serious FX topics and casual chats approachable as we like.

There are many FX sites and blogs out there; while some are hard to understand,

there are also wonderful blogs, but the trader’s intuition developed through enormous testing can be hard for readers to grasp.

We challenge the blog world with FX viewpoints that attempt to define as much of that intuition as possible.

Honestly, the world of FX is difficult.

To consistently earn profits, many elements are required.

Mental state, capital, knowledge, and experience are indispensable.

However, mental state, capital, and experience differ from person to person, so we cannot do much about that.

However, we can provide knowledge.

Knowledge means correct knowledge.

In the real world, simplistic notions like some “○○ theory,” trend-following on long-term charts, buying on dips, and selling into rallies are widespread.

Continuously winning with these superficial methods on the surface is only a small portion.

The reason is that the market is random.

Trying to win against a random market with only trend-following on long-term charts is simplistic.

To be clear, we are not denying these methods.

What we want to say is that using only these methods, without understanding how the market works, and using trend-following or○○ theory as the sole pillars to tackle a random market is too easy.

In the early days of the blog, we provided something that traders are surely going to learn, to a select few for a period of time.

That is the concept of Zones.

This time, though the report had been temporarily halted, we received many requests to revive it.

Why not learn how the world's top traders draw Zones and improve your FX skills?

If you’re unsure about Zones, this is a must-see! You can draw logically sound Zones!

What are the Zones that the world's top traders are watching?