"Can free materials be used?" A tough-verification review by a professional with over 10 years in the FX industry

■ People I want to recommend

・People who want to learn the basics of FX starting from “What is foreign exchange?”

・People who want to study steadily from the basics in order (over 100 pages in volume!).

・Since the publication is from 2012, some figures are old. It should be OK to look things up yourself as needed.

■ Not suitable for

・Those who dislike “reading material” since it’s over 100 pages

・Those who want to learn practical trading techniques first

(This is a basic FX learning material, so there are no trading techniques)

・People who don’t want free materials or email registration

(You need to register a free email address in advance and download the material from the URL provided in the email)

■ Results of verification

〇 Pros

It has full-color, well-structured explanatory text, and diagrams, making it easy to start learning FX basics.

Since it’s a PDF, you can study steadily on the go with a smartphone, etc.!

It has no excessive sales pressure, which is good, given that it is a publicly authorized financial instrument advisory by the Financial Bureau, etc.

〇 Cons

As it was issued in December 2012, honestly the figures are old.(^^;

Currency trading volumes change daily, but there seems to be no information updates.

Therefore, readers need to judge the freshness of the information themselves.

(Background)

This is free material, so I have written here based on actually applying for and reading it.

There is no special profit or anything; so some harsh comments may be allowed.

■ Go to the site of “FX Investment Master Guide” by FPO Co., Ltd.

Register by email, then access the URL sent by email to download the e-book (PDF).

※ Note:

You will be registered for FPO’s newsletter.

For details about applications, please check the FAQ on the other party’s site.

To the page offering the “FX Investment Master Guide”

https://www.fpo.bz/masterguide/?a8=A1bBK1OaoPi_h4GX0tirPb5JtbIKubGPeS5YSailNc.igSk-ES._ESbUhXNSlubUN1F4oSkRB0sHxs00000003196001

■ A quick peek at the content you’re curious about

(I will explain some parts selectively, so if you’re curious, please apply for free download.)

Introductory < Basic < Practical sections are divided, and it’s full color with diagrams that are very easy to see.

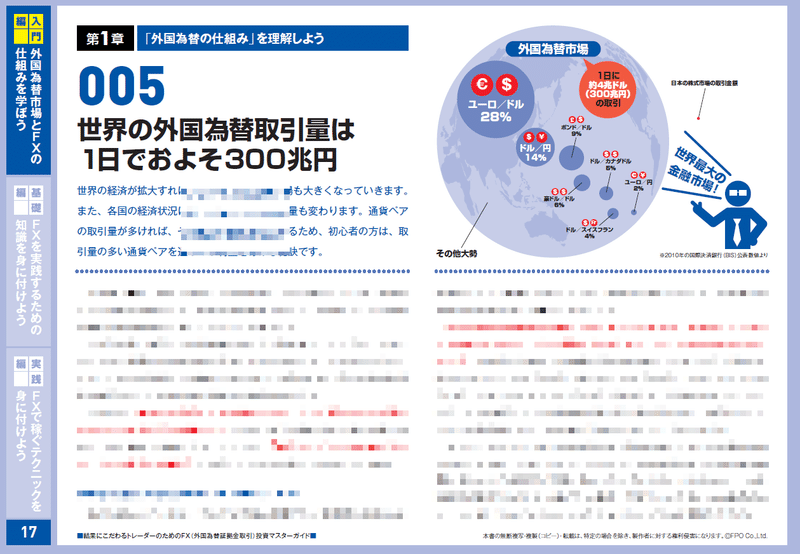

The figures are from 2010 sources, so for the latest information you’ll need to look it up separately.(^^;

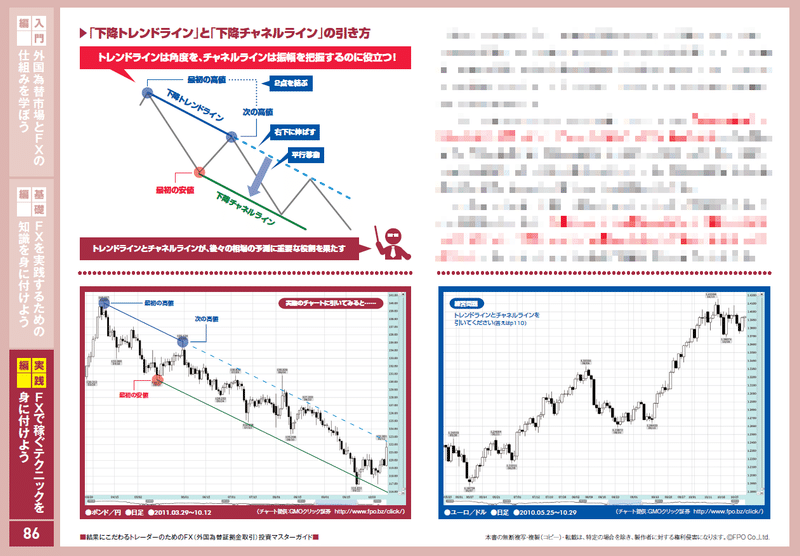

In addition to schematic diagrams, there are explanations with a chart that includes candlesticks, which is great.

From the creator’s perspective, drawing diagrams is easy, but including actual charts takes effort. Many famous books are just text to increase page count, so having many charts is a sign of quality material.

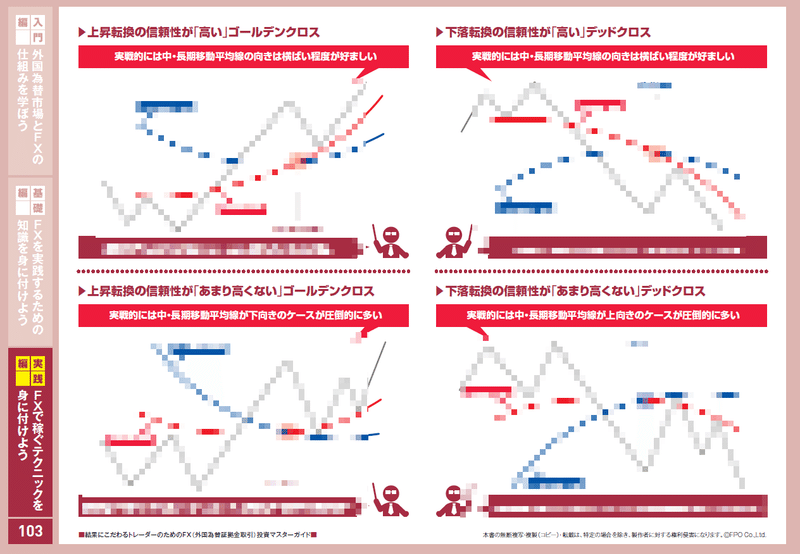

Even with moving average crossovers, it introduces usable “crossovers” for trading, so it contains solid, useful information.

■ Notes (some information is outdated)

The figures listed have sources, but are about 10 years old.

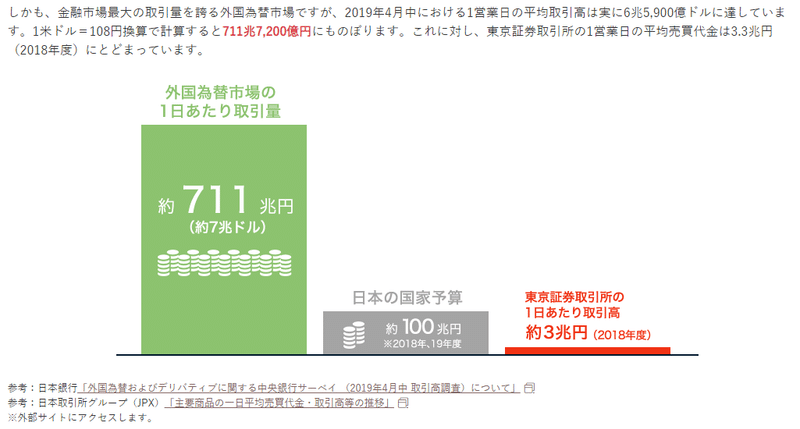

For example, it says “daily FX trading volume = 300 trillion yen,” but by 2019 it exceeded 700 trillion yen.

As a reference, here is MoneySquare’s site ↓

https://www.m2j.co.jp/fx-beginners/what

In particular, how to choose a FX company, leverage limits, and other regulations change over time, so it’s better to check the latest information on websites.

■ Is the trading method the missing piece in this material?

This material is meant to learn the base of FX, so it’s the best tool to understand FX basics.

Next,

I think you’ll want to learn “practical trading methods,” so I’ll note them here (it would be rude to readers to only verify free materials).

◆ Gotō-day trading

On Gotō days, target the “USD buying at the fixing”: the rate at 9:55 a.m. is the reference, so USD/JPY tends to rise from 9:00 a.m.

For reference ↓

・01: Long

Long when USD/JPY is cheap before or at 9:00 a.m., then take profit around the high around 10:00 a.m.

・02: Short

Short at the high around 10:00 a.m., then take profit before USD/JPY rebounds and rises

◆Breakout method

I’m modest enough to share this method as well. <(_ _)>

《Free / popular overseas methods revealed》 Read before being scammed by products or FX salons

https://note.com/fp_labo/n/n1e687d4dded0

■ What kind of company is issuing this?

I researched the issuing organization, so I’ll note it here.

〇 FPO Co., Ltd.

Established: 2006 (Heisei 18) August 4

Financial Instruments Business Operator Registration Number / Kinki Finance Bureau Chief (Finance) No. 300

Main businesses: publishing, education,Investment advisory (explained below), internet media, food service

→ They are a government-authorized investment-related business, so they operate in accordance with the law. That means they are not a scam operation (not that their trading methods are guaranteed to win).

《What isInvestment Advisory?

Banks and securities companies operate with government authorization.

To run an investment business, obtaining the Finance Bureau’s “Investment Advisory” allows you to engage in investment business including predicting price movements of stocks and FX.

Currently, obtaining “Investment Advisory” is highly regulated and difficult for most companies with substantial funds and personnel. (It was easier in the past...)