Average annual return of 57% "ORCA" 1 position and low drawdown EA

Higher profits can be expected compared with backtests!

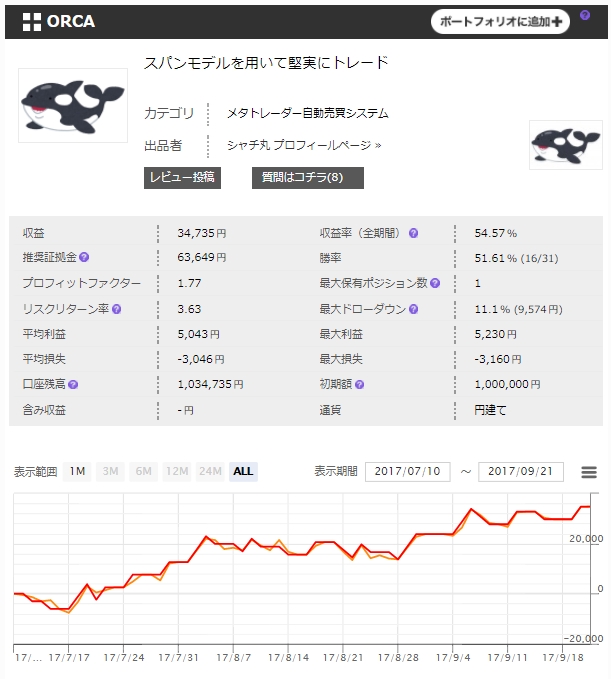

“ORCA”

The debut by a newbie seller, “Shachi-maru”!

Introducing a single-position EA that trades conservatively using a span model.

The forward two-month profit-and-loss curve is as shown, showing a favorable trend.

Because it operates with a single position in a swing-like manner, it features fewer entries and longer holding times, but

this EA has the potential to deliver profits that surpass that.

■The ideal account to compare via backtests…

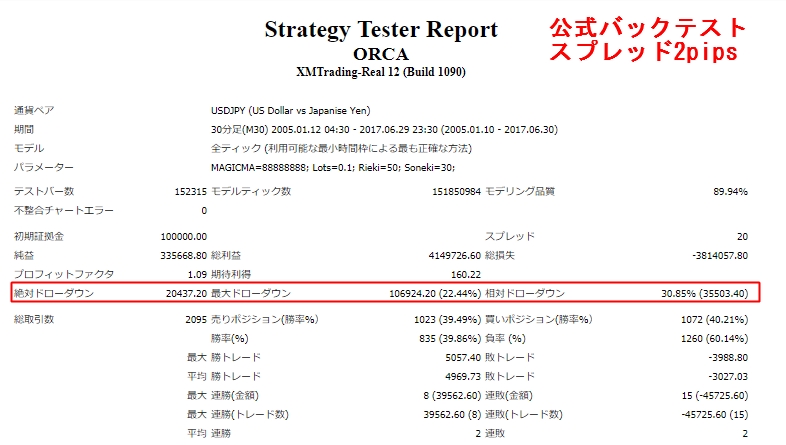

First, the official backtest.

There is backtest data covering 12 years from 2005 to 2017.

With a spread of 20 (2 pips), 100,000 yen grew by +330% over 12 years.

The maximum drawdown was 106,924 yen. Depending on operation timing, 100,000 yen may be insufficient as margin, so

it's advisable to have at least about 300,000 yen.

Since it is fixed at 0.1 lots, it achieves 3,356 pips, averaging about 279 pips per year.

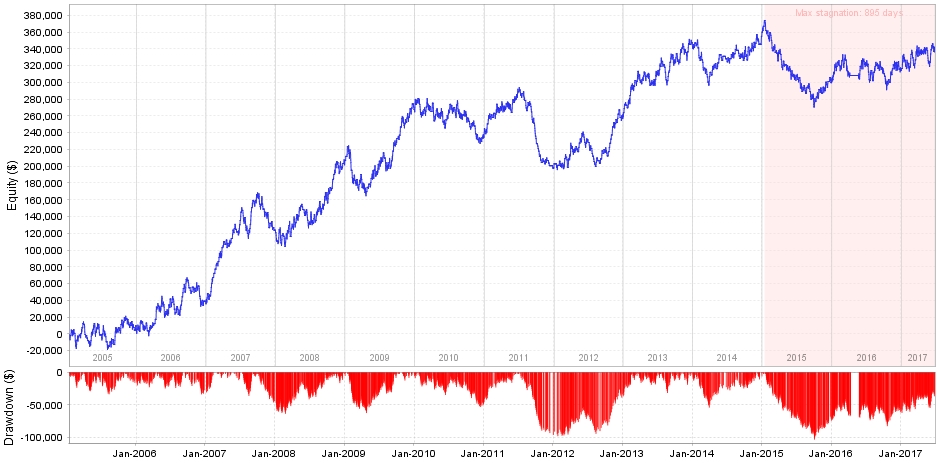

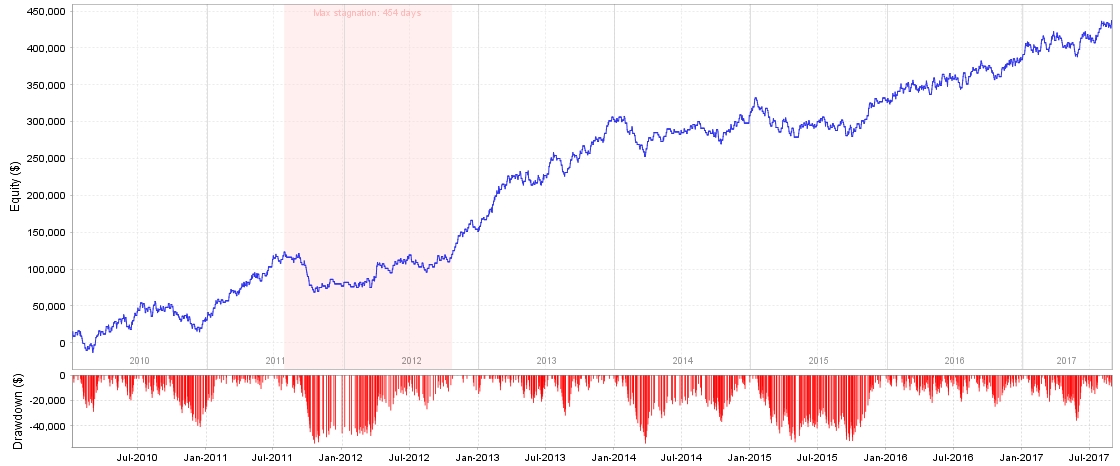

【Time-series Profit/Loss Curve】

If it hits a period of large drawdowns, there were years that were negative for the year overall.

(The figures are in USD, but please view them as JPY ¥.)

Hmm, it seems a bit scary, perhaps?

But wait a moment.

A USD/JPY spread of 2 pips is frankly not realistic.

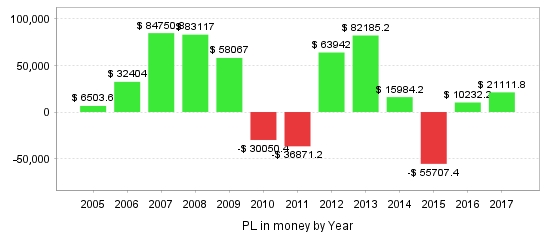

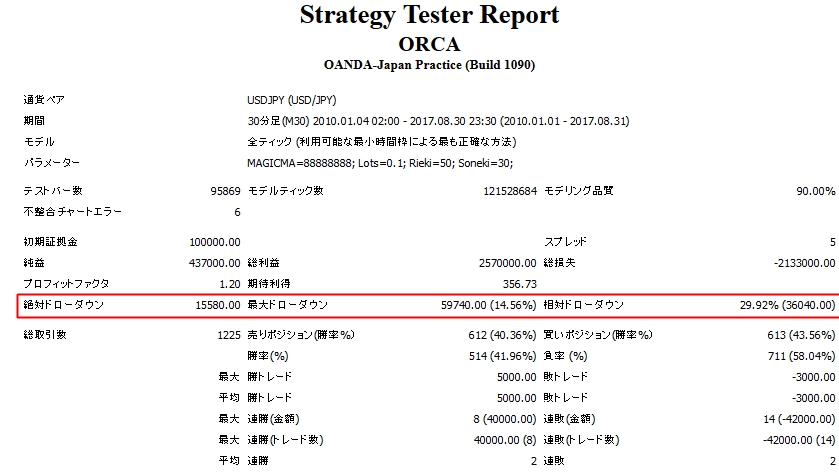

■Looking at backtest data on OANDA, the same as the forward…

With OANDA, the USD/JPY spread is typically around 0.4–0.5 pips, so the backtest was run with a spread of 0.5.

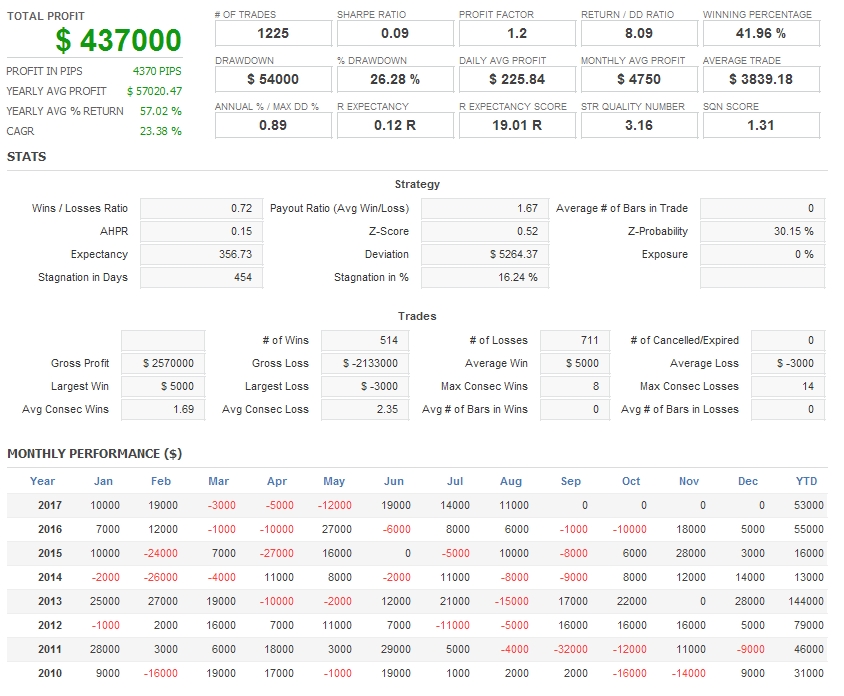

From 2010 to August 2017, with the same 100,000 yen margin, gains were +437%

The maximum drawdown is 59,740 yen, significantly lower than with a 2-pip spread.

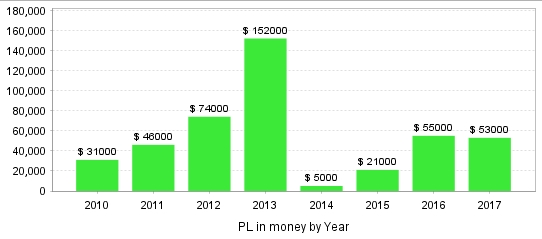

Yearly profit amountsthere are no negative years anymore, and profits have increased.

The best year exceeded an annual return of +200%.

For more detailed analyses such as monthly P/L, please see here.

Average annual return is +57%!

The default stop loss is 30 pips, so you can operate without taking on large risk.

“ORCA”

11,800 yen