No. 1 in popularity! Uncovering the secrets of Angel Heart【Developer interview available】

Sales reached 300 units sold in two months from the launch!

Strong performance in real forward testing.

“Angel Heart USDJPY”

We delve into its appeal.

【Angel Heart USDJPY 概要】

With up to four positions, this is a high-win-rate EA that enters in the trend-following direction.

In addition to TP and SL, it includes a “withdrawal mode” designed to minimize losses as much as possible.

Up to now, it has been so consistently favorable that some even hoped for a drawdown to come soon, but

a major drawdown finally arrived after almost three months of forward testing.

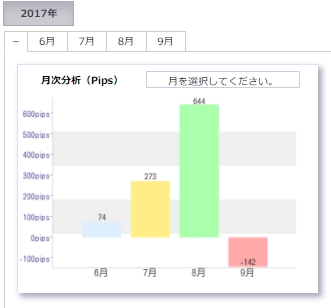

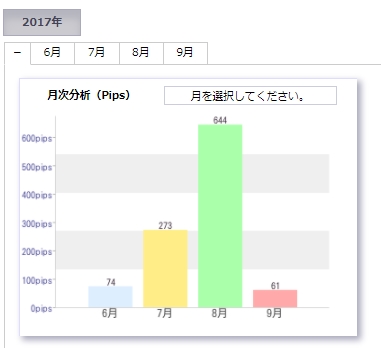

August was very strong, +644 pips!

There was a relatively large drawdown in early September, but

after that... recovered from -142 pips to +61 pips!

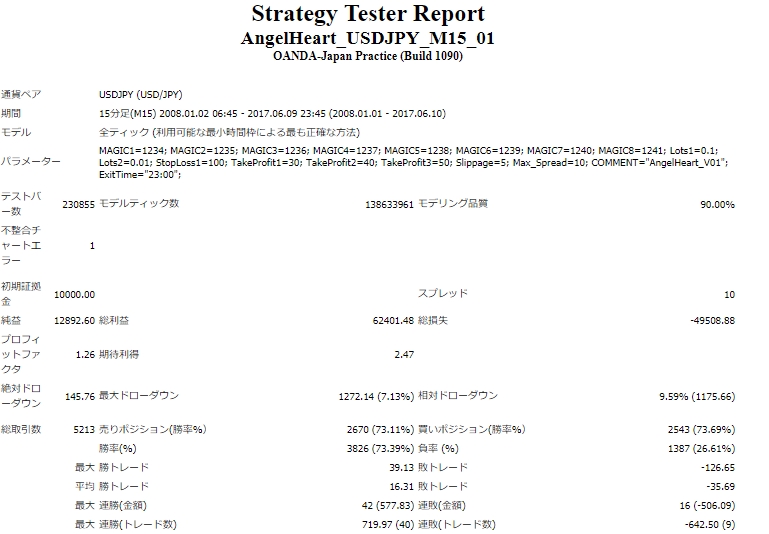

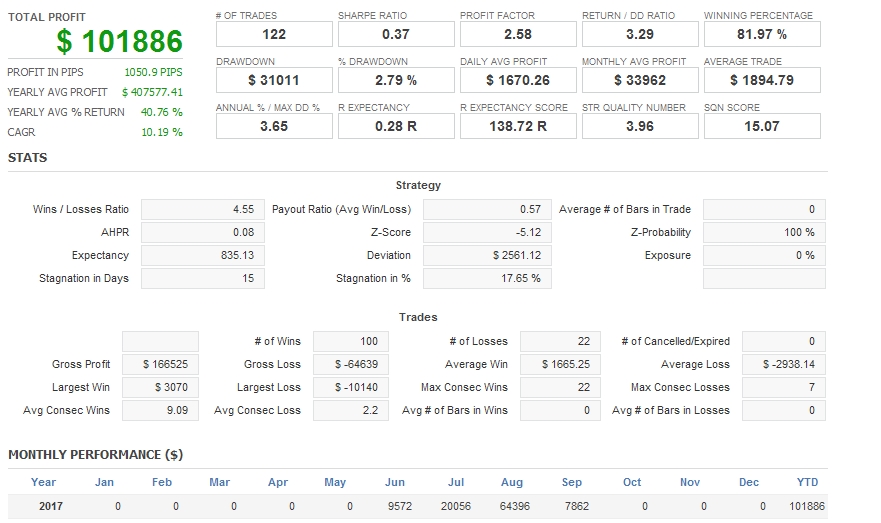

■Backtest Analysis

Let's examine risks and expected profit from the backtest!

Maximum drawdown is,1,272 dollarswhen operating at 0.1 lots.

As the recommended margin is 200,000 yen, even when considering the maximum drawdown over the past 10 years,

you can probably run 0.1 lots with 300,000–500,000 yen as cushion.

【No losses in the past 10 years!】

(※2017年は6月まで)

In the backtests, 2012 was the worst year, but it still shows +$870, so at 0.1 lot operation this profit is remarkable.

For a 1,000,000 yen account, operating 0.2–0.3 lots is fine, soeven with simple interest, annual returns of about 20–60%seem possible.

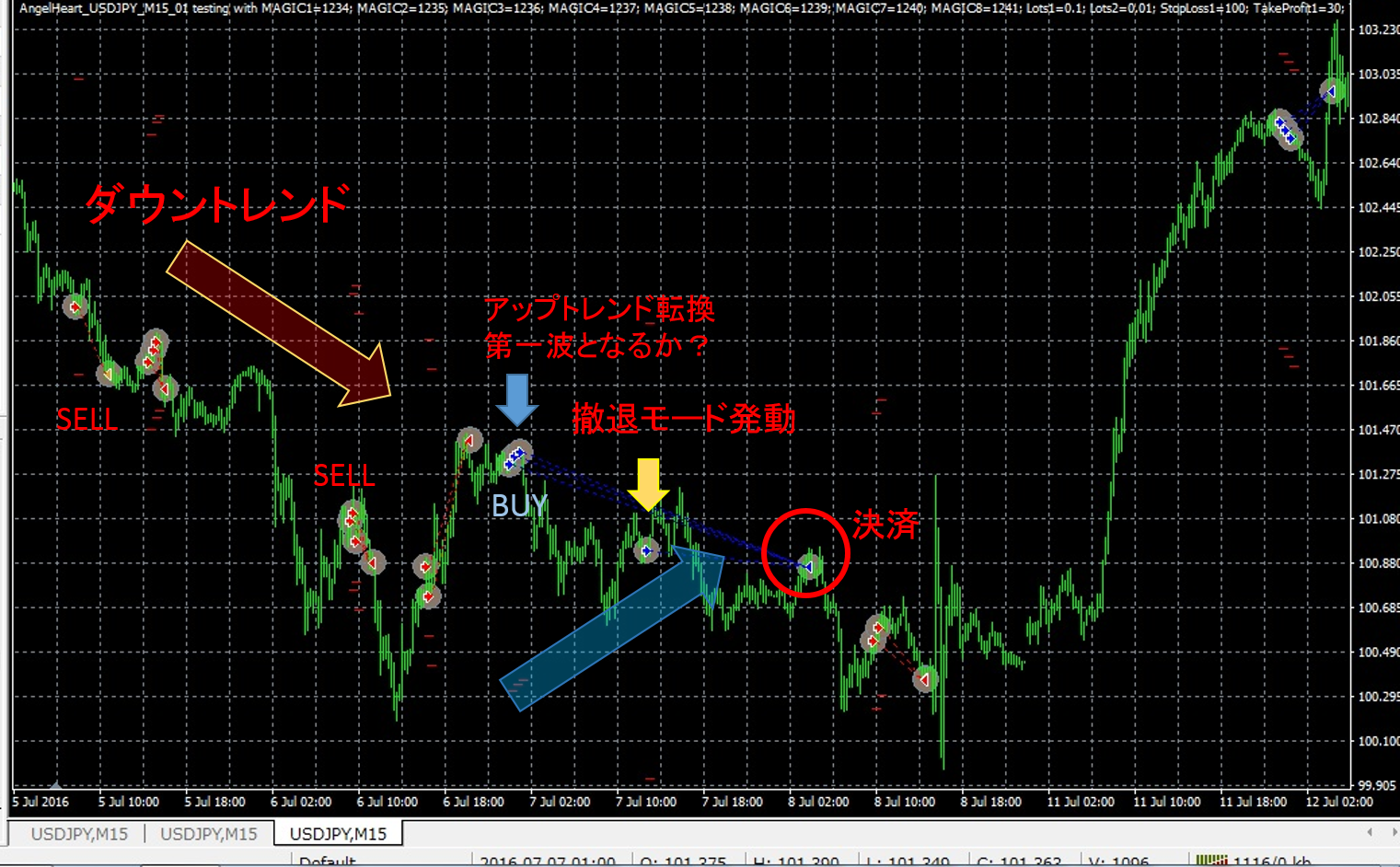

■Withdrawal Mode to limit losses

=====================================

About Withdrawal Mode

Elliott Wave is a high-probability method that works well, but it does not always work.

There are cases where Wave 1 was not actually Wave 1, and things do not progress as expected.

In such cases, it is designed to cut losses at the best place and prepare for the next entry.

Specifically, there are entries that activate after a certain period of time.

After this entry is activated, withdrawal mode is engaged and settled at the optimal place.

Basically, withdrawal-mode entries are designed to occur within about 12 hours.

(Not necessarily exactly 12 hours。)

=====================================

As a feature of Angel Heart, if the settlement point is not reached within 12 hours after entering,

the function called “Withdrawal Mode” is activated.

When withdrawal mode is entered, it will place entries in the minimum unit of 0.01 lots in the trading account.

(At this time, for accounts with a minimum trading unit of 0.1 lots, withdrawal mode is also 0.1。)

【Examples of Withdrawal Mode】

When the price does not extend much in the entry direction, this withdrawal mode is activated,

if the first wave of the trend reversal was a false moveor

when the trend ends and the price does not reach the TPthen Withdrawal Mode works effectively.

Also, the reason for entering 0.01 lots when Withdrawal Mode is activated is

① visually indicating that Withdrawal Mode has started.

② closing the 0.01 lot position can deactivate Withdrawal Mode.

This is said to be the case.

■Even with ultra-low spreads, forward is clearly more profitable!?

Astonishing findings were revealed…!!

【Backtest results (spread 0.4)】

【Real forward】

(Analyzed with Quant Analyzer)

Even keeping the spread roughly the same over the same period, for some reason forward yields about 40,000 yen more profit.

Typically, in backtests, lowering the spread increases profit, and widening the spread reduces profit.

Angel Heart USDJPY is backtested with a spread of 10 (1 pip), so

on live OANDA accounts where the spread is 0.4–0.5 pips,

naturally, profits are higher on forward.

Even so, there is almost a twofold difference between 60,000 yen and 100,000 yen.

We don’t fully understand the cause, but it might be related to OANDA’s low spreads and execution quality.

'Angel Heart USDJPY' is a rare EA that can be expected to outperform its backtests in forward testing.

A difference of 40,000 yen over three months suggests that on an annual basis, it could exceed the backtest's expected annual profit by around 30–40%.

■Developer interview!

Thank you for waiting ♪

We conducted a Q&A-style interview with the developer of the striking debut, “Angel Heart,” the developer “Angel.”

===========

Q: fx-on

A: Angel

===========

Q:Please tell us what inspired EA development and your experience with EA trading so far

A:I started using systems due to incompatibility with discretionary trading (including mental factors).

EA trading experience began in January last year with system trading (Ichiban Kachi, Color Your Life V2, EA_final_max_5pair, Hornet USDJPY, RSI Average EA, ForexAdore + self-made EA currently in operation).

Q:Are there any cautions about AngelHeart operation (spread, GMT, etc.)?

A:GMT+2 (summer +3) US-style daylight saving time is recommended.

In terms of GMT support, we handle UTC+0 to UTC+9, and

In the Angel Heart USDJPY logic, GMT matters only for the weekend settlement function. Brokers that move GMT to the positive side (like +9) only shift weekend trading prohibition times and weekend settlement times, so the current default value is fine; however, brokers that move GMT to the negative side (like -4 LAND-FX) may have the weekend settlement function not active, risking holding positions over the weekend, so please be careful.

For brokers adopting European winter time (GMT+1), you can set the exit time between 21:00 and 22:50 to support it.

Q:Do you think AngelHeart's current performance is a bit too strong?

Also, what market conditions would be challenging according to backtests?

A:Indeed, it overlapped with a favorable period. Even during key events, the EA moved in a beneficial direction, so luck was on its side.

I don’t expect this state to continue as is, but I think performance will trend upward with ups and downs. When it wins, it wins a lot, which is fun for this EA.

苦手な相場に関しては、値幅が広い(ボラリティが高い)時のレンジ相場でしょうか。

第一波かな?違う・・・

第一波かな?違う・・・

といったように最悪何回も往復ビンタを食らう可能性があります。

あとは、じわじわと含み損が増えていく相場に弱いです。そのような相場の時には損切りがうまくできないのです。

だいたいSLで負けるときはじわじわ系が多いですね(笑)。ここは改善したいと思っています。

苦手な相場とはちょっと違いますが、Angel Heart USDJPYは重要指標等でEAを止める必要はないのですが、ポジションを保有しているときはその時の損益によっては手動決済をしたほうが良い時もあります。

Q:今後の新作EAの予定はありますか?

A:大切な自作EAなので出品する予定はなかったのですがfx-on様の熱意に負けてしまいました(笑)。現在準備中です。コンセプトに関してはAngel Heart USDJPYのほうが面白いかとは思いますが、今年の成績はAngel Heart USDJPYを上回っているEAです。楽しみにしていただければと思います。

その他:尊敬している開発者

A:CYさん。Color Your Life V2は1番のお気に⼊りとして稼働中です。

Angel Heart USDJPYとしては一本勝ちを目標としており、いずれは一本勝ちと肩を並べるくらいのEAに成長して欲しいと願っています。

もともとfx-onのEAを運用されていたとのことで、利用する側の目線に立った開発、サポートをされています。

コミュニティの書き込み数が多いことから、いかに活発にコミュニケーションが行われているかが伺えますね。

コミュニティを全て読めば、ベテランユーザーさんからのアドバイスや豆知識なども得られますのでぜひ参考になさってみてください!

『Angel Heart USDJPY』

19,800円