Search for 100 bagger (100x stock)! September 21, 2021 issue [Look for lagging corrected stocks!]

Note: This is about 25 minutes long.

1. Sakura Memo

Look for lagging stocks that corrected from their peaks!

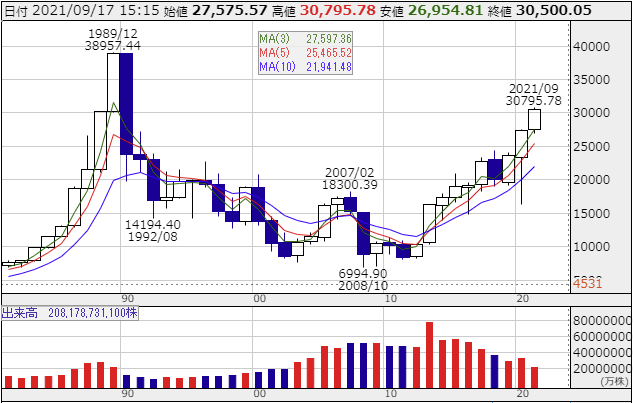

From the low on August 20, the lagging stock corrections in Japan have progressed, and the Nikkei Stock Average closed at a new year-to-date high on September 14 (Tuesday).

Although the overall stock market remains very strong, if you look at the Nikkei’s past movements, last year’s annual price range of 11,244 yen was as large as the latter part of the bubble era in 1988–1989, indicating a substantial price range.

[Nikkei Stock Average – Yearly]

Source: Kabutan

The average price range over the most recent 10 years from 2011 to 2020 is 5,086 yen, and an annual range around 5,000 yen is typical. In fact, from the start of Abenomics in 2013 for seven years, the annual range has been between 4,000 and 6,000 yen, so last year should be considered an exceptional value.

The upside target for the Nikkei Stock Average is realistically around 32,000 yen; even with a substantial rise, around 33,000 yen is the upper limit for this year, so upside potential is limited to about 1,500–2,500 yen, making buying the index now not very lucrative.

Therefore, in this issue, under the theme of finding lagging stocks, we will present two carefully selected stocks whose recoveries from past highs have been slow relative to their earnings rebound.

① Tokyo Seimitsu [7729]

② INPEX [1605]

For more details, please see the PDF file.