"The Secrets of Easily Winning Trades" — The Trading Hours to Trade, Based on Transaction Data

・People who check charts as much as possible but still can’t win

・People who are tired of watching lots of charts in the mindset of “quality over quantity!”

・People who don’t know when it’s okay to trade

■ Conclusion this time

★ Trade during the times when the exchange rate moves significantly ★

This time, based on the data released by FX brokers for this month

we have summarized the time periods when price movement is large.

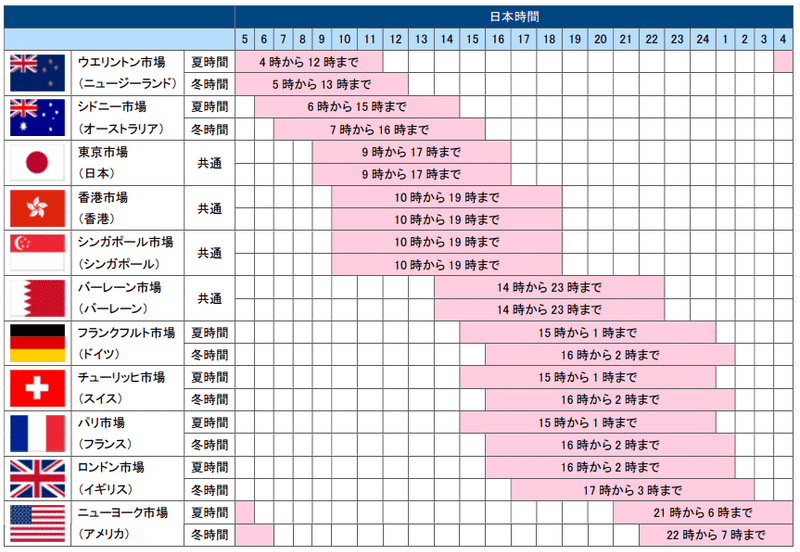

■ Refresher on basics: the 3 major markets and times

As a basic concept in FX, it is said that exchange rates move actively during the trading times of the “3 major markets.”

《Foreign Exchange: 3 Major Market Trading Times》

・ Tokyo market: 9:00–17:00 Japan time (around 9:00, around 15:00)

・ London market: 16:00–26:00 Japan time (16:00–19:00)

・ New York market: 21:00–6:00 Japan time (21:30–23:00, 3–4:00)

※ The times in parentheses are when price movements are large

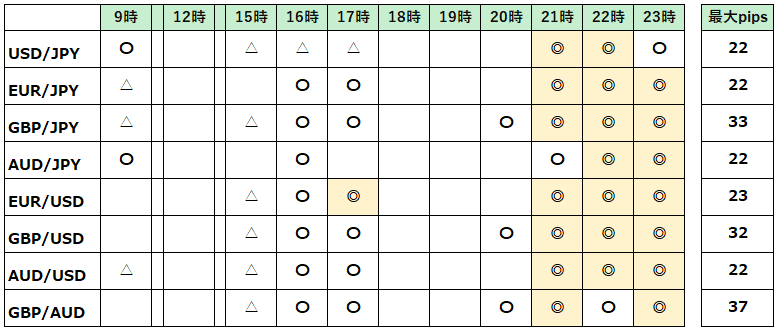

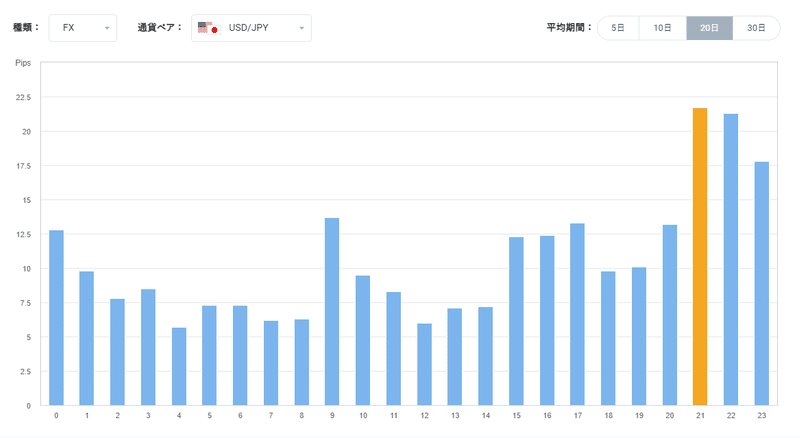

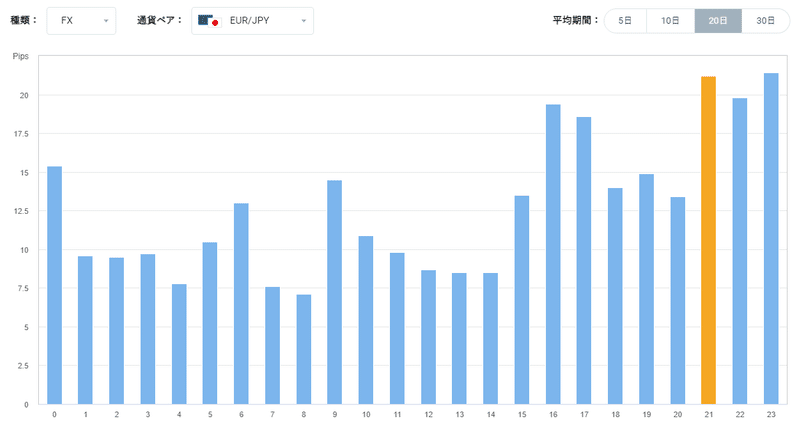

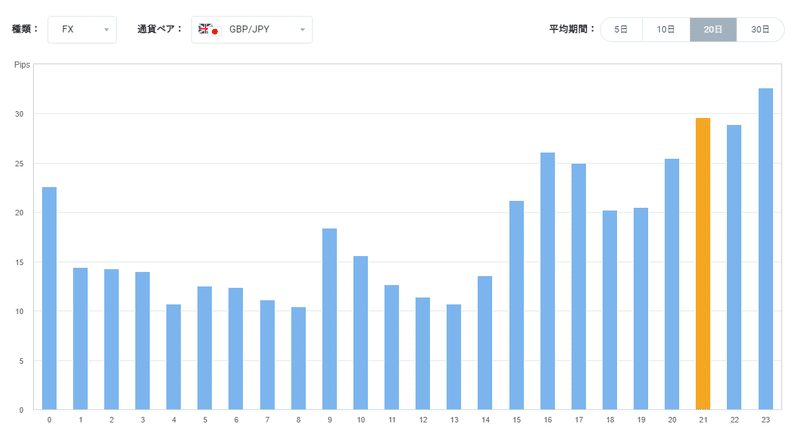

■ This month’s highly volatile time periods (average over about 20 days)

※ Maximum pips: the maximum range between high and low for each time period. Please view as the average over the most recent 20 days.

・ For all currencies, movement is greatest after 21:00.

・ In particular, pound-related currency pairs can move around 20:00, so you’ll want to check the charts at 20:00.

・ For the euro and pound, movements can begin before 16:00, so to capture the early move you’ll want to look at the chart at 15:30.

※ If major economic indicators are released, there may be rapid changes outside of the above.

※ There may be differences on certain dates or days of the week, such as Go-To days.

■ Information referenced

If you’d like to verify for yourself, please refer to the links below.

Also, data such as “average of the most recent 20 days” is updated from time to time, so please understand that it may not match the images above.

《Reference: OANDA: Volatility Graph Chart》

https://www.oanda.jp/lab-education/oanda_lab/oanda_rab/volatility/?waad=KreTQiP4&ugad=KreTQiP4